Canberra advice: Should you sell your home before you buy?

It is the ultimate juggle; to sell first and then buy, or buy first and then sell? It is a situation home owners will encounter; if upgrading isn’t on the cards, then it could be downsizing. Educated home owners will tackle the decision strategically.

Stress and emotion often run high when selling your biggest financial asset. Many home owners assume they need to buy and sell as close together as possible to mitigate any market fluctuations in property prices. But, like anything, the ideal scenario is hard to create in the real world.

Price movements present complications but should play a crucial part in the decision. All home owners aim to buy and sell well, which hinges on market conditions.

Buying first was less risky during the recent Sydney boom, as prices escalated; competition was high meaning homes transacted quickly. It was the ultimate sellers’ market, with homes likely to sell well.

Canberra tends to avoid extreme price swings, offering home owners a steady pace of growth. Sydney’s most recent trough-to-peak saw house prices escalate 89 per cent, while Canberra offered a more modest 34.5 per cent.

A sellers’ market allows you to hold out for the best achievable price; if prices are rising, waiting could result in a better outcome. Buying first is less risky in a sellers’ market, you are not dictated by a timeframe, providing greater control on the selection of your new home. It requires a strong financial position, with high-income earners, and those with substantial equity better placed to obtain finance for two homes.

That said, selling first can help to set the budget for the next purchase, provide certainty, reduce financial risks and avoid the stress of bridging finance. This type of finance can be costly with higher interest rates – reliant on securing a sale, it is designed for short-term.

A buyers’ market signals weaker housing conditions, indicative of falling prices, homes lingering on the market longer, and sellers offering discounts. With homes transacting at a slower pace in a downturn, selling first gives a better lens on your financial position. A downturn tends to make upgrading easier, you may be selling at a lower price, but you will also be purchasing lower.

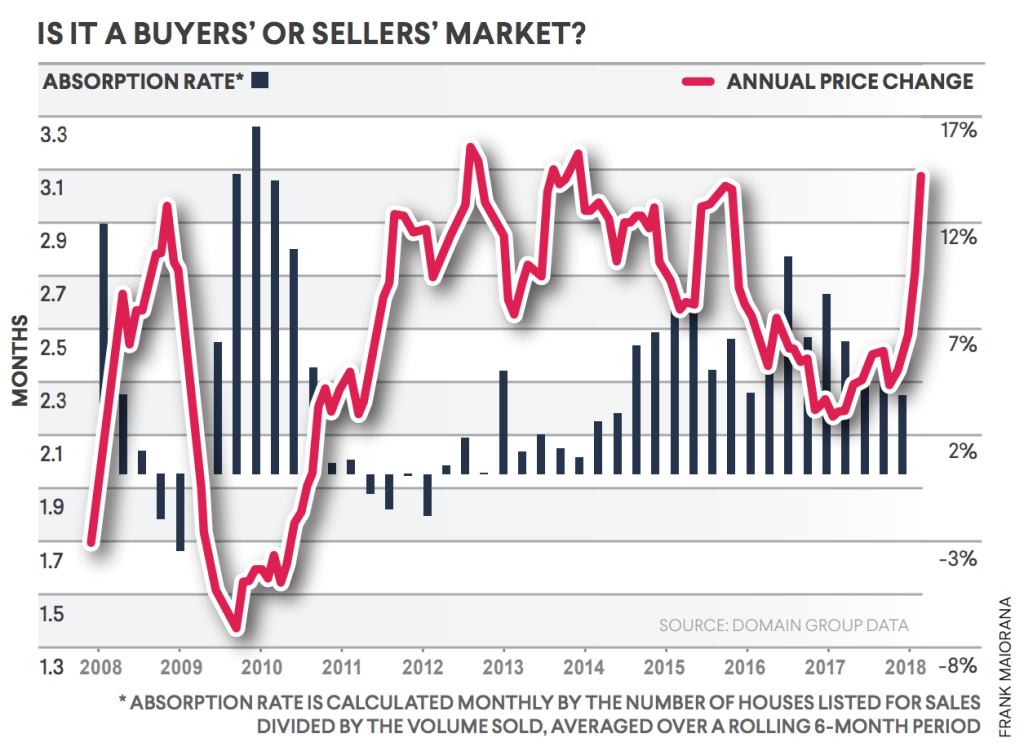

Who is in Canberra’s driving seat? The rate of absorption indicates whether the pendulum is swinging towards the buyer or seller. Simply, it is the number of months it would take for the current homes on the market to be sold, which provides insight into buyer and seller activity, and the time taken for homes to transact.

- Related: How did Canberra’s property market stack up in 2018?

- Related: Canberra house prices stall while units experience the sharp decline

- Related: Will home owners benefit from the Canberra light rail?

At the end of 2018, the absorption rate was just over three months to sell all the houses listed for sale in Canberra. This is a jump from the recent low achieved in the latter half of 2017 when total house stock would have taken just over two months sell. The absorption rate has been gradually rising since the beginning of 2018 and is now at the highest rate since mid-2014.

A negative correlation exists between the absorption rate and price movement – as the rate of absorption rises, price growth stalls or reverses.

The statistic helps to anticipate market activity and the all-important buyers’ or sellers’ market conundrum. Currently, Canberra’s house market is leaning towards a balanced one, meaning demand appears to be meeting supply. This is in line with current price growth, as Canberra house prices held steady over the year, increasing a marginal 0.1 per cent to $738,933. Having a balanced market should make the decision to sell or buy first a little easier.

Dr Nicola Powell is a senior research analyst at Domain Group. Tweet your questions to @DocNicolaPowell.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.