Rate rises could hit renters harder than homeowners

In one of the current housing market’s worst ironies, the people likely to be slugged hardest by the latest interest rate increase are those who don’t actually own property.

Renters already face a dire shortage of accommodation, with vacancies at rock-bottom levels, and now it’s predicted that many investors will try to pass onto them all, or some, of the extra cost of having a mortgage.

“The Reserve Bank’s interest rate rise will have an impact on renters,” AMP Capital chief economist Shane Oliver said. “As the cost of buying a home goes up for an owner or investor, they may try to pass that on to their tenants. It might not be the full amount of the increase, but it could be a big chunk.

“With market conditions so tight, and vacancy rates so low, tenants may not have too many other alternative properties to rent or, if they’d been saving up for a deposit, then it’s now going to be harder for them to buy. And, in the longer term, the higher rate could lead to a fall in the property market and less construction, which could tighten the rental market even further.”

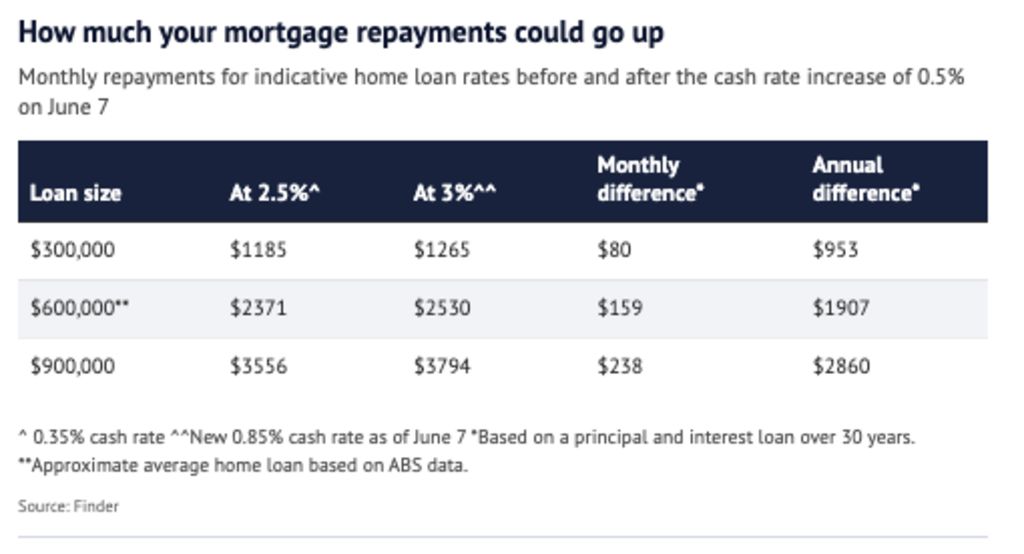

Last week the RBA lifted the cash rate by 50 basis points to 0.85 per cent in its second rise in two months, with more predicted to follow in a bid to slow the rapid rate of inflation.

According to RateCity, a home owner with $1 million owing will see their mortgage repayments rise by $265 a month. If the cash rate hits 2.10 per cent by the end of this year, as many economists are now forecasting, someone with a $1 million mortgage could see repayments rise by a total of $1083 by the end of this year.

RateCity research director Sally Tindall said in those areas where there are already shortages of rental accommodation, tenants may find themselves “throwing more money at rents” to keep their homes.

“I think they could find their rents going up as a result of the rate rise, particularly in areas of Sydney or Melbourne or anywhere across Australia where the rental situation is dire,” she said.

“If you factor in the borders reopening too, that could further fuel demand for rental places, and we might see more investors moving their properties away from residential tenancies and back to short-term platforms like Airbnb as tourists come back. It means investors may have more room to increase rents as a result.”

The prospect of more rate rises on the horizon could also spur some investors to sell, and to deter others from entering the market. The latest Australian Bureau of Statistics figures for April showed the biggest drop in investor lending since May 2020.

The recent Domain Rental Vacancy Rate Report showed that residential rental vacancies are currently at crisis levels, ranging from 1.6 per cent in Melbourne and 1.4 per cent in Sydney, to 0.6 per cent in Brisbane and 0.3 per cent in Adelaide.

Domain chief of research and economics Dr Nicola Powell says the extent to which renters could be slammed depends on the vacancy rate in their particular location and the circumstances of their landlord.

“If the investor needs the cash flow to repay their mortgage, they may be very sensitive to rate rises and want to pass on the extra costs,” she said. “But if they’re already negatively geared, then they might not be so fazed by the rise.

“Certainly, those tenants who are coming to the end of their leases will be at greater vulnerability to higher rents.”

Reports are coming in all the time, however, about tenants being evicted so that landlords can raise rents, according to Tenants Union of NSW chief executive Leo Patterson Ross.

“If landlords think they can get higher rents, we’re seeing a lot of tenants being evicted,” he said. “Or if tenants don’t have any rental alternatives, then they might see their landlord passing on the higher rate of interest. Landlords always do risk losing a good tenant in that way, though, and sometimes the value of the rent rise can be wiped out by the period their rental is then vacant.”

BIS Oxford Economics head of macroeconomic forecasting Sean Langcake says landlords pushing rents up may not always succeed, but the difficulty is that the rental market isn’t terribly transparent.

“The interest rate is just one factor in determining rents, but it can be very hard for tenants to know if they’re being offered a good deal,” he said. “And if the rise is too much, they still often don’t know if they could find a better rent elsewhere.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More