Property cheat sheet: three ways the market has tipped in buyers' favour

In real estate, the word on the street about the market is as compelling as crunchy data.

“I think this area is on the up”; “My niece scored a bargain there”; “I heard he sold it for less than he wanted…”.

The general vibe in the industry right now is this – the upper hand has switched from sellers, who were riding high prices a hot market, to buyers, who now have the chance to score a property they love within budget, taking their time and enjoying more choice.

And we have the numbers to back that sentiment up.

These are three sets of digits that prove the advantage in the market is now tipping the way of buyers.

Listings are up

More choice of properties for sale means less competition among buyers.

When buyers have greater options, it water downs FOMO and the urge to fight (read: keep on bidding and pay more than your opposition) to win the keys.

Right now, Canberra buyers have a bigger boost in options than anyone in Australia. Listings in the capital have increased almost 20 per cent in the month to March (according to data from the most recent Domain House Price Report, which is crunched quarterly).

Adelaide has had the second biggest jump in listings, followed by Perth.

Canberra: Listings up 19.8 per cent (monthly change)

Sydney: Up 14 per cent

Darwin: Up 16.7 per cent

Gold Coast: Up 13.6 per cent

Brisbane: Up 12.4 per cent

Adelaide: Up 18.5 per cent

Hobart: Up 16 per cent

Melbourne: Up 15.9 per cent

Perth: Up 17.8 per cent

Clearance rates are down

Clearance rates are still one of the best measures of market performance. The figures reveal how many properties sold that week from those on offer.

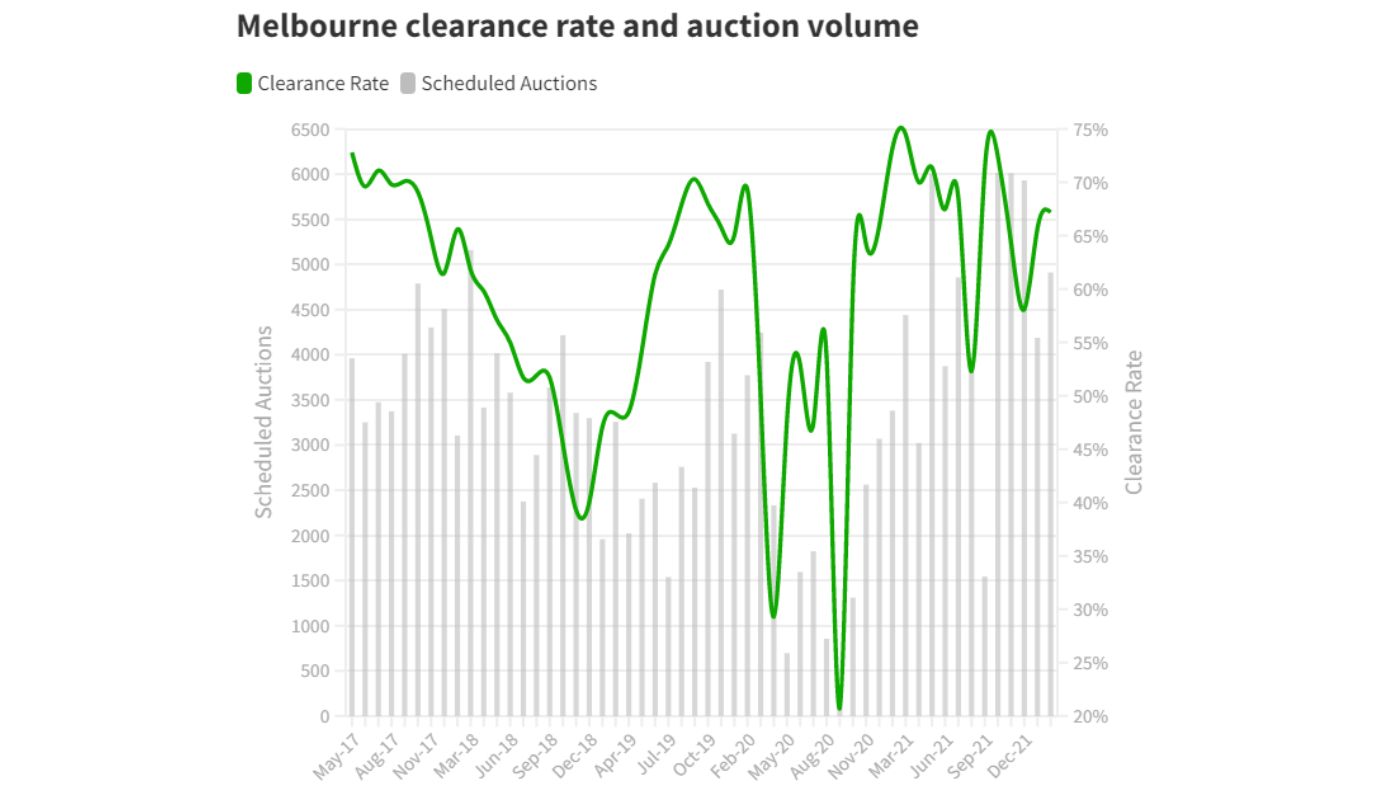

In Melbourne, there are two big games in town – auctions and AFL. Melbourne is known as the auction capital of Australia. It’s a popular method of sale and a weekend pastime.

