Interest rates hold at 11-year high as another key real estate number climbs

The cash rate paused in September but another number that is a key indicator of the housing market has been climbing.

As the nation’s cash rate held for a third month at 4.1 per cent, the national clearance rate is rolling along on its strongest run in two years, showing the appetite for buying property remains high, despite the challenges of servicing a mortgage.

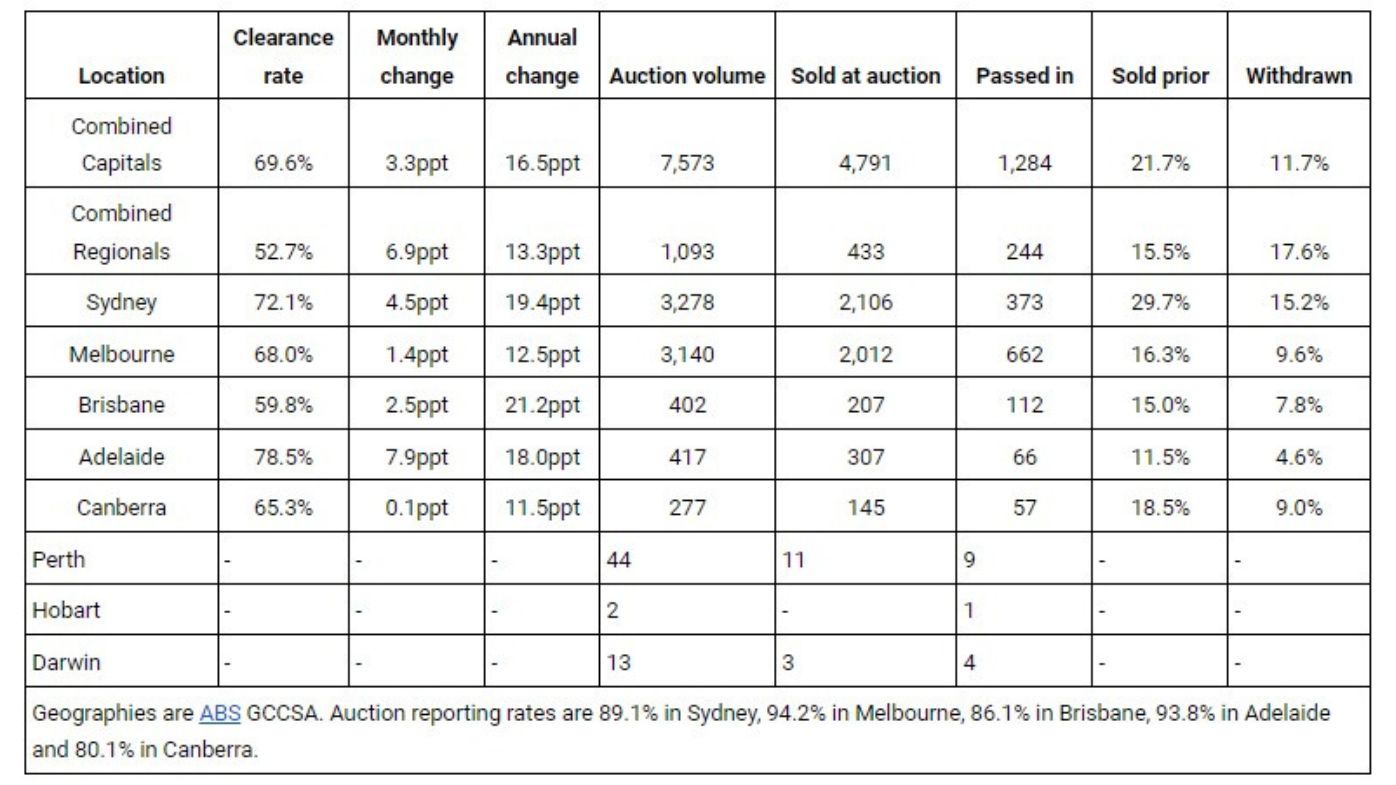

New Domain data reveals the clearance rate – the proportion of advertised homes transacting – went up over the month of August, hitting 69.6 per cent for the combined capital cities and 52.7 per cent for the combined regional zones.

This represents also an annual increase of 16.5 per cent for the capitals and 13.3 per cent for regional Australia.

Every capital clocked an individual monthly and annual spike in the clearance rate, part of a 24-month spree of improvement.

Domain’s chief of research and economics Dr Nicola Powell says the August Auction Report contains positive signs to start spring – the traditional selling season.

“While the clearance rate hasn’t quite reached the peak we saw in June, the numbers are still impressive compared to recent years,” she says.

“In fact, this marks the strongest run of clearance rates in two years for the combined capitals and the strongest for the combined regionals since April 2022. This indicates selling conditions remain strong on top of auction listings rising – a good sign as we ramp for the spring selling season.”

Options for buyers have opened up earlier than usual, with listings lifting to conclude winter and more choice look likely as the months roll on.

“Auction listings have been increasing early, which is an unusual trend for the winter season,” Dr Powell says.

“There has been a steady uptick in volumes in recent months. Improved clearance rates, coupled with growing confidence, are likely motivating sellers to return to the market and boost supply.

“We anticipate this trend will continue as we move into the warmer months.”

NAB home ownership executive Andy Kerr says the rate hold – at an 11-year high – provides surer footing for mortgage holders who will come off fixed rate loans during the year.

“A third straight month of steady rates gives homeowners some much-needed stability over their repayments and a better idea of how they can manage their household budgets as they contend with rising living costs,” he said in a statement after the RBA’s decision.

“Customers with fixed rate home loans due to finish up soon also have greater sense of certainty as they roll off onto more solid ground.”

Some economists, including Ray White’s Nerida Conisbee, are predicting that the cash rate will stay the same for the rest of the year.

Conisbee said in a statement: “At this point, barring any unexpected events, it is likely that they will remain at current levels for some time. The next movement is likely to be a cut, however this is unlikely to happen this year.”

However, she expects that renters will continue to feel the pinch. Construction is not at a level to improve supply, which would soothe price pain.

“Far less positively, rents continue to increase and have some while to run,” she says.

“Last year, we wrote about how although advertised rents were rising very quickly, it was yet to show up in the inflation figures. This is because there is a lag between when advertised rents start to increase and the flow through to already tenanted properties. However, the converse is also true.

“Advertised rental growth is starting to slow but it will take some time for it to flow through to properties already rented.

“Also problematic is that rates at current levels are exacerbating rental and price growth because of their impact on the number of new homes being built. Already, housing approvals have fallen to levels not seen in around ten years.

“With housing finance costs so high, this is discouraging both owner occupiers and investors from buying new properties. Fewer properties being built will push more people into buying or renting existing homes. The rents/rates spiral has a while to run.

See inside this year’s The Block houses for sale…

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More