Number of new apartments halves, shrinking supply pipeline: JLL report

The number of new apartments hitting the market across Australia’s big cities has halved over the past year, prompting concern of a future rental crisis, a new report shows.

The number of apartments being marketed across six capital cities fell 48 per cent over the 12 months to March, according to JLL’s 1Q 2019 Apartment Market Report. The number of apartments under construction also dropped 10 per cent.

Sydney, in the midst of its steepest market downturn in two decades, saw the most significant shift, with new apartments down 77 per cent year on year. Marketed apartments dropped 51 per cent in Melbourne and 59 per cent in Brisbane.

The danger now is that the drop in supply could put increased pressure on the rental market in years to come, said JLL’s head of residential research for Australia Leigh Warner.

“It will take some time for the supply pipeline to get going again and, with still very strong levels of national population growth, we could quite easily move into supply shortages over the next few years at the national level,” Mr Warner said.

“This could result in real pressure on renters in some parts of the country … and move us from a housing price affordability crisis into a rental affordability crisis.”

Projects, tracked by JLL, are being redesigned for other land uses including office, hotels and student accommodation by existing or new owners, particularly in Melbourne.

Developers are also increasingly changing projects to better target owner occupies, given investors have largely left the market, the report says. Anecdotal evidence suggests that in Sydney, marketing firms are being more selective of the projects they take on, focusing on lower value properties within reach of first-home buyers.

“In [quarter one] there was an increase in planning submissions lodged, reflecting both lapsed approvals being resubmitted and developers changing schemes to better suit current demand trends and more specifically target owner-occupiers with smaller projects, larger apartments and higher quality finishes,” Mr Warner said.

He added the continued decline in supply, illustrated that pre-sale requirements put on developers made the apartment pipeline very responsive to weaker buyer demand.

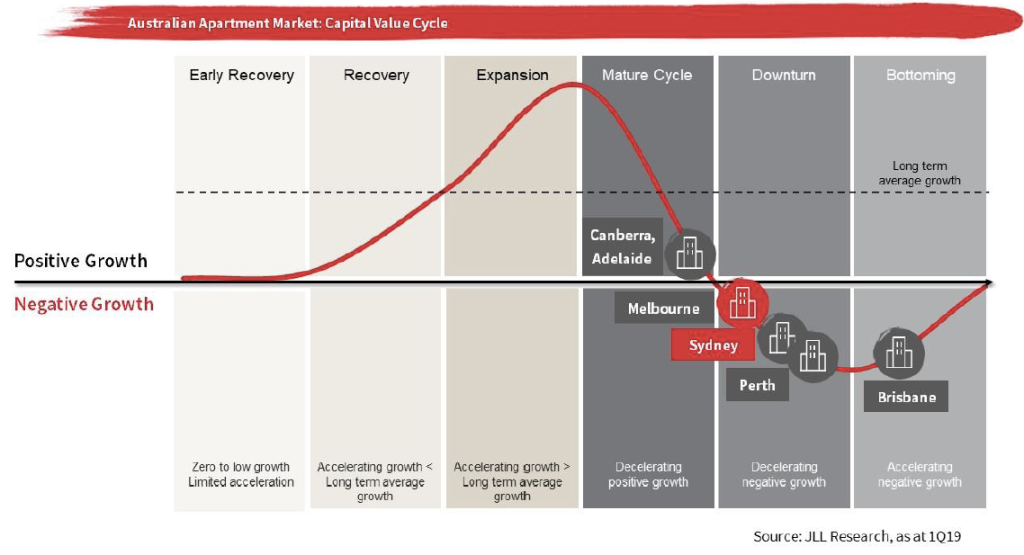

With investors, particularly foreign investors, unlikely to return to the market anytime soon, conditions are expected to remain tough in the short-term, with many parts of the country to see further downward pressure on prices and rents before starting to stabilise late this year.

“The combination of still tight credit, the federal election and buyers holding off to see where prices will settle in some markets will all remain headwinds in the short-term.” Mr Warner said.

“However, we think the medium-term outlook is very different … very low completions over the next few years, along with continued strong population growth, will see us quickly move into an under-provision of space and see rental markets tighten once more.”

Brisbane and Perth are expected to lead the next cycle as economic and population growth continue to improve. Price growth will take longer to return in Sydney and Melbourne, but lower investor activity could see the rental market turn around much quicker.

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More