South Coast market remains strong as holiday home prices continue to rise

For Canberrans, the summer holidays have become synonymous with a break to the South Coast. The short drive makes it the No.1 destination to escape the dry heat for an ocean breeze.

The school holiday countdown has begun, with many already locking in their summer break abode. For some lucky enough to have the financial capacity, they may even be considering a holiday home purchase. With many reaping the benefit of equity growth on their Canberra homes, some will be unlocking and utilising it while interest rates remain low by historical standards.

The South Coast is not only a magnet for holidaymakers, the area has always attracted downsizers and retirees.

A number of young families and city professionals could also be opting for a sea change, a trend that is likely to have gained pace since the meteoric rise of Sydney house prices.

An increasing number are seemingly choosing to purchase in regional NSW rather than being pushed to the city fringes and, as flexible working hours and remote offices become more common, leaving the city rat race becomes a greater possibility.

Across many capital city markets property prices are softening, a trend which has been predominately driven by Sydney and Melbourne. This downturn is a first for Australia, with previous incidences coinciding with interest rate rises from the Reserve Bank. Instead this one has been aided by the tightening of credit by the banks following regulatory intervention and a royal commission.

Borrowers are now faced with rising mortgage rates, tighter credit conditions, greater scrutiny from lenders and reduced borrowing power, which have impacted on all capital cities to a varied degree.

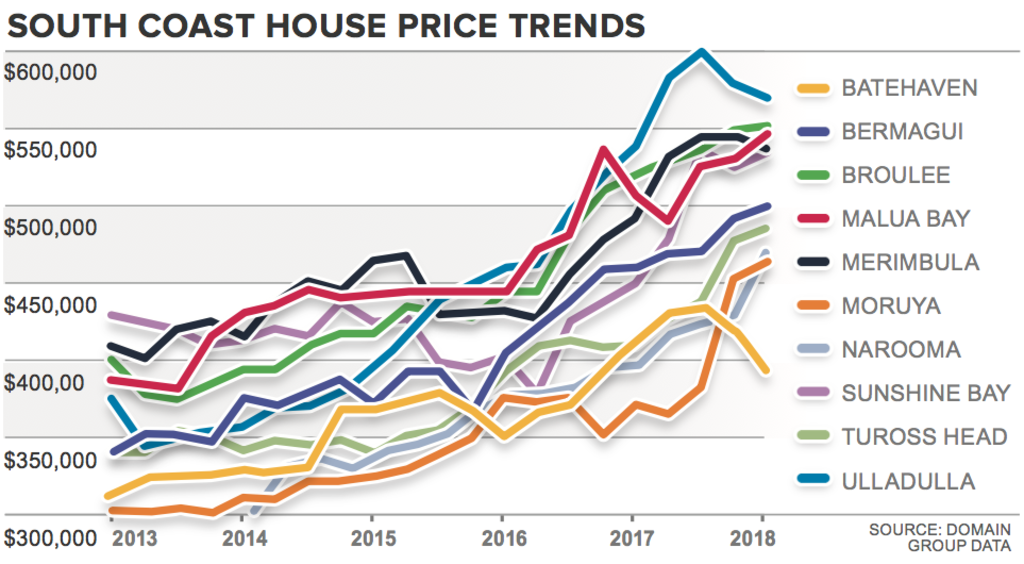

The South Coast has bucked the national trend with many areas continuing to experience price growth. The market remains strong in Tuross Head, Sunshine Bay and Narooma, with prices a staggering 18 per cent higher compared to last year and the median house prices at $485,000, $533,750 and $469,875 respectively.

Many other coastal areas continue to provide home owners with robust price growth, with houses up 9.2 per cent in Merimbula to $537,500, and 8.5 per cent in Bermagui to $499,000, and 7.4 per cent in Malua Bay to $545,000. Broulee and Ulladulla provided a more modest pace of growth at around 6 per cent to $551,500 and $570,000 respectively.

Despite property prices continuing to rise across key areas of the South Coast, most are displaying a lower pace of growth relative to last year. And the change in the lending landscape is likely to be slowing price gains.

Care should be taken when considering a property purchase in a location that is predominantly driven by investor activity – prime holiday spots are a great example. Areas that have a higher proportion of investors can display a greater volatility in price, as they tend to be more exposed to market changes, particularly in light of the recent lending changes that specifically targeted investor activity.

Consider purchasing in an area that has a greater mix of local owner-occupiers rather than a sub-market solely dominated by holiday rentals. This can help to improve the buyer pool when it comes to resale and an owner-occupied-led market means it is less exposed to retreating investor activity.

Purchasing a holiday home will remain a firm dream for many Canberrans and for some it will be a reality as home owners continue to unlock capital growth.

Top 3 South Coast homes currently for sale:

39 Cooks Crescent

3 bedrooms, 2 bathrooms, 1 car space

Auction: 11am, November 17

Agent: First National Real Estate Batemans Bay, Pat Jameson 0405

3 Murray Street

2 bedrooms, 1 bathroom

Auction: 1pm, November 24

Agent: LJ Hooker Moruya, James Hamilton 0408 135 553

Merimbula (also pictured as top feature image)

4 Ocean View Avenue

4 bedrooms, 5 bathrooms, 2 car spaces

Price guide: $1.52 million

Agent: Salis Real Estate, James Cravana 0428 139 976

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More