Potential home-buyers warned fixed interest rates to rise as Reserve Bank winds back stimulus

Potential home-buyers are being warned that mortgage rates could get more expensive quickly, even if the Reserve Bank leaves official interest rates on hold for some time.

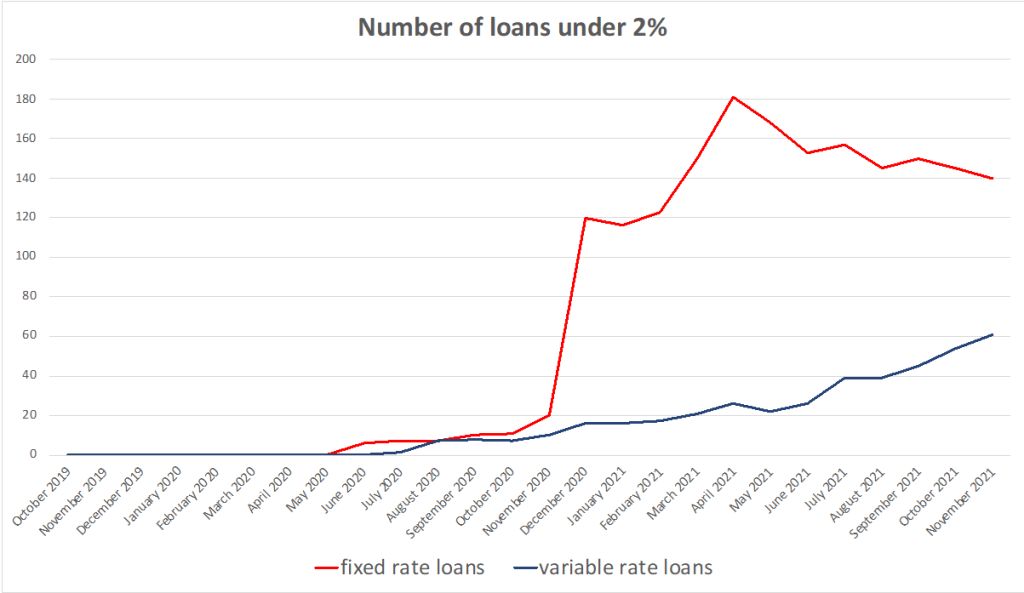

New buyers this year have been able to lock in low fixed rates of under 2 per cent from a range of major lenders, but these pandemic-era deals have started to become less plentiful and less attractive.

“We are already starting to see an increase in lots of fixed mortgage rates,” ANZ senior economist Felicity Emmett said.

“And we’re likely to see quite significant rises in the next couple of months, in the order possibly of up to 50 basis points.

“When someone, a new house buyer, is going out looking for a loan, the lowest rate they can find, rather than being 2 per cent … is more likely going to be closer to 2.5 per cent.”

As the economy recovers, the Reserve Bank is gradually reducing its stimulus measures. It will stop pushing down the three-year government bond yield, which is linked to fixed home loan rates – as opposed to variable mortgage rates which are more closely linked to the cash rate.

All things being equal, rising fixed rates could put downward pressure on house price growth, Ms Emmett said, adding regulators would watch the effect on demand for credit when deciding whether to make it any harder to get a home loan.

Existing borrowers who took out cheap fixed rates will need to refinance in the next few years, but are likely to be able to meet higher monthly repayments because banks factor in a buffer when assessing loan applications, she said. However, higher repayments could mean they have less money to spend elsewhere.

Separate figures showed a rate rise of just 0.25 per cent on a million-dollar mortgage would lift monthly repayments by $137, rising to $561 for a 1 percentage point rise.

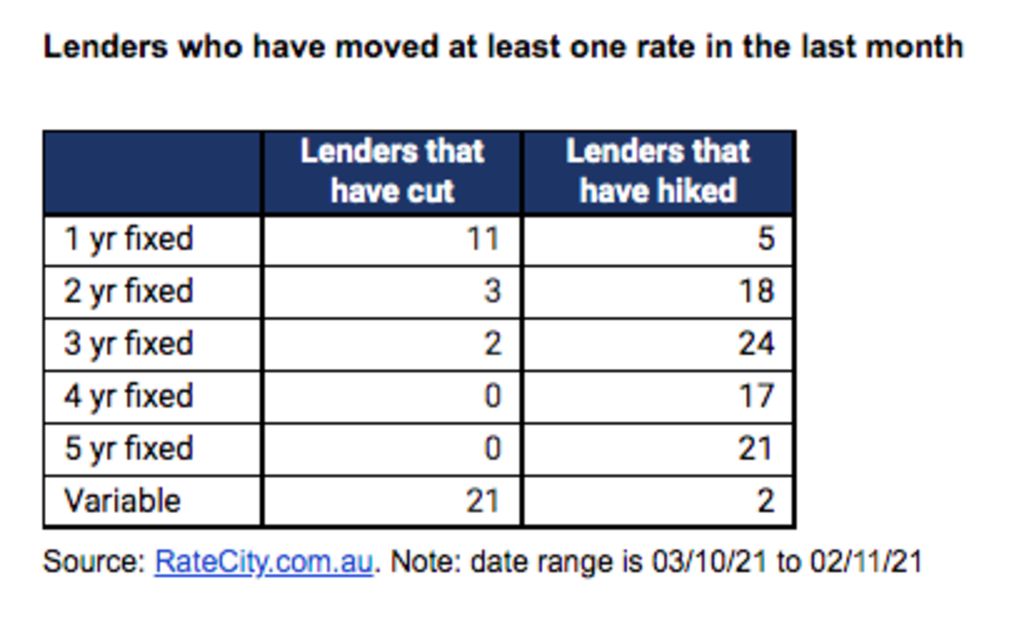

RateCity research director Sally Tindall said many major banks have already started lifting fixed rates over two- to five-year terms.

“We are expecting plenty more to follow, not just from other lenders following in their wake but as the cost of funding pressures continue to rise,” she said.

“For anyone who hasn’t yet [fixed] and wants to, there is still time. If you shop around you’re still going to get a competitive deal.”

She warned borrowers to consider whether a fixed rate suited their needs, as these products usually restrict extra repayments and may charge break fees.

Buyers should also be aware that when the fixed period ends, they start paying a revert rate, which is often much higher than the cheapest variable rate their lender offers. This revert rate may be used when someone applies for a home loan to work out maximum borrowing capacity, meaning their borrowing power could be less than if they had chosen a cheap variable-rate product.

On the ground, mortgage holders are already asking broker Chris Foster-Ramsay what it means for them.

“There’s every chance there will be a rate rise soon, whether it’s official or not,” the principal broker at Foster Ramsay Finance said.

“We’ve had a few [homeowners], and there will probably be a few more in the next couple of weeks, that will come to us and say they want to fix.

“When you fix you need to understand and look at it as a holistic proposition – if there’s a change in your circumstances and you need to break that rate or change banks or sell the property, you risk … additional break charges which can be anywhere from a couple of hundred to several thousand.”

He also advises clients looking for a fixed rate to keep part of the loan variable and to consider not locking in for more than three years.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More