Regional housing markets around Australia rise amid pandemic: Herron Todd White

Pent-up demand from buyers around Australia is prompting rises in regional property markets across the country despite the pandemic recession, a new report has found.

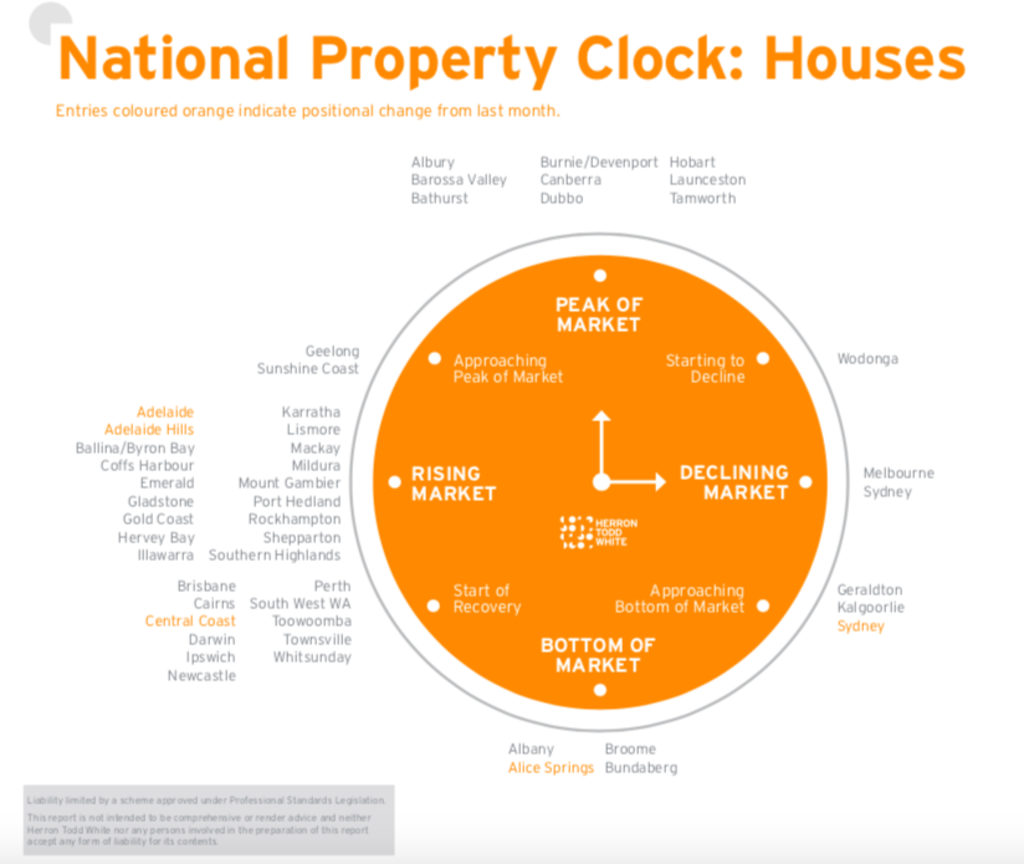

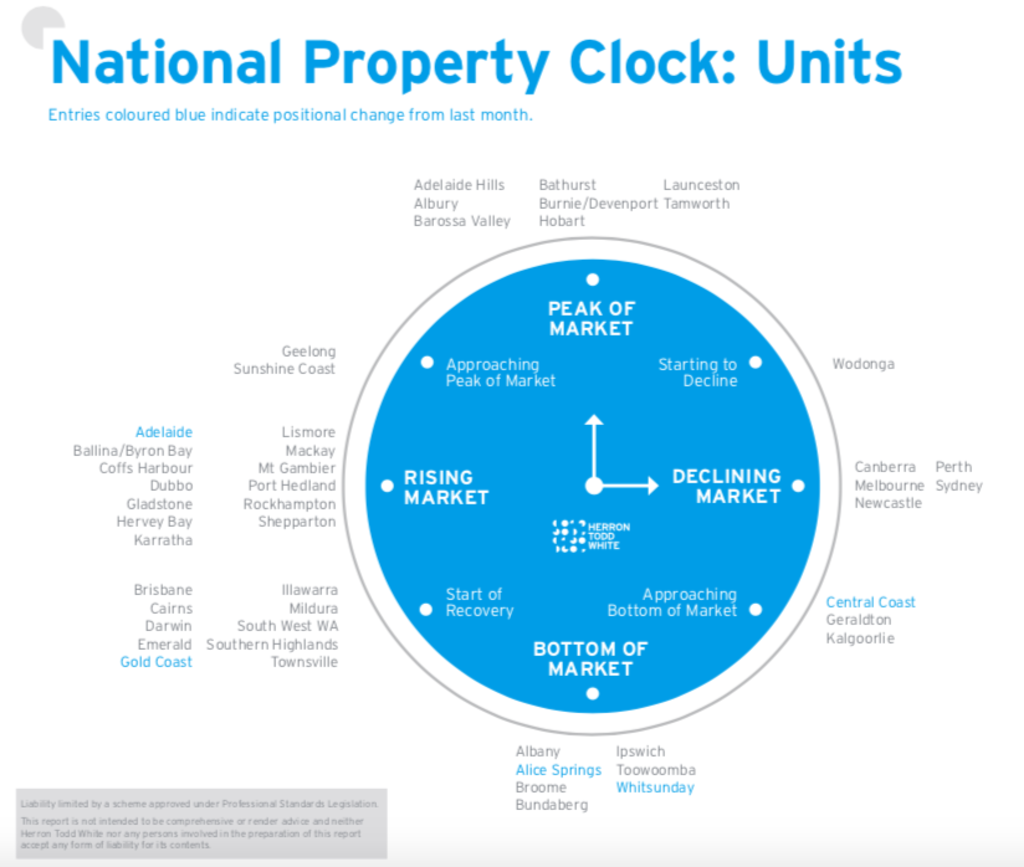

Regional centres from Coffs Harbour in NSW to Hervey Bay in Queensland, as well as smaller capital cities such as Adelaide, are tipped to be rising housing markets, according to a national report from property valuers Herron Todd White.

But major capitals Sydney and Melbourne are seen as declining markets across the board, while Albany in West Australia and Queensland’s Bundaberg had already reached the bottom in October.

Despite enthusiastic bidding at recent Sydney and Melbourne auctions, the valuers took into account the low number of homes for sale at the moment, questioning whether there would be enough buyers if the number of sellers rose.

“Melbourne is the most obvious impact,” Adelaide-based Herron Todd White director of valuation policy and compliance Kevin Brogan said.

“Without coronavirus, you would quite often see 1000 auctions in a week. Up until a week ago, they were having 50 or 60 auctions,” Mr Brogan said.

“Sydney and Melbourne had a really strong demand [driven by] new population that’s been taken out of the equation completely.”

Values in the two largest cities had been hit harder than elsewhere, although they were more resilient than expected due to the lack of stock. Even so, the real impact was yet to be seen.

“How much of that demand exists if a significant amount of properties come to market?” Mr Brogan said. “The lack of supply is holding up the market.”

Markets where the pandemic had barely hit, such as Adelaide and the Adelaide Hills, were performing strongly in comparison, he said.

The report said houses and units in Coffs Harbour on the NSW mid-north coast were rising in October.

It found there was a “severe shortage” of available rental properties relative to demand and there was also a strong demand for new houses against a declining number of new builds. But there was a steady number of house sales.

Coffs Harbour-based Nolan & Partners selling agent Craig Gardner noted there were few homes for sale in the area and an influx of tree-changers.

“Stock levels are down on what they were historically, [and] the highway bypass is about to start. [Workers] are going to be here for four to five years. I think it’s going to increase prices,” he said.

Sydneysiders were driving property prices, whether as an investment or to live in, he added.

