Property prices rise in every capital city in November: CoreLogic

The COVID-19-induced house price weakness appears to be over as house prices rose in every capital city last month for the first time since the pandemic took its toll, but experts warn that big risks remain next year.

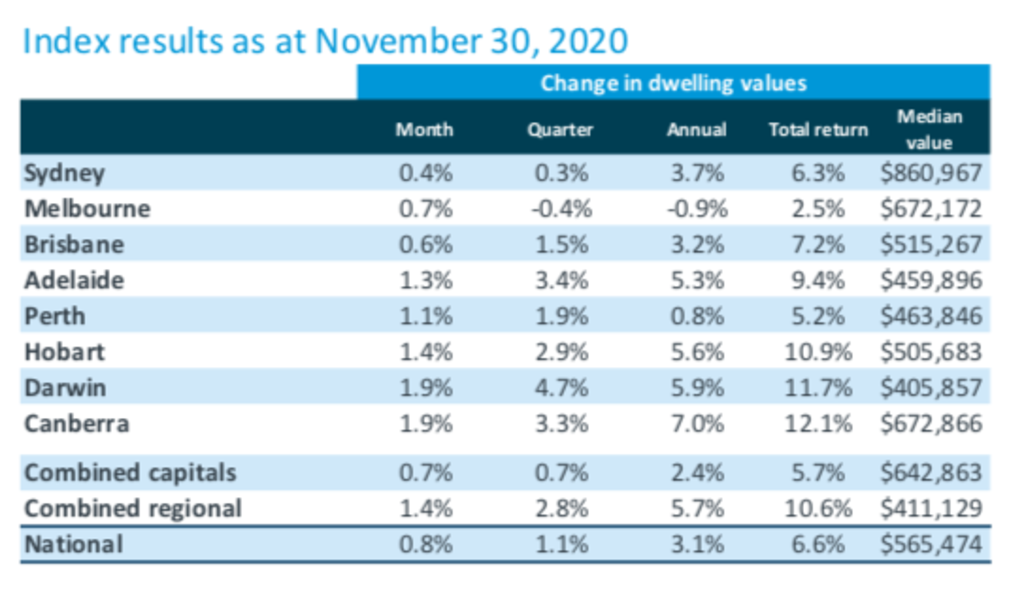

National home values rose 0.8 per cent over November to a median of $565,474, the latest CoreLogic Home Value Index, released on Tuesday, shows.

And if the current growth trend persists, national values are likely to surpass pre-pandemic levels in early 2021, after falling just 2.1 per cent between April and September, CoreLogic’s head of research Tim Lawless says.

“If house values continue to rise at the current pace, we could see a recovery from the COVID downturn as early as January or February next year,” Mr Lawless said.

“The recovery in Melbourne, where home values remain 5 per cent below their recent peak, will take longer.”

Sydney values rose 0.4 per cent in the month, while Melbourne jumped 0.7 per cent, its first month back in positive territory since the pandemic hit.

Brisbane, Adelaide, Hobart and Canberra all reached record highs in November, according to the index, while Darwin and Canberra recorded the biggest jumps in home values – rising 1.9 per cent to medians of $405,857 and $672,866, respectively.

Over the past year, the national median value is up 3.1 per cent.

The increase comes after interest rates were slashed to record lows in the month, allowing potential buyers to borrow more.

Consumer confidence has also been rising as the two largest states contain their virus outbreaks, with Melbourne’s real estate market swinging back into gear after a strict lockdown.

At the start of the crisis, several economists were predicting housing values to drop by 10 per cent or 15 per cent, which has not happened so far.

Some economists have been upgrading their outlooks, with Westpac last week predicting no further price falls and 4 per cent price growth next year, while ANZ scrapped its forecast for a 10 per cent drop to predict growth next year of 8.8 per cent in Sydney, 7.8 per cent in Melbourne, 12 per cent in Perth and 9.5 per cent in Brisbane.

Buyers have also been taking advantage of government grants to build new homes, with official figures showing a 3.8 per cent rise in building approvals in October, and approvals for houses rising for the fourth consecutive month.

House and unit prices diverged, with strong house price growth of 1.1 per cent over the past three months lifting city-wide property values, while the unit market fell 0.6 per cent in the same period, Mr Lawless said.

“This trend towards stronger conditions in detached housing markets is evident across most of the capital cities,” he said.

“Relative weakness in the unit market can be attributed to factors including low investment activity, higher supply levels in some regions and weaker rental market conditions across key inner-city unit precincts.”

Sydney house prices rose 0.9 per cent in the past month to a median of $1,000,170, while unit prices fell 0.7 per cent to a median of $728,168.

Melbourne’s median house price rose 0.6 per cent to $790,543 and its median unit price also increased 0.7 per cent to $568,056.

Mr Lawless said Melbourne’s unit market values were “surprising” but an exception that would be short-lived unless overseas migration turned around sooner than expected.

The cheapest homes are driving the recovery. Across the capital cities, the most affordable quartile of homes rose in value by 1 per cent in November, faster than the 0.6 per cent growth in the most expensive quartile.

Even so, the pandemic-induced price weakness appears behind us, despite pockets of risk, Domain senior research analyst Nicola Powell says.

The question of when international borders would reopen as well as the end to government income support and mortgage holidays remained the biggest headwinds for the property market.

“We have so much government stimulus masking the true effects of COVID … we won’t see the true impacts until [that ends],” Dr Powell said. “The question now is how soon international borders will reopen to restore the imbalance in pockets of the rental market.”

Apartment-heavy investor markets close to capital city central business districts are at greater risk, according to Dr Powell.

“It’s a question of how many of these investors can weather this disruption … if we do see rental markets disrupted for a longer period of time they’ll start offloading,” she said.

“It seems like the weakness in price that occurred during COVID is now behind us but there are still risks that remain ahead even though all cities are growing and are extremely resilient.

“There are still pockets of vulnerabilities in our cities but it looks like our markets are going back on track.”

In the meantime, the limited number of homes on the market in the face of strong buyer demand from owner-occupiers in a low-interest rate environment is fuelling the property market’s recovery, according to the index.

A separate report showed Australians are keeping up well with their mortgage repayments thanks to ultra-low interest rates, fiscal stimulus and early access to superannuation.

Mortgage arrears are likely to rise in the coming months, but from a low base, ratings agency S&P Global Ratings said.

Job losses have been higher in sectors such as tourism and leisure, where workers are more likely to rent, which could temper increases in arrears, S&P said.

Good progress on the public health situation was underpinning the economic recovery, a positive for debt serviceability, but confidence remains fragile, the agency said.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More