Short-term plan for long-term gain: Will home owners benefit from the Canberra light rail?

Conversations can often become derailed by the billion-dollar light rail debate. It is synonymous with the north or south divide, with Canberrans tending to offer definitive viewpoints either for or against.

The ACT remains one of the fastest growing jurisdictions in the country, behind Victoria. As our population grows, access to roads, schools, employment hubs and public transport becomes strained. Given the growing desirability of our region and the forecast population, the evidence is mounting that the territory needs to introduce measures to reduce the volume of traffic and the prospect of heavier congestion on our roads.

This has been one of the ferociously debated conundrums of the light rail. Will the project deliver enough transport benefits to counterbalance our forecast population growth, and will travel time be reduced sufficiently compared to the current transport options? This is open to debate.

The introduction of permanent infrastructure should act to support the city’s transport backbone. Light rail is a fixed network that will encourage more efficient development, smarter use of space, and the introduction of new mixed-use precincts along the route. In comparison, a new bus route doesn’t have the same impact, since there is an element of uncertainty, with the prospect of rerouting instantly possible.

The permanency of light rail offers developers, home owners and investors greater confidence. It is the introduction of a durable transport network that sends a positive message that often stimulates associated investment activity, leading to urban renewal, commercial and residential development. The increased density along the corridor should also improve the patronage, which will have a positive impact on the cost-benefit of the project.

There is no doubt that the controversial light rail project has provided a buzz of excitement that has enveloped Canberra’s northside property market. However, it is home owners in suburbs directly neighbouring the light rail corridor, and especially within a short walking distance to a tram stop, who are particularly set to become key benefactors. That is, if home owners can bear the roadworks and inconvenience caused in the meantime, the payoff could be a financially fruitful one.

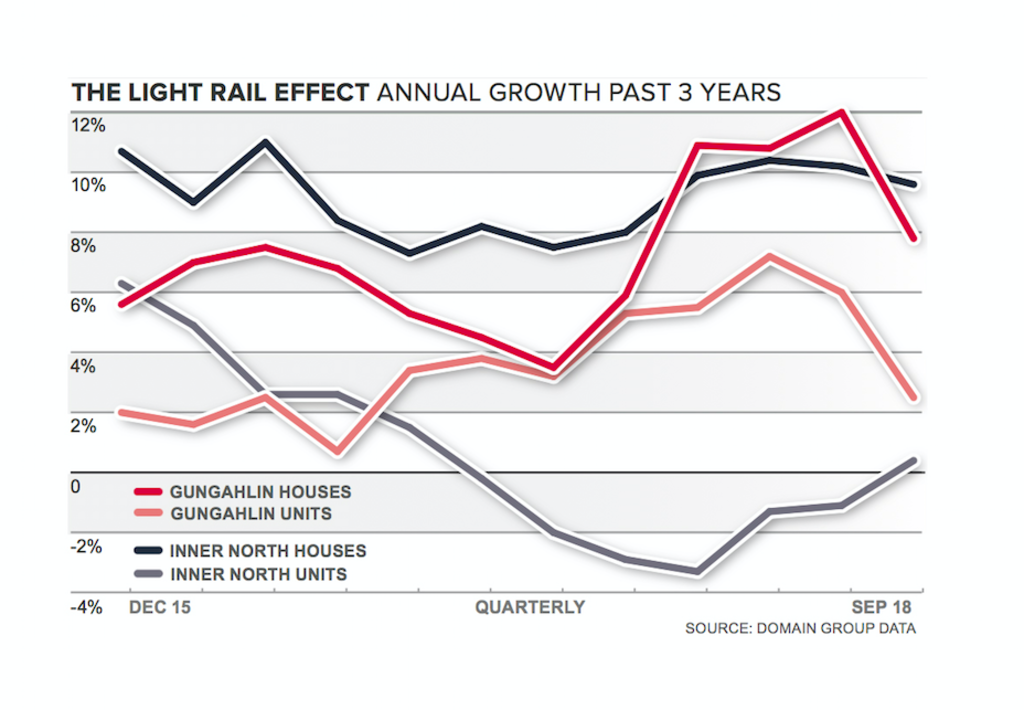

Houses in the Inner North and Gungahlin have outperformed the headline rate of growth recorded for Canberra. During the first half of the calendar year homeowners in the two north-side districts have reaped the benefit of double-digit annual growth. Despite price growth slowing in the third quarter, the annual pace has surpassed Canberra’s 4 per cent improvement. Houses in Gungahlin rose by 7.8 per cent to $679,000, while in the Inner North they jumped by 9.6 per cent to $936,000.

Gungahlin and Inner North units have bucked the broader negative price trend. While Canberra unit prices declined by 4 per cent over the year to $412,888, Gungahlin units grew by 2.5 per cent to $405,000 and Inner North units a minor 0.4 per cent improvement to $465,000.

The most frequent question – how much will properties near the light rail be worth when it’s complete? It is difficult to quantify the exact impact on prices, but it is likely to be a positive one given the influence of light rail on property values across the globe.

At the time of a major infrastructure announcement, a speculative spike in property prices often occurs, as investors become engaged and locals excited at the prospect of future capital growth. It is only once the project is complete that the true price impact can be determined.

It is important to note that Canberra does not experience the level of congestion that has been seen in the other cities that have had light rail introduced – a key element when considering the impact on prices. Therefore, the influence on price growth is likely to be of a lesser extent, compared to other case studies.

Whether purchasing an investment or your family home, it is imperative to make a sound judgement based on a variety of factors – not just light rail. Consider the extent of surrounding development and ongoing supply pipeline that could weigh on price growth. Also consider the economic drivers pulling residents to the area, which will continue to support the future demand for housing.

- Dr Nicola Powell is Senior Research Analyst at Domain Group. Tweet your questions to @DocNicolaPowell

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More