The "heartbreaking" statistic that shows long it takes a young, single Aussie to save for a home deposit

Single Aussie millennials are saving for up to 16 years for a house deposit.

The figure is the latest “heartbreaking” statistic showing the depth of the challenge to enter the property market.

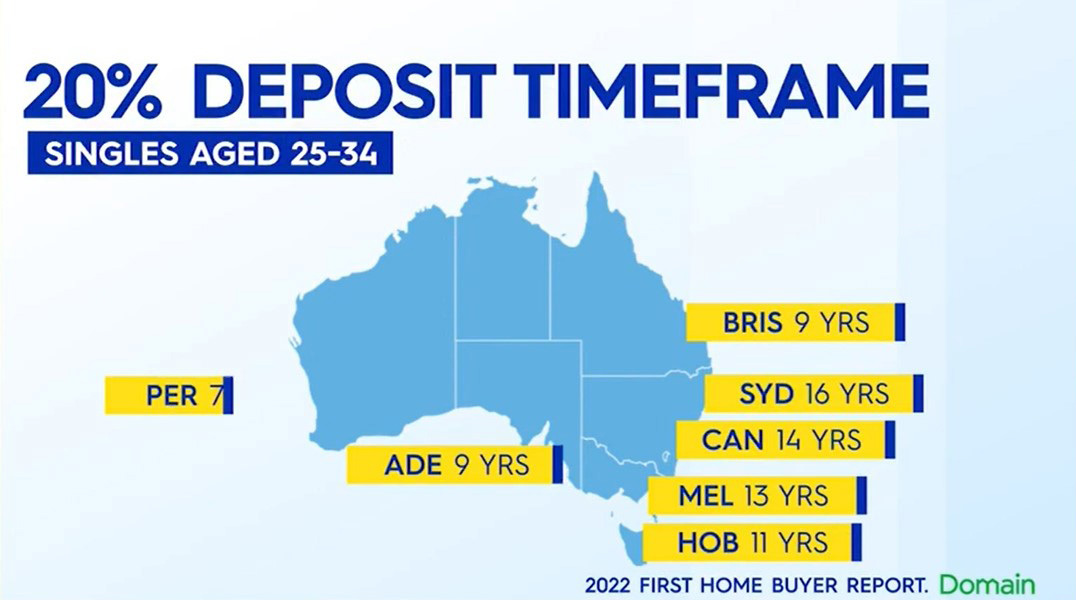

Single Sydneysiders aged 24 to 35 need 16 years to squirrel away a 20 per cent deposit on a $900,000 home, according to figures in Domain’s 2022 First Home Buyer report.

Speaking on the Today show on Tuesday, Domain managing editor Alice Stolz said parents carrying “scar tissue” from the high interest rate period of the 1990s were wary of encouraging their children to enter the market as rates again creep upwards.

Although property prices have been dropping in the highest-value eastern capital cities of Sydney and Melbourne, the amount they lifted during the pandemic has set a monumental benchmark for first-home buyers.

Predictions by leading economics, including AMP’s Shane Oliver, indicate that even with a 15 to 20 per cent fall, prices would only return to December 2020 levels.

“We expected with interest rates rising that house prices would soften. However, the problem for first-home buyers is they are obviously paying more and more when it comes to their mortgages each month,” Ms Stolz said.

“It is really putting a bit of fear in their pockets and making them not apply for first home loans on a record basis.

“We have not seen this drop for three years now, in terms of first-home buyer activity.”

A “heartbreaking concept” is the period it takes a single house hunter in Sydney to save a deposit, Ms Stolz told hosts Karl Stefanovic and Sarah Abo.

“And these are supposed to be the best years of your life,” she said.

Sydney single millennials are enduring the longest saving period nationally, followed by Canberra (14 years), Melbourne (13 years) and Hobart (11 years), Domain numbers show.

Only three capital cities snuck in below the decade-long mark – Adelaide and Brisbane, at 9 years, and Perth, on 7 years.

New loans for first-home buyers has slumped to its smallest volume since April 2019, when the property market was last in a downturn.

AMP Capital chief economist Dr Shane Oliver told The Age that first-home buyers were retreating from the market because of interest rate rises.

The Reserve Bank has set the nation’s cash rate at 2.35 per cent, with more increases flagged.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

/http%3A%2F%2Fprod.static9.net.au%2Ffs%2F2c4d8e0e-c3dd-456c-a85b-dfab7f0014a8)

/http%3A%2F%2Fprod.static9.net.au%2Ffs%2F762774f7-c2dd-4180-bb0e-66722b568e7c)