Rents fall across capital cities but are still unaffordable for many tenants in Australia

The number of people needing affordable housing, including those who have never had to seek help before, is tipped to reach catastrophic levels by next Easter, a new report has found.

The Rental Affordability Index (RAI), released Tuesday, found that while rents had fallen across every capital city, they had not fallen enough for anyone on a low income.

People who lost jobs during the COVID-19 pandemic and found themselves in the low-income earner category, including many essential casual workers, were now considered to be at high risk of rental stress.

John Engeler, the vice-chairperson of National Shelter, said that impact would likely be felt at Easter next year, after the coronavirus-related financial support measures including JobKeeper and JobSeeker end in March.

“Unequivocally, there will be a whole raft of people who’ve never had to even think about social housing that will have to join the waiting list,” Mr Engeler told Domain.

“We’re worried that when the rental eviction moratorium ends, JobSeeker reduces, and JobKeeper goes away, there will be a wave affecting more renters.

“If you’re in a situation where you have no savings, have run out of good will with the landlord, you’ve got a rent debt [and no job], the cumulative effect will be catastrophic.”

The report found that in Melbourne, rents fell by the biggest amount of all the capital cities, dropping by 7 per cent between September 2019 and June 2020. Rents in Sydney and Brisbane fell by 6 per cent over the same time.

However, each capital’s affordability was still very low.

A score of 100 on the RAI report, produced by National Shelter, Bendigo Bank, The Brotherhood of St Laurence and SGS Economics and Planning, indicates that households are spending 30 per cent of their income on rent, placing those on low incomes in rental stress.

Melbourne’s index score was 140, seeing the average household spend 22 per cent of their total income on median rents, with some pockets more affordable than others.

Rents in the inner city, inner north east, and tertiary education precincts had dropped, the report noted, with areas which were previously unaffordable or moderately unaffordable now acceptable. That included Melbourne’s CBD, West Melbourne, Southbank, South Yarra and Carlton.

The middle ring suburbs in the north-east corridor such as Kew East, Balwyn North and Eltham South have shifted the other way, with rents moving from moderately unaffordable to unaffordable.

In Sydney, where the index score was 126, rental affordability increased most in suburbs including Forest Lodge, Annandale and Double Bay.

The average rental household in Sydney spent about 24 per cent of total income on rent, which was the same in regional NSW, the report noted.

“Despite the lower rental rates, the difference for very low-income households is negligible, as they still face severely unaffordable rents across Sydney,” it stated.

Meanwhile, Brisbane’s rents became more affordable than those of regional Queensland, where tenants fled to during the worst of the coronavirus pandemic.

Brisbane’s index score was 129, seeing the average household spending 23 per cent of their income on rent, while regional areas had an index score of 123, equating to 24 per cent of total income.

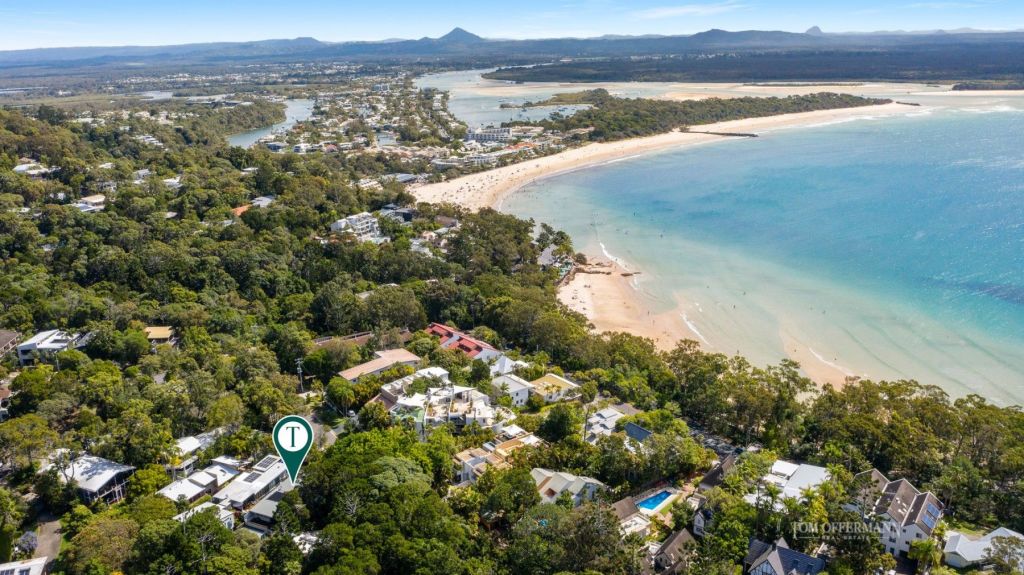

The Sunshine Coast’s Maroochydore and Noosa now have rents which are deemed moderately unaffordable to unaffordable. The area inland from Noosa, towards Pomona, is also being hit by higher rents.

Parts of the Cairns and Toowoomba regions have shifted from acceptable to moderately unaffordable, the report noted.

“We are seeing a movement away from the capital to regional centres which is tightening rental affordability across regional Queensland,” executive officer National Shelter’s Adrian Pisarski said.

“Despite JobSeeker being a welcome boost to many low-income renters, it was not enough to lift them out of rental stress.

“This shows the depth of our rental affordability problem, where even with additional support, there is not one place in Australia where a JobSeeker recipient can rent affordably.

“As we’ve seen in Victoria, there is a massive need for government investment in social and affordable housing – and now is the time for it since borrowing costs are so low in Australia. Without investment in this space, we are ignoring our responsibility to help people be decently housed.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More