Sharp uptick in housing sentiment post-federal election in some states: Westpac

Consumer sentiment towards housing has been boosted across some of Australia even before taking into account the re-election of the federal Coalition and key monetary policy changes, Westpac Australia Economics says.

Sentiment in NSW toward house prices has taken a sharp turn upwards, likewise Tasmania.

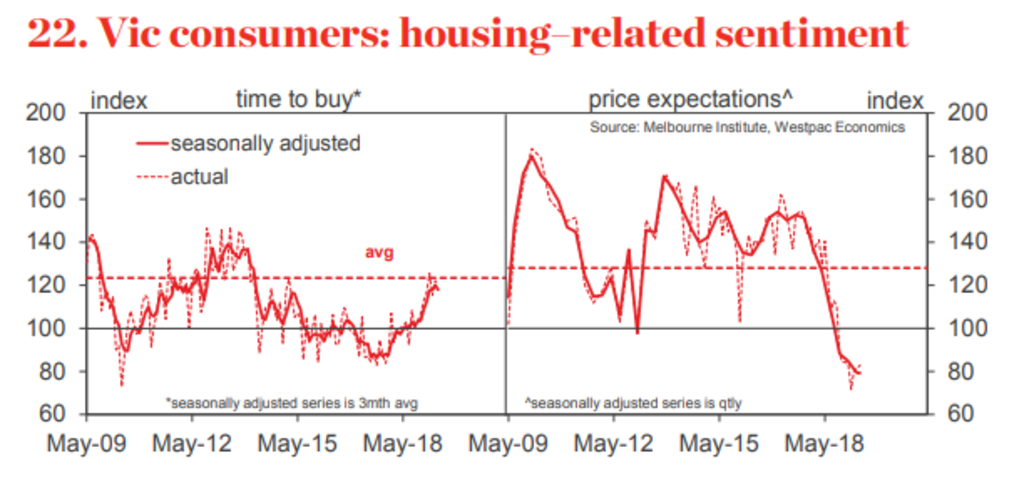

The response was more muted in the national results, and in Victoria, Queensland, the ACT and the remaining states and territory, Westpac’s Housing Pulse report, released on Tuesday, shows.

“Prices have continued to decline but at a slower pace. Turnover remains very low but auction markets and listings are showing an improved tone,” the report states.

Consumer sentiment about whether it is time to buy has been trending upwards for about 12 months across Australia.

Since the election, the Australian Prudential Regulation Authority has removed a restriction key to slowing the flow of credit. The restriction was a policy which required mortgages to be stress tested for repayments at a 7 per cent interest rate. APRA will now allow banks to set their own stress-test rate.

The Reserve Bank has also given strong indications that it will cut cash rates to a new historic low of 1.25 per cent at next week’s meeting, with some pundits predicting another cut later in the year.

These, combined with the apparent death of Labor’s tax reforms and the planned introduction of the Coalition’s first-home buyer guarantee scheme, have prompted some property experts to rethink dire predictions.

AMP Capital chief economist Shane Oliver was the first to predict a top-to-bottom fall of 20 per cent across the capital cities, but revised it down to 12 per cent and indicated he believed the market had just about reached bottom.

The Westpac report indicated that sentiment may rise further following these changes.

“Needless to say, next month’s sentiment results, due out June 12 and surveyed in a week that is expected to see the RBA’s first 25 basis point rate move, will be of intense interest,” it stated.

Real estate agents in Sydney and Melbourne have reported a rise in apparent market sentiment in the wake of changing market conditions, but have warned it would take a few weeks yet to see the full effect.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More