Clearance rates in Melbourne crept upwards between February and March – landing in mid-60s – but are much lower than clearance rates at same time last year (March 2021) and the summer market that closed out the year, where they hit the early to mid-70s.

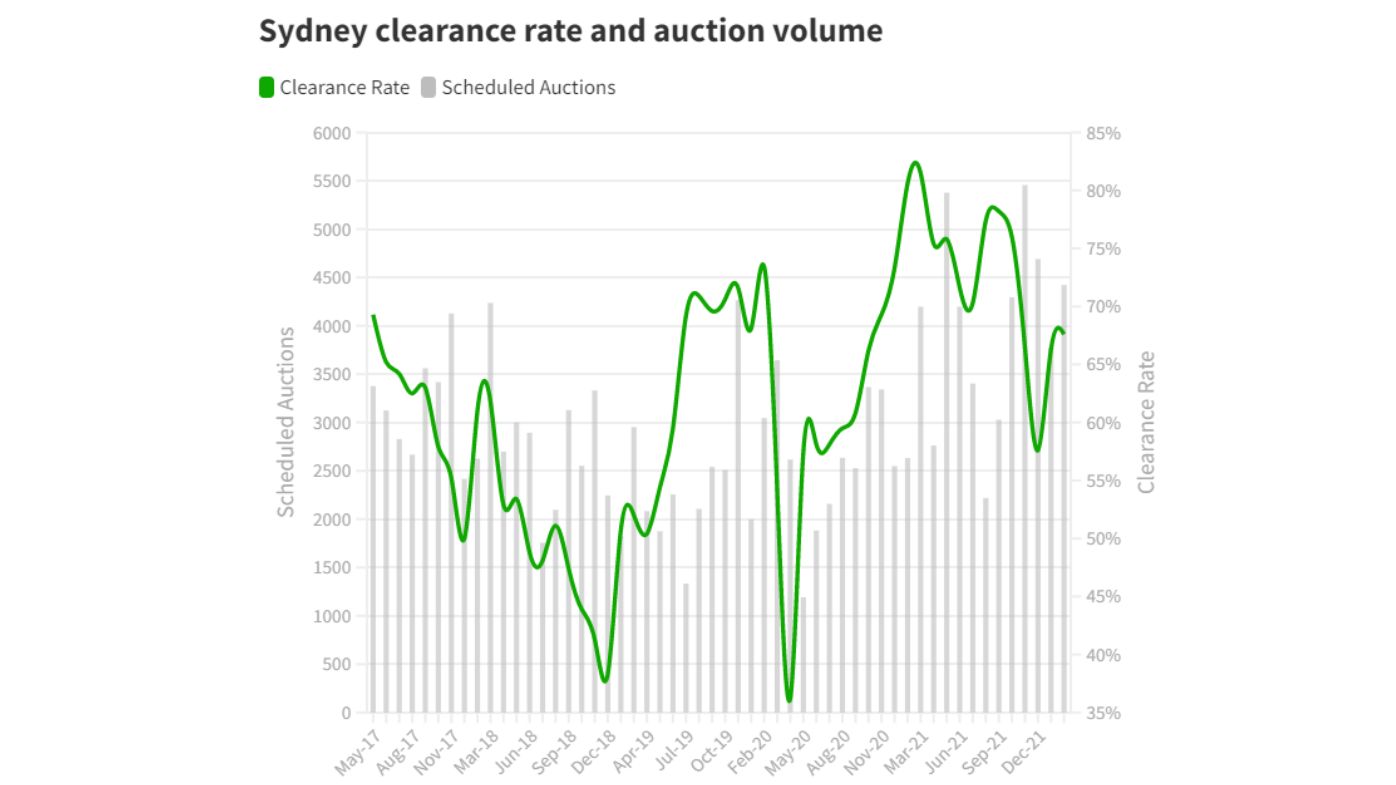

In Sydney, the clearance rate continues to clock in below 70 per cent (for five months in a row), which suggests a cooling market, according to Domain’s research team.

