The Aussie homeowners hit hardest by price declines

Some of Australia’s wealthiest homeowners have been cut the deepest by declining property prices.

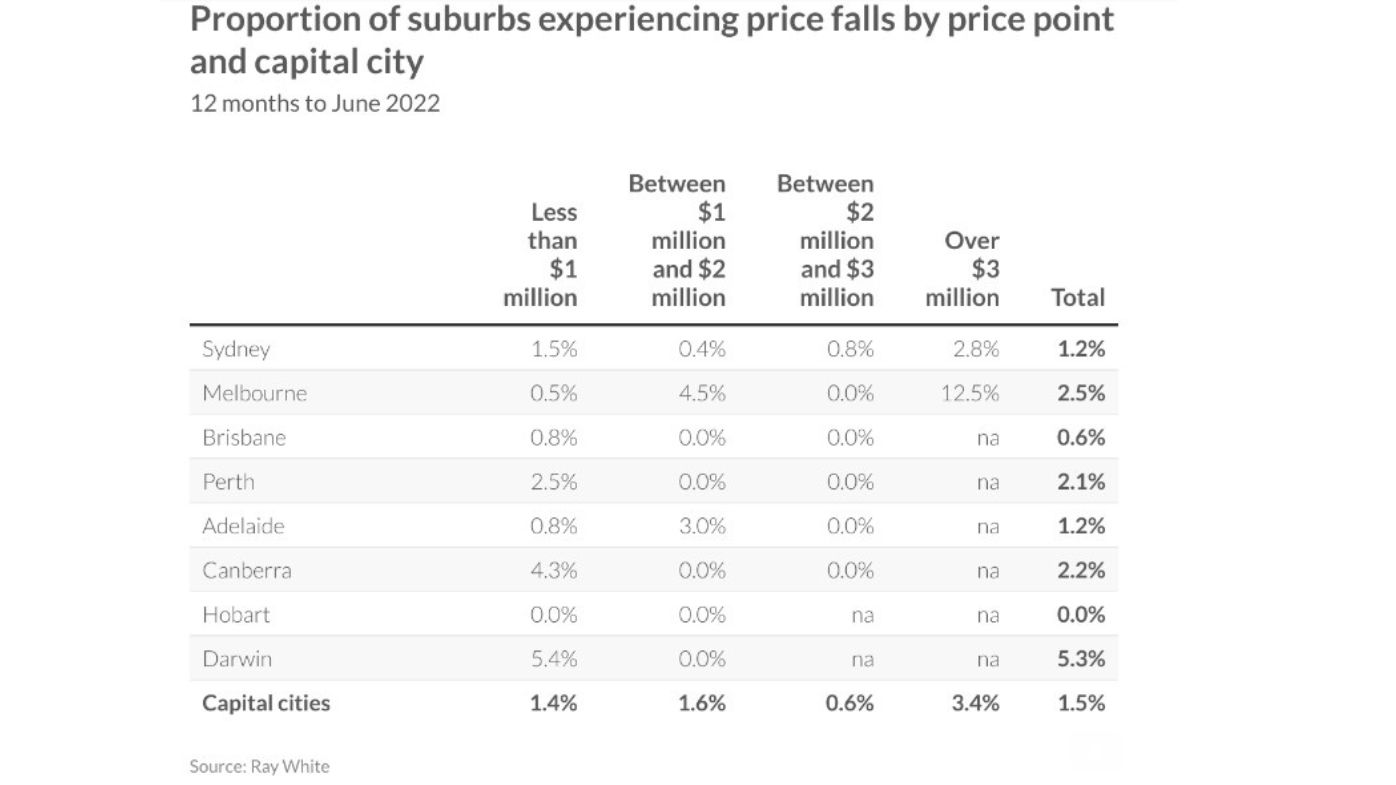

Of suburbs with a median north of $3 million, 12.5 per cent of those in Melbourne have seen value shaved off their properties over the past year, new research shows.

And in Sydney, 2.8 per cent of suburbs with medians of more than $3 million have experienced price declines across 12 months, according to Ray White data.

However, elsewhere in Australia – Perth, Canberra and Darwin – it was mostly the more affordable suburbs where prices have slipped over the same period.

Ray White’s chief economic Nerida Conisbee analysed dropping prices according to four brackets – suburbs with medians less than $1 million; medians of $1 million to $2 million; medians of $2 million to $3 million; and medians more than $3 million.

The largest proportion nationally, and the only in double digits – at 12.5 per cent – was Melbourne’s prestigious $3 million-plus category.

Suburbs in Melbourne’s $1 million to $2 million median range – 4.5 per cent of them – were also whacked by a price slump.

The sub-$1 million market to dive the most was in Darwin. In the Northern Territory capital, 5.4 per cent of postcodes with a median under six-figures suffered price declines, making the affordable end of market even more accessible, followed by Canberra, at 4.3 per cent of cheaper suburbs.

Ms Conisbee said this could reflect a retreat by first-home buyers.

“Interest rates are on the move, prices are slowing but at a suburb level we are yet to see much evidence of widespread declines in prices,” she wrote in her weekly economic report.

“So much so that only 1.5 per cent of Australian capital city suburbs have seen a decline in house prices over the past 12 months.

“While it isn’t too surprising that Melbourne and Sydney have the most suburbs seeing price declines, by price point it becomes more interesting. In Sydney, a higher proportion of very expensive suburbs ($3 million plus median) and more affordable (less than $1 million median) are seeing price declines.

“The middle range (between $1 million and $3 million) are yet to see much movement down. In Melbourne and Adelaide, cheaper suburbs are not seeing much movement down however at higher price points, a higher proportion of suburbs are seeing declines.

“Elsewhere around Australia, it is cheaper suburbs, perhaps reflecting the first home buyer pull back, as well as fewer investors. Higher price point suburbs are either holding steady, or alternatively still recording increases.

“Sydney and Melbourne have only recently seen a very slight decline in prices. Nevertheless, price increases are set to continue to slow over the remainder of the year. With inflation remaining high, it looks like we are in for a few more interest rate increases, and with that a calmer market.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More