Tenants could 'fall into rental stress' despite government support payments

Tenants who have lost work due to the coronavirus crisis could find themselves in rental stress despite government support payments, new modelling shows.

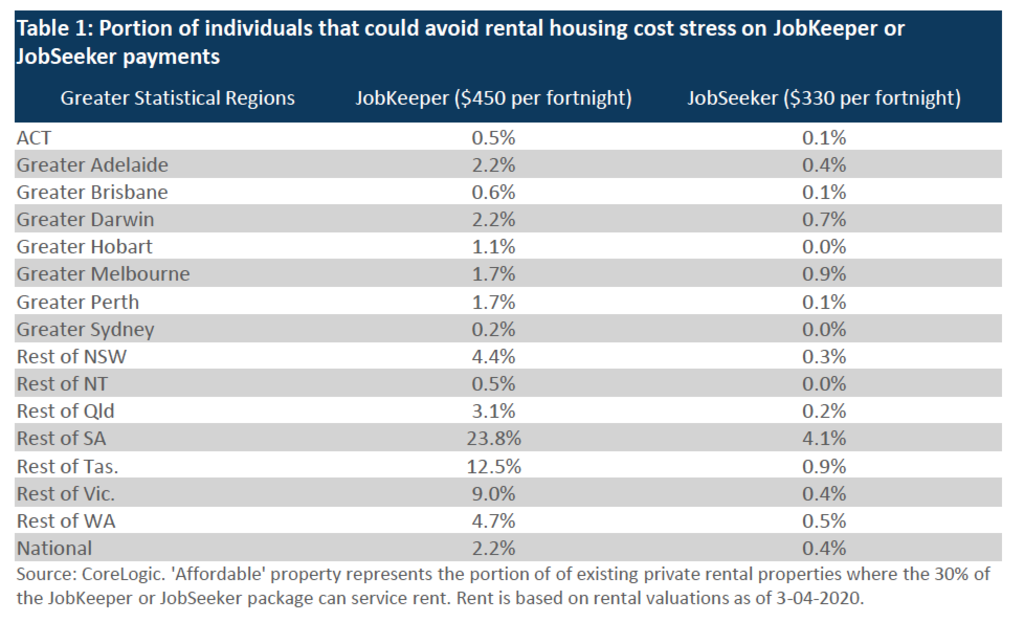

Less than 2 per cent of housing in most capital cities is considered affordable for a tenant renting solo on the JobKeeper payment of $1500 a fortnight, CoreLogic figures shows.

Only 0.2 per cent of Greater Sydney rentals would be affordable for singles, with the cost of almost any rental home pushing a tenant into housing stress – when more than 30 per cent of one’s income is spent on rent or mortgage payments.

Sydney is followed by the ACT, Brisbane, Hobart, Melbourne and Perth, where 0.5 to 1.7 per cent of properties are priced below the stress level – at $450 per fortnight for individuals on JobKeeper.

