Real estate experts watch for a 'Trump bump' in the housing market

Add “Trump bump” to the lexicon of property terms that will be on repeat in 2025.

Some agents and brokers in the US luxury housing market say a price-rise phenomenon, following this year’s presidential election, will come to pass.

It’s already in play in Palm Beach, Florida, one major selling agent says.

However, pundits are divided on whether incoming President Donald Trump’s proposed real estate tax reforms, promised release of federal land for building and a deregulation program will crank prices and activity.

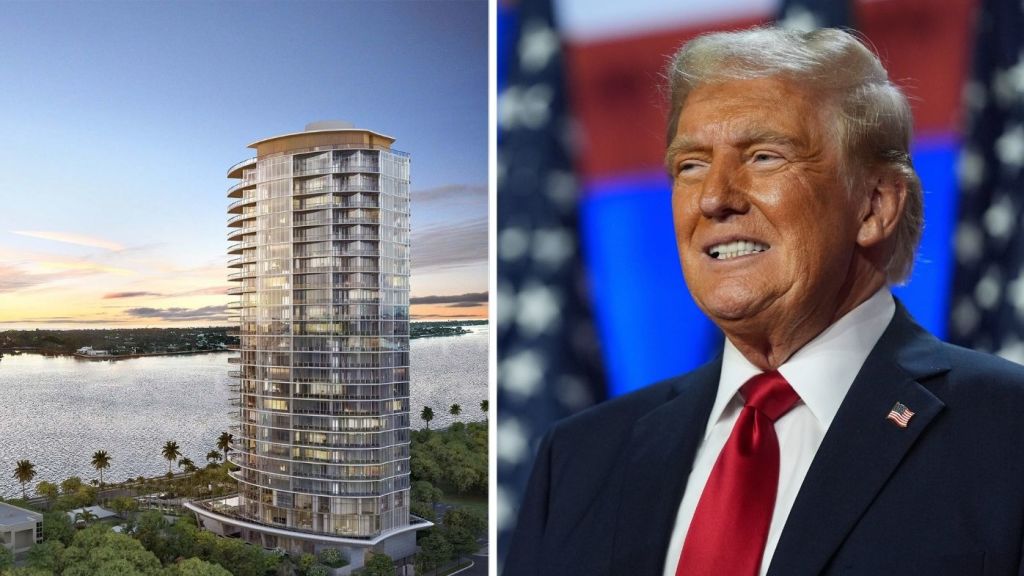

A waterfront penthouse in Palm Beach recently transacted for every cent of its hefty price tag – $US33.5 million ($AU52.6 million).

Although the sky home in the Forté on Flagler complex is a “grey box” – a phrase that describes a shell requiring a custom fit out – it sold for cash in just six weeks, according to an exclusive report by the New York Post’s Gimme Shelter section.

Rich buyers are expressing new interest in Palm Beach, given its increased profile as the home of Trump’s Mar-a-Lago resort.

The listing agent and director of sales for Forté on Flagler, John Reynolds of Douglas Elliman, told the Post Trump’s win has energised the south Florida market.

“We are seeing renewed attention in Palm Beach, which is undoubtedly tied to Donald Trump, whose election victory has brought even more energy to the market, along with greater certainty around long-term capital gains and a sense of stability,” Reynolds said.

The “bump” part of the equation more broadly refers to the anticipated effect on market dynamics.

The Trump-Vance camp have promised to halve the cost of housing the US, according to Newsweek.

However, with tax reform and deregulation on the cards, the impact would take time to be observed, given the layers of government required to introduce such changes.

Regulation fees in the US are responsible for 25 per cent of a newly-built home’s cost.

Danielle Hale, chief economist at Realtor, said in a statement that the force of the “bump”, if it occurs at all, will depend on “what campaign proposals ultimately become policy and when”.

Hale said: “The new administration’s policies have the potential to enhance or hamper the housing recovery, and the details will matter.”

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More