Potential homebuyers able to borrow less as property prices rise after APRA interest rate change

Potential homebuyers face the prospect of being able to borrow less to buy property that costs more and more this spring.

Someone applying for a home loan from now on will have their maximum borrowing capacity reduced by tens of thousands of dollars, after a move by the bank regulator to make sure borrowers can still repay their debts when interest rates eventually rise.

Banks must now check if borrowers could afford their repayments if interest rates were 3 percentage points higher than the loan product rate, up from a previous buffer of 2.5 percentage points, under changes announced on Wednesday by the Australian Prudential Regulation Authority.

This is likely to reduce the maximum borrowing capacity for the typical buyer by about 5 per cent, APRA expects.

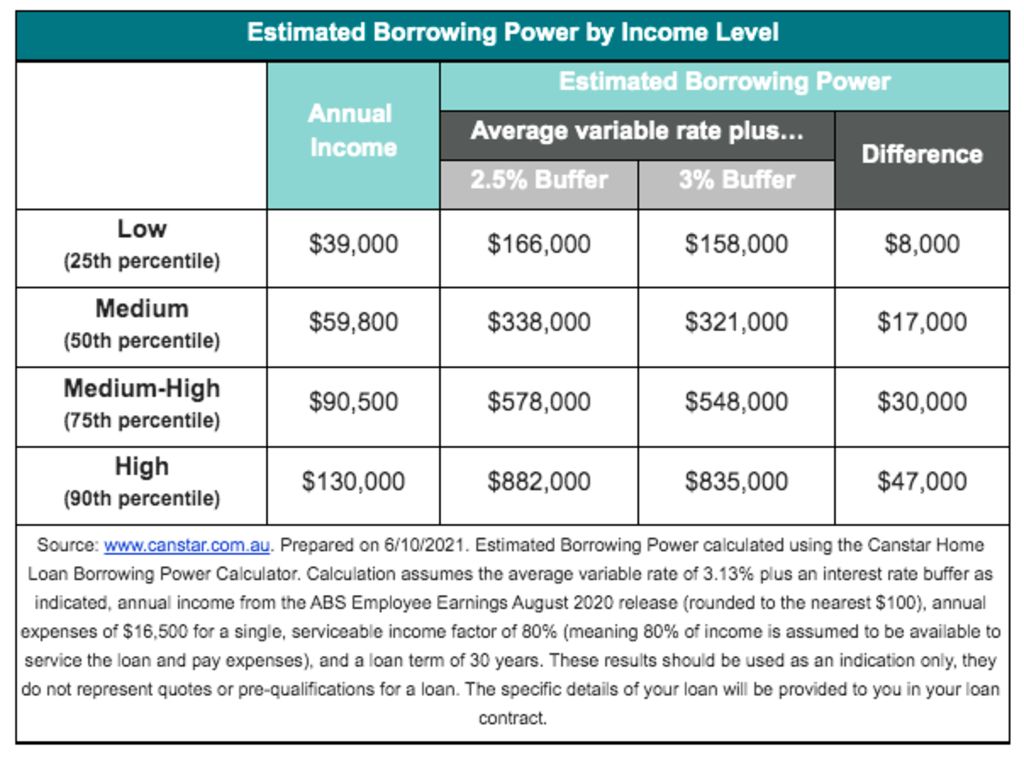

Comparison platform Canstar estimates someone on an income of $90,500 a year would have their maximum borrowing power reduced by $30,000 by the move to a 3 per cent buffer.

Under a 2.5 per cent buffer on top of the average variable rate of 3.13 per cent, this buyer could borrow a maximum of $578,000, but with a 3 per cent buffer, this drops to $548,000.

Someone on an income of $59,800 would lose $17,000 in buying power, while a high-income earner on $130,000 would be short $47,000.

At the same time, economists say prices will still rise as the regulator’s move is too modest to push house prices lower, and will likely slow the current pace of 20 per cent annual growth in home values to a smaller gain next year.

Property price growth set to slow after APRA lifts interest rate buffer: economists

Property price growth set to slow after APRA lifts interest rate buffer: economists Home loan crackdown likely to prompt slower house price growth, not price falls yet: economists

Home loan crackdown likely to prompt slower house price growth, not price falls yet: economists Home buyers pay off credit cards to borrow more for housing, but rarely take out large debts compared to incomes

Home buyers pay off credit cards to borrow more for housing, but rarely take out large debts compared to incomes The buyers who could be impacted by a crackdown on high-debt home loans

The buyers who could be impacted by a crackdown on high-debt home loans

In practice, not all buyers would be offered so much credit and not all buyers borrow the maximum available, while some lenders such as CBA have already lifted their serviceability floor. The amount someone can borrow depends on whether their income is enough to cover the repayments and whether their deposit is enough to afford the property, and banks also consider borrowers’ monthly expenses – the maximum figure assumes a borrower slashes their annual non-housing expenses to a frugal $16,500 for a single.

But in expensive neighbourhoods, mortgage brokers say buyers are increasingly trying to borrow as much as possible to keep up with a property price boom.

In pricey Sydney, Shore Financial chief executive Theo Chambers is seeing about 90 per cent of clients hoping to borrow their maximum.

“This will push them back even further,” he said. “I understand it might help affordability … it might soften the crazy prices, [but] it reduces someone’s ability to borrow.

“The problem is, the Sydney property market is so expensive, they’re already struggling, they’re already compromising.”

Even so, Mr Chambers warned that a later increase in interest rates could be a significant rise in someone’s repayment, and was concerned that not everyone was calculating affordability for the future.

In Melbourne, Mortgage Choice Yarraville’s Garry Megalogenis said first-home hopefuls starting out in their careers would be “drastically” impacted by the change.

“They are struggling at the moment and adding that 0.5 per cent buffer on top of the already high buffer – it will impact them.”

He said he had seen quite a few buyers looking to borrow their maximum after missing out on auctions over the last couple of months, and said many had done their research and knew that rates were likely to rise in future.

As for a buyer who wants to borrow, for example, $600,000 from a borrowing capacity of $1.2 million, the change would not affect them, he said.

Will Unkles, director of 40Forty Finance and a specialist in the first-home buyer market, said while most borrowers would not be affected as they were seeking a smaller loan than their limit, the rest would need to consider compromising.

“The clients that are stretching themselves, which a lot are in this market, to try and keep pace and buy what they intended to buy – this means some clients who are approved up to their maximum will have to recalibrate their budget slightly,” he said.

“It may mean a slight adjustment on property size, land size, location.”

Canstar group executive financial services Steve Mickenbecker said the change to borrowing power might make a difference as to which suburbs a buyer could afford in a larger city, but would not force buyers out of the market.

He said the change would likely affect first-home buyers, who do not already have rising equity in their current home like upgraders do, and investors, who are now set to be assessed for serviceability across their total property portfolio, including their family home.

“If you’re not borrowing the maximum, this means nothing to you,” he said. “If you’re right at the margin, it matters.”

Mr Mickenbecker said it was critical for buyers to understand interest rates will rise from ultra-low levels in future.

“What we know is interest rates will go up,” he said. “What we don’t know is when.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More