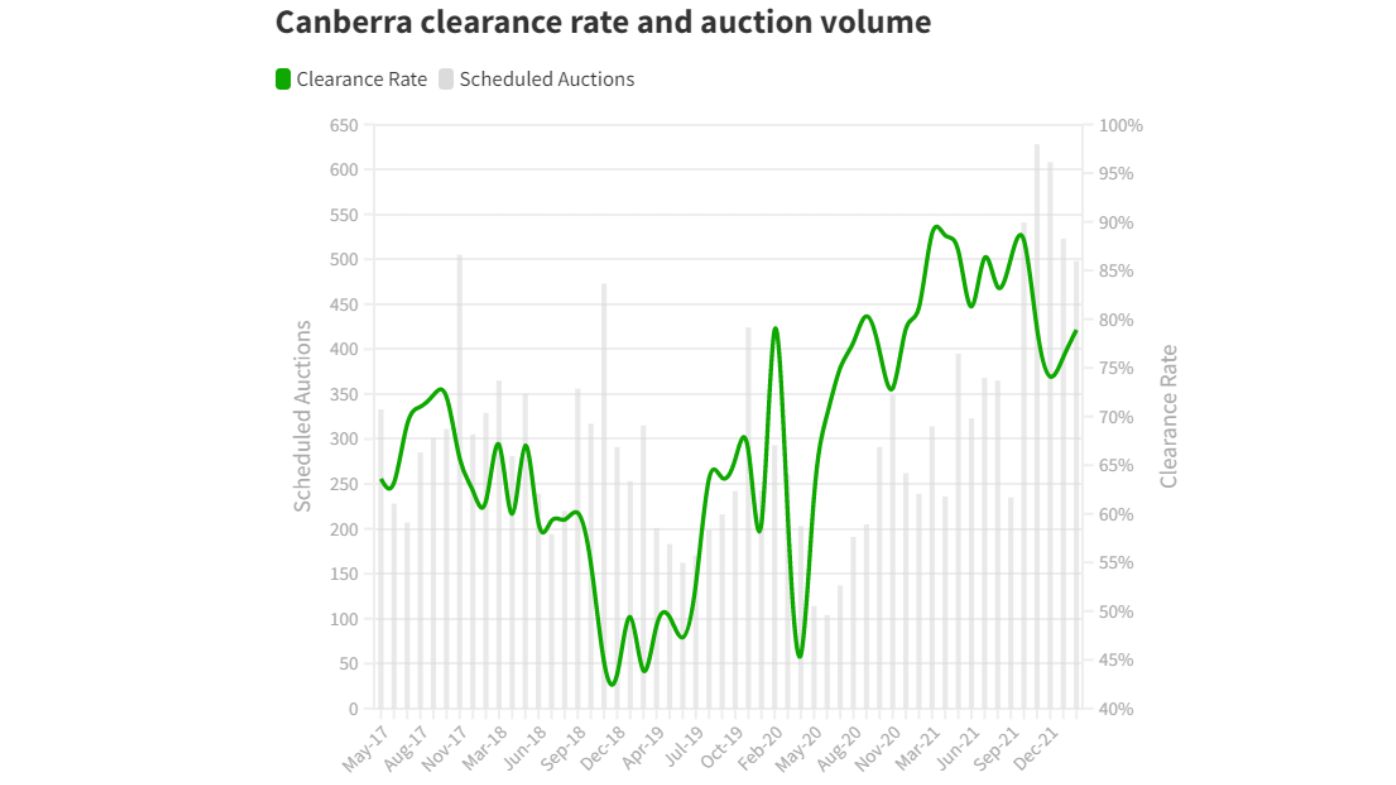

Canberra’s clearance rate is almost 10 per cent lower than the same time last year, and are sitting a little bit below the 80 per cent-plus clearance rates that defined 2021.

Properties are taking longer to sell

The average number of days that houses are on the market has increased in some capital cities between February and March.

Buyers are biding their time and haggling harder, resulting in some homes remaining on the market for longer in Melbourne, Sydney, Canberra, Brisbane, Darwin, Hobart and Perth.

Only in Adelaide are houses selling ever-so slightly faster than the previous month.

In Melbourne, houses are on the market for a week longer, and it has skipped out by six days for Sydney and the ACT.

Domain measures days on market for private treaty listings (properties going auction have a set campaign of three or four weeks, but private listings linger until a buyer strikes at an acceptable price).

Buyers will see expressions of interest, private sale or even simply “contact agent” on private treaty ad, which means pick up the phone and start negotiating.

Canberra: March, 48 days on market; February, 42 days on market

Sydney: March, 46 days on market; February, 40 days on market

Darwin: March, 108 days on market; February 107 days on market

Brisbane: March, 37 days on market; February 35 days on market

Adelaide: March, 65 days on market; February 68 days on market

Hobart: March, 31 days on market; February 26 days on market

Melbourne: March, 52 days on market; February 45 days on market

Perth: March 61 days on market, February 65 days on market

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More