Melbourne and Sydney continue to lead property price decline: CoreLogic figures

Australia’s largest cities are continuing to lead the property market downturn, with new figures showing price falls accelerated in both Melbourne and Sydney last month.

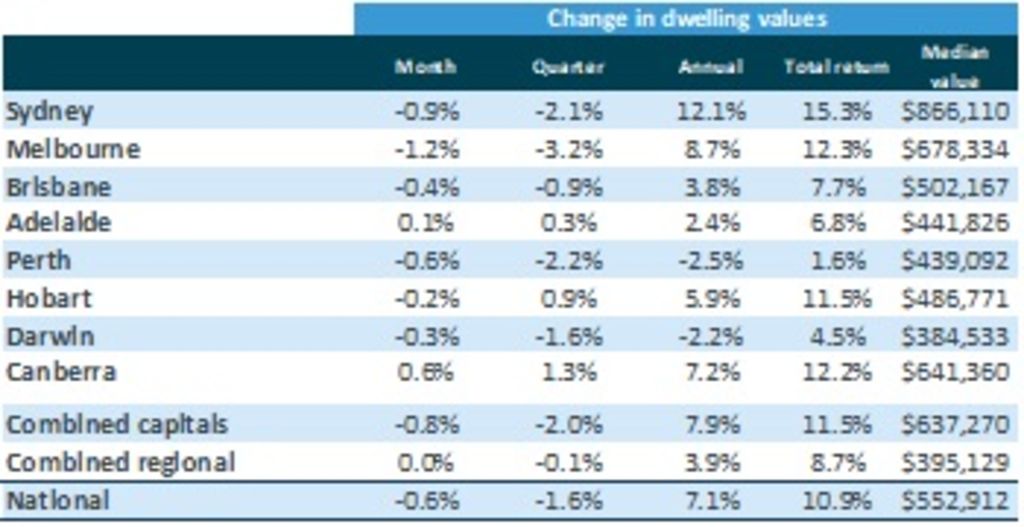

Australian housing values dropped 0.6 per cent in July, according to the latest CoreLogic Home Value Index, released Monday, marking the third consecutive month of prices falls amid the coronavirus pandemic.

Melbourne recorded the largest drop, with the median dwelling value falling 1.2 per cent over the month to $678,334. It was followed by Sydney with a decline of 0.9 per cent to a median of $866,110.

CoreLogic’s head of research Tim Lawless said despite the declines, overall, Australia’s housing markets had remained relatively resilient through the COVID-19 pandemic so far.

“The impact from COVID-19 on housing values has been orderly to date, with CoreLogic’s national index falling only 1.6 per cent since the recent high in April – and housing turnover has recovered quickly after its sharp fall in late March and April,” he said.

CoreLogic head of residential research Australia Eliza Owen said values in Melbourne and Sydney were now down 3.5 per cent and 1.7 per cent respectively, since March.

“Generally, we’ve seen an acceleration in the rate of decline for Sydney and Melbourne, but not across other capital cities with the exception of Hobart … which has been a little volatile … after such a strong growth rate for the five years to 2019.”

Both cities, but Melbourne in particular, had been more heavily impacted by the coronavirus pandemic than other capitals, Ms Owen said, and had markets that were more reliant on overseas migrations, which had been brought to a standstill.

“I don’t see how Sydney and Melbourne can avoid an acceleration of their downturns right now, while international borders are still closed,” she said.

The second lockdown in Victoria and move to stage four restrictions in Melbourne would only put increased downward pressure on prices, Ms Owen said.

“The restrictions will see a more immediate shock to transaction activity; already we’re seeing more properties withdrawn from auction, we’re seeing fewer new listings coming onto the market and fewer reports generated for real estate agents [for properties which may come onto the market],” Ms Owen said.

“Both the physical limitations of selling property and uncertainty generated by another six weeks of lockdown is going to see fewer people trying to sell their property – but that could keep some stability in the market.”

The figures also showed the top end of the market was still leading the downturn.

In Melbourne, values at the top end of the market were down 5.2 per cent while lower values declined 1.2 per cent. In Sydney, the upper quartile fell 2.5 per cent, while lower values remained virtually flat with a fall of 0.1 percent.

Importantly, Ms Owen noted, the top end had recorded the most significant rise in values throughout the second half of last year and into early 2020.

Ms Owen said markets with higher concentrations of investors and more recent purchasers would be hardest hit, but added that the extension of mortgage repayment holidays and JobKeeper and JobSeeker payments, albeit at a reduced rate, would limit forced selling.

She said it would not be until March when the market was really put to the test.

Across the rest of the country, prices edged down slightly in Brisbane, Perth, Hobart and Darwin, falling 0.4 per cent, 0.6 per cent, 0.2 per cent and 0.3 per cent respectively over the month.

Canberra and Adelaide posted a rise in dwelling values over the month, with prices up 0.6 per cent and 0.1 per cent.

Ms Owen said both cities had benefited from low coronavirus case numbers and eased social distancing restrictions. She added that Adelaide was a relatively slow and steady market, with the traditionally low transaction and investor volumes, while Canberra’s job market had been less impacted by the coronavirus pandemic due to the higher proportion of public sector employees.

Regional markets were generally showing more resilience to falling values. Across the combined regional areas, values were unchanged in July compared with a 0.8 per cent fall across the combined capital cities index. Regional Victoria and regional Western Australia were the only regional markets to record a fall in values, with prices down 0.5 and 3.2 per cent.

Ms Owen said regional areas typically lagged behind capital cities for price movements and typically saw less price fluctuations, with smaller gains and smaller declines.

Domain senior research analyst Nicola Powell said the property market was holding up extremely well given the economic impacts of the coronavirus pandemic, particularly markets outside of Sydney and Melbourne.

“[However] we are just at the start of this downturn … the weakness in the market is going to be there while we see our economy struggling through job losses, rising unemployment and lockdowns. The declines will continue, and I think will continue to be focused in Sydney and Melbourne, while other capital cities continue to hold up well.”

Dr Powell said that just as with the first lockdown, many Melbourne homeowners had decided to hold off buying and selling during the city’s second lockdown, resulting in a pullback in new listings and slow down in transactions, creating a shortage of stock which helps support prices. However, she added that more sellers were comfortable with online auction the second time around.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More