Luxury Drummoyne penthouse with harbour views sells off the plan for record $9 million

A $9 million penthouse sale on Sydney’s waterfront has led a surge of multimillion-dollar off-the-plan purchases in Australia’s capital cities this month.

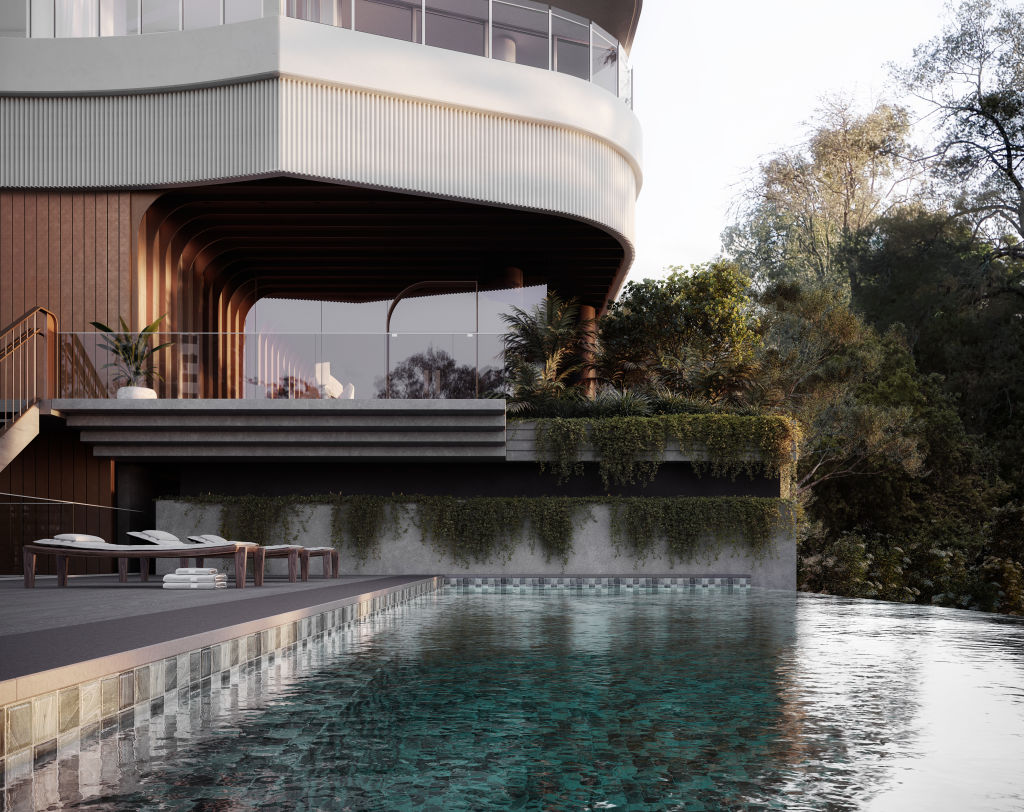

The whole-floor four-bedroom penthouse with views of the harbour sold at The Isles, a boutique development of just nine luxury apartments in Drummoyne that comes with its own “secret beach”.

Local buyers bought the swanky apartment for just over $9 million on Father’s Day, said CBRE’s managing director of residential projects, David Milton.

“We had four people running on it, so yes, we did expect it to sell well,” he said. “There’s a lot of confidence in the high-end market because it’s stock that’s not repeatable.

“They’re buying in these positions around the harbour and the harbour is not getting any bigger, so it’s getting harder and harder to get new quality stock.”

The apartment sale is thought to set a new record for Drummoyne. Domain data from Australian Property Monitors shows the only other sale to come close was a four-bedroom apartment, also on St Georges Crescent, selling for $4.5 million in 2011.

The deal comes as wealthy homebuyers get the jump on the traditional spring selling season despite Australia officially being in recession thanks to COVID-19.

Three more apartments sold for more than $5 million each in The Isles development last week, which Milton attributes to cashed-up downsizers paying for top-shelf homes due to the fact they will be spending more time in them.

“You’ve got people who are saying, ‘I’ll be buying something that is really special because I’ll be spending more time there … I might not be going on as many holidays, so why not get what I’ve always wanted’,” he said.

At Kurraba Point, two apartments were sold by Colliers International at the new Merrinda development by Avance in the first week of September – a penthouse for a whopping $6.45 million to buyers from Port Stephens and a three-bedroom apartment for $3.25 million to downsizers from St Ives.

In Brisbane, a local downsizer paid $4.043 million for a pad at the new 160 Macquarie, a riverfront apartment development in St Lucia.

Melbourne has also posted surprisingly big sales, despite COVID-19 lockdowns forcing real estate agencies to shut down on all but a digital front.

Downsizers snapped up a three-bedroom apartment at 17 Spring Street at the gateway to the CBD for $6.5 million.

A Brighton family paid $4 million to combine two large ground-floor apartments at The International on Bay Street in Brighton, and two apartments with hefty price tags also sold at Camberwell’s Victoria and Burke – one on the ground floor for $3.85 million and another on the first floor for $2.3 million.

CBRE managing director for residential projects, Andrew Leoncelli, said both of the Camberwell sales went to local couples downsizing from larger properties.

“One came from Burke Road in Malvern East wanting to be closer to the action and was more than happy buying a first-floor three-bedroom on the Burke Road facade, while the other is a younger, dynamic couple still actively working, but wanting a larger outdoor terrace facing north [which is] perfect for entertaining.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.