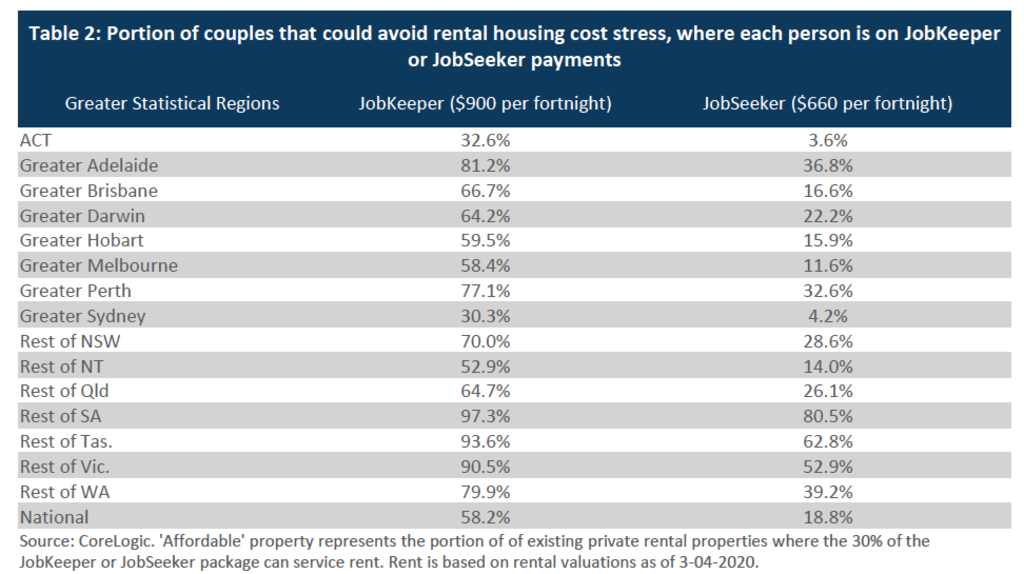

The proportion of affordable rentals increased significantly for dual income households, said Eliza Owen, CoreLogic’s head of research in Australia.

“Doubling the assistance far more than doubles the amount of stock that becomes available,” Ms Owen said. “Even small amounts of extra assistance could make [many more] households affordable … [as] rental prices are relatively bunched up compared to the distribution of income.”

About 30 per cent of Greater Sydney properties would be deemed affordable for a dual-income household, according to the modelling based on valuations of private rental market properties, which did not take into account tax on the payment, or voluntary employer top-ups.

The proportion of affordable rentals would climb to about a third of properties in the ACT, close to 60 per cent in Melbourne and Hobart and more than two-thirds of properties in Brisbane, Perth and Adelaide.

“We would expect to see an increase in group households and I think an increase in people moving back with their parents,” Ms Owen said. “That could potentially increase rental supply … especially for properties that only house one person.”

Ms Owen said support payments also went significantly further in parts of regional Australia, with as many as 23.8 per cent of properties affordable for single South Australian tenants, living outside of Adelaide, and 97.3 per cent affordable for couples.

“Flat payments are proportionately beneficial … where rents are cheaper, such as in regional Tasmania and South Australia. Incidentally, these are areas that may be more severely impacted by the economic slowdown in terms of the concentration of the labour force in agriculture, food service, tourism and accommodation,” she said.

Rental properties were likely to become more affordable as more became available, Ms Owen said, due to households consolidating to save funds and the return of short-term holiday rentals to the private rental market. She noted the modelling was based on valuations done in early April and rent discounts were already occurring for new stock.

While many capital city renters would technically be in rental stress, Ms Owen added, reduced discretionary spending – such as lower transport costs due to social distancing measures – might make it slightly easier to reallocate finances to meet payments.

For those on JobSeeker, now at $1100 a fortnight, less than 1 per cent of rental housing in each capital city was affordable. That’s despite a $550 increase to the payment last month, which effectively doubled the highest allowance.

“The data highlights that the JobKeeper payments significantly increases the portion of affordable rentals,” Ms Owen said, but noted those on this lower payment likely qualified for rent assistance and would be eligible for social or affordable housing, for which there are significant waitlists.

“A final takeaway may be that now is an opportune time to explore more social and affordable housing supply. As well as added benefits to the construction sector, the government could look to create housing supply that complements the payments being offered,” Ms Owen said.

She added that it was important for landlord and tenants to negotiate reduced rents if needed, to keep as many people in their homes as possible.

“Policies that enable people to hold onto their existing residence are vastly beneficial for the economy. It’s going to be much easier to come out on the other side of this downturn … if you have secure housing,” she said.

The federal government has encouraged such negotiations and announced a six-month moratorium on evictions, but this has yet to be enacted by all the states and territories, which will also be left to make a call on any further financial support for renters.

There are also calls for the government to implement rent control, as the states did during the Great Depression and the federal government did during World War II – fixing rents at 1940 levels, with variations administered by independent tribunals.

“Setting residential rents at affordable levels would also protect millions of vulnerable Australians,” says Liam Davies, a PhD candidate at the Centre for Urban Research at RMIT University, in a piece for The Conversation.

Mr Davies said low income households had been spending unsustainable amounts on rent even before the pandemic hit.

“This ‘war on two fronts’ will push many to the brink. A moratorium on evictions will delay the pain, but not avoid it. The national cabinet should take inspiration from Australia’s wartime cabinet and regulate rents nation-wide.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.