Is it cheaper to buy a house at auction or make an offer before?

Home sellers who take their property to auction consistently collect at least 10 per cent more cash than the highest offer they receive beforehand. But does it follow that buyers can save money by making an early offer instead of buying at auction?

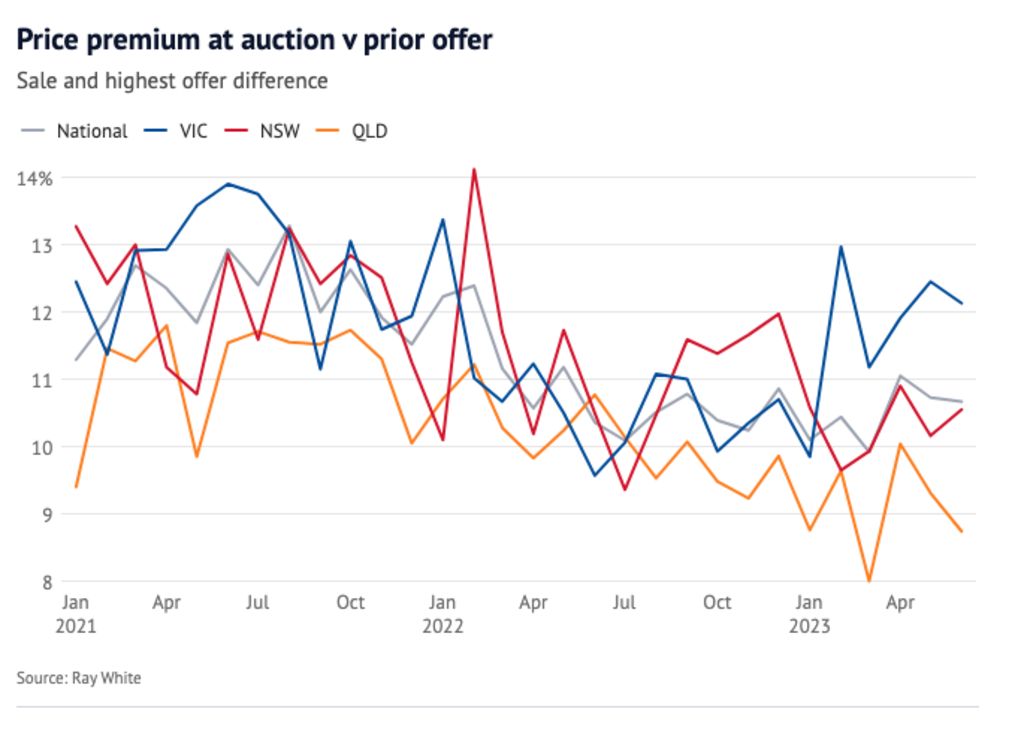

Analysis of auction sales compared with early offers for the first six months of this year shows a differential generally of at least 10 per cent.

“We took in a huge sample of sales, and generally we’ve found that vendors who take their properties to auction do better in that auction-type environment,” said Nerida Conisbee, the chief economist at Ray White, which undertook the analysis. “Auctions tend to shorten the lead time to the sale, so that usually maximises the price too.

“Auctions are very transparent as well, so you can clearly see all the buyers in the market. But with a prior offer, you’re relying on just what the agent is telling you. But for buyers, it’s better to give an offer, as then you’ll usually get a better outcome with a lower price.”

The gap between the figure offered prior and the auction result is fairly consistent around the country. Over the past six months, buyers in Victoria had the biggest differential, in February at 12.98 per cent. NSW hit its peak of 10.91 per cent in April – also the best month in Queensland, with a 10.05 per cent divergence, and the best time nationally at 11.06 per cent.

However, the result does depend on the type of property, its price range, the number of similar homes for sale and the circumstances of the vendor and buyer, says Maxine Piekarski, business manager at Melbourne buyers’ agency Advantage Property Consulting.

“If you’re buying a one-bedroom unit in Melbourne, for instance, where the market is quite soft, if a buyer makes an offer, agents will generally jump on that,” she said. “But there are so many scenarios that can play out, and it depends on how realistic the vendor is being too.

“When I was buying my home, the vendor said I could have it if I offered $1.75 million, which was just above my budget, so I went to auction and bought it for $1,665,000. If a buyer makes an offer that’s too low, that can also motivate an owner to go to auction, as they think they have nothing to lose.”

RMIT senior lecturer in economics Dr Peyman Khezr says it can be difficult to accurately measure any price differential because when a buyer makes a good offer and the property, as a result, doesn’t go to market, then that wouldn’t be counted.

“It’s difficult to find identical property and identical circumstances so you can conclude without any degree of doubt,” he said. “My gut feeling is that there’s basically a right time to make and accept an offer and a right time to go to auction, and they depend on a lot of different factors.”

Speed of sale might be one, suggests Sydney agent Frederico Fraga-Matos of BresicWhitney, where a vendor might accept an offer because they need to sell quickly as they’ve already bought, or where a buyer wants to buy before a loan pre-approval expires.

“Sometimes buyers are nervous about buying at auction too,” Fraga-Matos said. “It is a stressful process and there’s a chance the price can go crazy there. But many find auctions attractive as you have a fixed result, whereas someone making an offer can change their mind on the way to sign the paperwork.”

At present, buyers are increasingly making offers prior in the hope of obtaining a property more cheaply, especially with the cost of living rising and interest rates increasing.

Operating theatre technician Stewart Griffiths just sold his late parents’ five-bedroom house in Sydney’s Hornsby Heights, at 10 Waddell Crescent. A buyer offered him $1.2 million to sell prior.

He was tempted as he’d never sold at auction before, but his agent, Alex Iannuzzelli, also from Ray White, urged him to hold his nerve.

“And I’m so glad he did,” said Griffiths, 54. “At first, the auction was terrible, as the first bid came in at $600,000 and everyone fell silent and I started regretting not taking the offer. But then the bidding just took off – with 30 registered bidders – and it ended up selling for $1,506,000, $406,000 over the reserve.”

In Melbourne’s Cheltenham, Voula and Sam Tsakiridis sold their home under the hammer last weekend for $1.63 million through Ray White Cheltenham’s Angela Limanis. The pair, who have cabinetmaking business AOK Kitchens, received an offer of $1.45 million on the morning of the auction but declined it.

“We thought we’d leave it up to the buyers; that way they got their fair chance,” Voula said. “We’re glad that we went to auction, definitely, because if we accepted the offer we would have missed out on that extra $180,000.”

Sam added: “It gives everyone a fair go, and it gives you pretty much a true sense of the transparent value of your property.”

With Elizabeth Redman

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More