Key sign Australia's housing market is beginning to recover

Despite high interest rates, rising rents and a lack of supply, new data reveals that Australia’s housing market is beginning to recover.

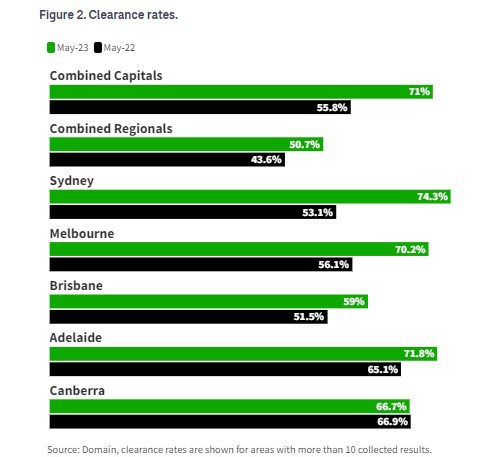

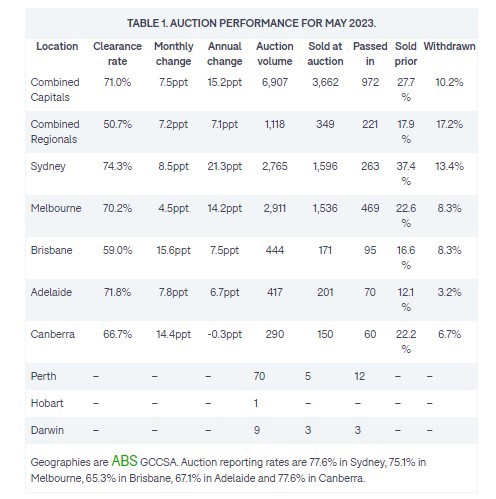

Domain’s May 2023 auction report shows that clearance rates across the combined capital cities have risen to a 17-month high of 71 per cent – its highest point since October 2021.

Clearance rates are a key property market indicator and are a measure of how many properties are sold at auction.

The data shows that Canberra is the only capital to have not seen an annual increase in clearance rates, with Sydney, Melbourne and Adelaide, all achieving beyond 70 per cent.

Offering a glimmer of hope, Domain’s Chief of Research and Economics, Dr Nicola Powell, says: “The continual rise in clearance rates aligns with the broader momentum that has built as Australia’s housing market begins to recover.”

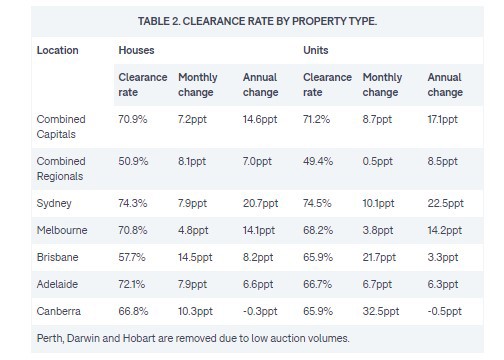

Sydney has come out on top as the best-performing capital city with a clearance rate of 74.3 per cent, its highest since October 2021.

Melbourne achieved a 19-month high at 70.2 per cent, with its clearance rate increasing for the fourth consecutive month.

Brisbane is the least strongest capital from the data at 59 per cent, despite its clearance rate marking its steepest monthly increase.

Adelaide achieved a clearance rate of 71.8 per cent, the first time its gone above 70 per cent since March 2022.

Canberra at 66.8 per cent, is the only capital to see an annual decline in clearance rate. However, it achieved a significant monthly increase in the year.

Perth, Hobart and Darwin were removed from the data due to low auction volumes.

“Canberra remains one of the weaker capital city auction markets, mainly reflecting that this city hasn’t progressed as far along the property cycle as other markets (like Sydney),” Dr Powell says.

“Canberra’s auction market has seen vast improvement from the weaker conditions seen late last year, and it indicates the pricing expectations between buyers and sellers are better aligned. The more expensive areas of Canberra are showing weaker clearances while the more affordable pockets are currently the strongest.”

While clearance rates are surging, auction listings remain weak across the combined capital cities.

Domain’s data shows that Sydney is down annually by 18 per cent and Melbourne by 29 per cent.

“The mix of high interest rates, rising prices and rents, and lack of housing supply, shows that even though there are less homes going under the hammer, buyers are willing to place favourable auction offers when choice remains limited,” Dr Powell says.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

/http%3A%2F%2Fprod.static9.net.au%2Ffs%2Fa95fb9d4-0e50-4cac-85d8-6b65fa6048b3)

/http%3A%2F%2Fprod.static9.net.au%2Ffs%2F3b909b84-d46a-4195-9eaa-2f5c5c317353)