Less profit going into vendors' pockets as auction market rides temporary ups and downs

The peak of the market has passed, as the major spring selling season unfolds with less profit going into the pockets of vendors.

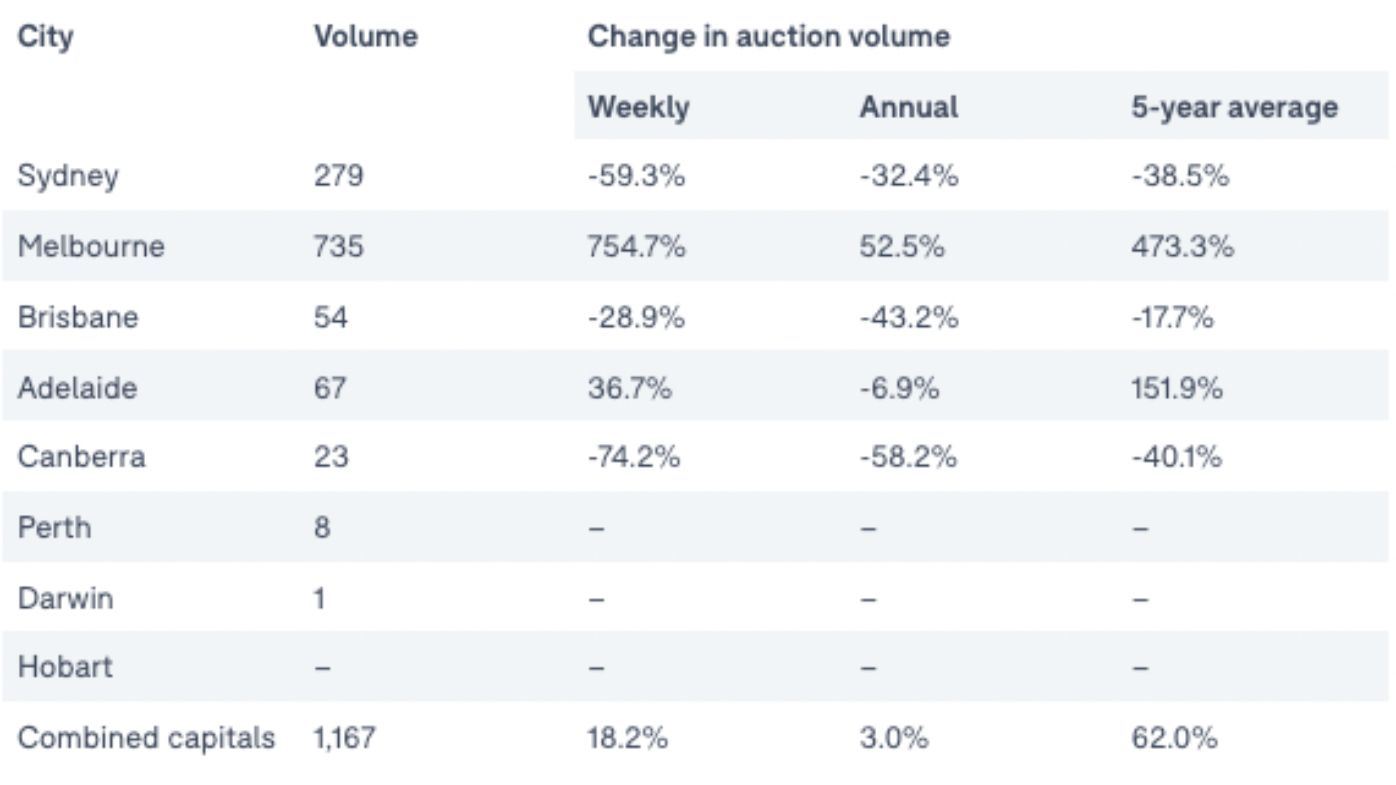

Data showing the cooling of the market lands as buyers and sellers ride waves of public holiday interruptions to auctions. Two capital cities this weekend – Melbourne and Adelaide – have clocked an improvement on auction volumes, but other capitals remain low, with more public holidays next week.

Sellers who traded in autumn this year timed their run to make the greatest possible profit from their property, with the height of the market coming and going in the June quarter, CoreLogic data shows.

CoreLogic’s latest Pain & Gain Report, which assessed 102,000 property sales, revealed in the three months to April, homes hit a gain peak of 94.1 per cent.

This mirrored the dizzying height of national property values, before the price declines that have come hand-in-hand with interest rate rises, which began in May after a 12-year honeymoon of rate holds.

“This particular Pain & Gain report provides a line in the sand and confirms the moment when the housing market peaked and started to turn,” CoreLogic’s head of research Eliza Owen said.

“The figures align with peak growth in our national Home Value Index and highlights the decline in the rate of profit-making sales, which has been largely influenced by an increase in the rate of loss-making resales in Sydney and Melbourne.”

Interest rate hikes have induced a price softening in Sydney and Melbourne, but other capitals remain strong, notching sale price gains, CoreLogic found.

The proportion of houses that made a profit – 96.5 per cent – outperformed the percentage of units that made a profit (88.1 per cent).

Melbourne and Adelaide have recorded an increase in the number of properties headed under the hammer on Saturday, October 1.

Overall, national auction numbers are 18 per cent higher than last week.

However, Sydney, Brisbane and Canberra have less properties for auction this weekend compared to last Saturday.

New South Wales, Queensland and the ACT have another round of public holidays – Labour Day on October 3 in NSW and the ACT, and the King’s Birthday on October 4 (Queensland only).

Auction volumes were impacted last week by the day of mourning for Queen Elizabeth. Victoria’s property market spiraled into the deepest lull, due to the AFL grand final holiday gifting Victorians a four-day weekend.

The auction capital of Melbourne focused instead on one of the year’s biggest sporting events at the MCG, with auction volumes tanking by 90 per cent to end September.

The recovery in Melbourne sees 735 properties to auction on Saturday.

The clearance rate jumped a little across the combined capitals, hitting 60.2 per cent, Domain figures show – the highest clearance rate since April and the fourth consecutive week higher than 55 per cent.

Melbourne’s market registered a higher rate of postponed, sold prior and withdrawn auctions last Saturday due to the AFL public holiday.

“The run of higher clearance rates compared to winter indicates that seller price expectations are adjusting to meet buyers’,” September’s Domain weekly auction preview report said.

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

/http%3A%2F%2Fprod.static9.net.au%2Ffs%2F515d4827-87a1-4b82-b63e-e8febe5085f2)