“With bank interest rates so low investment returns are better. Things are selling really quickly … and [there are] multiple offers on properties,” Mr Gardner said, adding that the success of stamping out the virus locally helped the local property market take off from June onwards.

Hervey Bay – 292 kilometres north of Brisbane – was another region that was tipped as a rising market for houses and units.

The report found there was a strong demand for houses in the area in October, with an increasing amount of house sales.

Hervey Bay-based Carter Cooper Realty agent Kim Carter said she had seen demand from a range of buyers, including Melburnians purchasing sight-unseen.

“It’s absolutely crazy. It’s so busy,” she said, adding that the market was quiet at the height of the pandemic in April but had picked up in the past three months.

She said her office had seen an increase in the number of house, unit and even land sales thanks to government grants encouraging new builds.

“Stock levels are very tight. We’re listing houses and selling them within a couple of days.”

The region’s proximity to Brisbane was a reason for its popularity among buyers, Ms Carter said. She believed it would continue to gather pace once Queensland’s borders reopened.

Further north, Bundaberg was tipped as being “at the bottom” of the market for houses and units despite the increasing volume of house sales, according to the report.

Ascot Real Estate selling agent Greg McMahon said the market was “red hot” at the moment despite prices not rising for years.

“Admittedly, prices have been flat for the past 10 years but there’s a lot of activity and the phone is ringing red hot, particularly from Sydney and Melbourne,” Mr McMahon said.

He said while unit sales had struggled, the house market was much stronger.

“Where vendors are pricing their properties at a realistic figure they can sell between one to seven days,” Mr McMahon said.

On the other side of the country, Albany – 418 kilometres southeast of Perth – was also seen as at the “bottom of the market” in October, according to the report.

But Ray White Albany principal Darren Leslie said it was not reflective of the sentiment on the ground.

“We are at the coalface of contracts,” Mr Leslie said. “We know prices are going up, we know demand is there … the data won’t have been reflected to the valuers yet, not in its entirety.

“There’s significantly less stock on the market and high buyer demand and our asking prices are being attained – or very close to asking prices.”

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More