Number of near-retired Australians still paying the mortgage skyrockets, experts worried

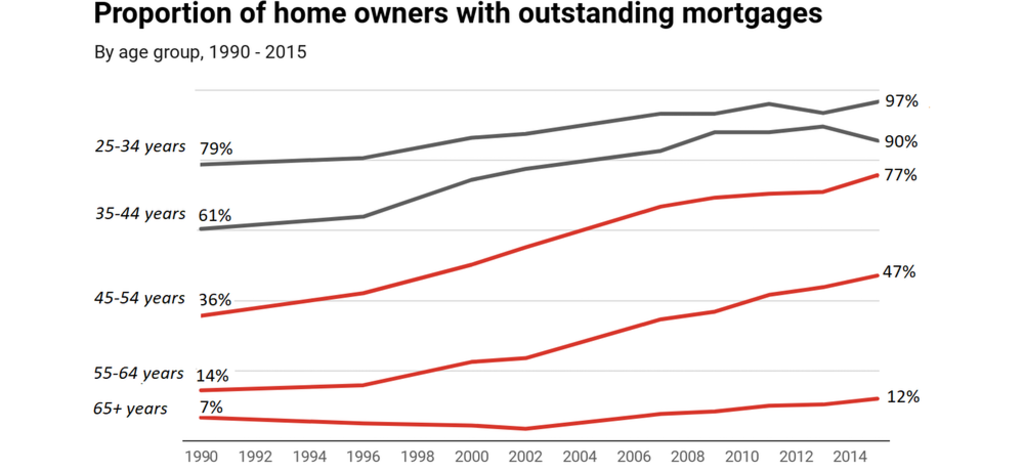

The number of home owners aged 55 to 64 still paying down their mortgage has jumped from 14 per cent to 47 per cent in 26 years, prompting concerns for their wellbeing into retirement and the superannuation system as a whole.

Numbers in all other age groups also increased, with fewer and fewer Australians owning their homes outright, even into old age.

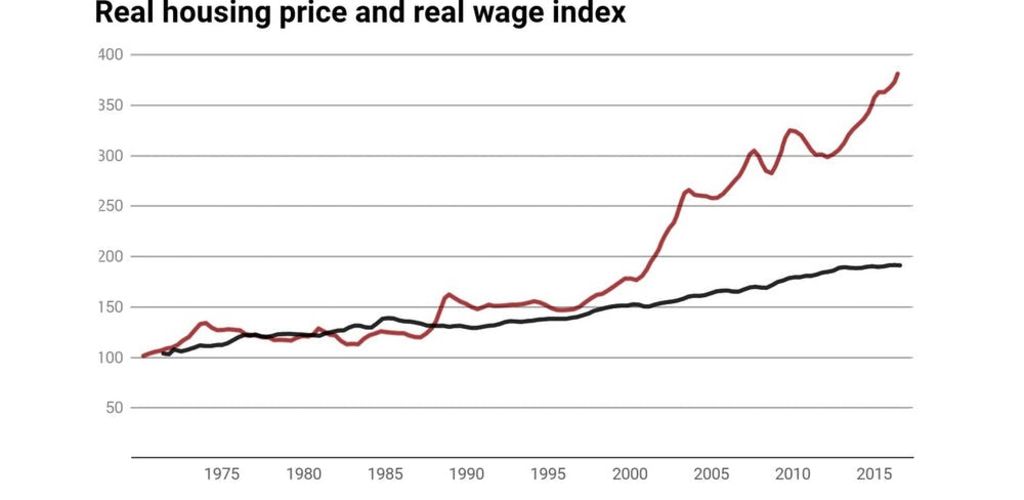

Emeritus Professor of the RMIT School of Global Studies and Social Sciences Gavin Wood said the runaway property market was exacerbating the issue, as price growth ran away from wage growth.

“So not only is the share of home owners carrying a mortgage rising rapidly with those approaching retirement, but the amount of debt relative to their income is soaring,” he said.

Professor Wood said older generations could expect to feel the pinch as they continued to work longer to pay down their debt, or even draw on their super.

He said anyone older than 44 would also be at risk of being unable to pay their mortgage after losing a job and being unable to rejoin the workforce, or being struck with a sudden illness and being unable to draw an income from anywhere other than their super.

Professor Wood said that could lead retirees into mortgage stress, and force them onto the pension if they prematurely run out of super.

“There’s a broader public policy concern,” he said. “We know one in four of those making a withdrawal on their superannuation are using that to pay off their mortgages.

“If that becomes more widespread, it threatens to undermine one of those important goals of the superannuation guarantee.

“One of those goals is that Australians have comfortable retirement living independently of the aged pension.”

Industry Super Australia chief economist Stephen Anthony placed the blame for the issue squarely at the feet of successive Australian governments which he said allowed the property market to balloon out of control.

“For upwards of 15 years, policy makers have taken their eye off the ball and forgot that housing is about families,” he said. “The underlying problem is the disconnect between the real fundamentals, supply and demand.

“We allowed demand to get well away from supply and we subsidised it.”

Mr Anthony said he was concerned that superannuation nest eggs could be diminished as a result, but said he was glad they existed to provide a second layer of support for older Australians in mortgage stress.

Professor Wood said the potential reasons for this trend was the aforementioned ballooning price-to-income ratio, the uptake of flexible mortgage products which allowed home owners to take equity out of their loans and the rise of working past the traditional retirement age, which might make home owners more prepared to pay mortgages for longer.

He called on the government to take these developments into consideration during its retirement incomes review.

“I’m not claiming that [this situation has] come to fruition, I’m flagging it as a future concern,” Professor Wood said. “It may be that it’s an overly pessimistic view.

“Governments need to be prepared to address it. With regard to the housing market, it can have implications that go beyond housing policy itself.”

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More