Sydney vendors lead the way with pre-auction selling trend

The market slowdown, in line with rising interest rates and inflation, has led to the a selling trend as some vendors avoid taking price risks under the hammer.

Last week, the Reserve Bank’s latest hike saw the cash rate 0.25 percentage points higher at 2.85 per cent – the seventh increase since May.

Some economists predict it will peak as high as 3.85 per cent by March 2023, taking average mortgage rates just above 6 per cent.

Vendors in Sydney are leading the way by adjusting how property deals get done in a cooling market.

Over the past week, Sydney has seen the highest rate of sold homes prior to auction (of the capital cities) at 31.7 per cent, reaching its highest point since May.

This means is that vendors are aware of the market conditions and are open to negotiation.

Domain’s chief of research and economics, Dr Nicola Powell, is keen to see whether Sydney’s trend of selling homes prior to auction will influence the other capitals.

“When it comes to selling your home, vendors often face a difficult decision; lock in a pre-auction offer or push through to auction day where there’s potential for a higher price,” she says.

“That’s been made even more difficult in this spring’s current selling conditions. Apart from Melbourne and Sydney, we’ve seen a slump in overall auction listings which would be playing on sellers’ minds.

“Sydney normally leads in market trends so it will be interesting to see if sold priors will continue to increase across the country in the months ahead.”

As a whole, it very much appears to be a buyer’s market with vendors often lowering their price expectations to sell. This can be seen in the uptick in the national clearance rate.

Last Saturday, the combined capitals’ clearance rate increased to 60.6 per cent, making it the fifth week in a row of rates hitting above 60 per cent.

Sydney achieved its best performance since March, hitting 64.3 per cent. Melbourne experienced a slight decline in clearance rate, down to 59.8 per cent. However, Canberra marked the biggest weekly decline, down 7.6 per cent to 56 per cent.

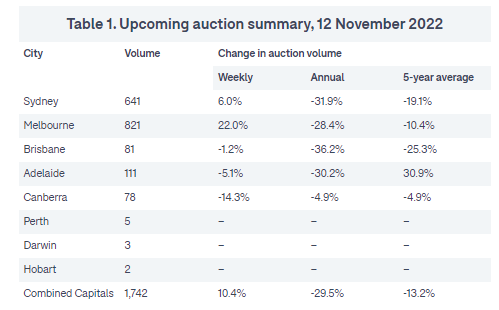

Overall, homes are continuing to go under the hammer with 1,742 auctions scheduled this Saturday across the combined capital cities, with a 10.4 per cent increase since last week.

The latest Domain data shows that Melbourne has seen the highest auction volume with a 22 per cent rise week on week.

Sydney has seen a slight shift, and the other capital cities have seen a decline.

Three Sydney homes going to auction this weekend

10 Arundel Street, Forest Lodge

89 Barcom Avenue, Darlinghurst

343 South Dowling Street, Darlinghurst

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

/http%3A%2F%2Fprod.static9.net.au%2Ffs%2F6cb87069-3681-4fa9-89f9-d8cc75c6b6a2)