The Millennial guide: how to afford a first home in 2024

How do you afford a home in 2024?

Don’t live in it.

A leading economist says young Aussies who want a way into the market will need to be more patient and harbour “a greater appetite for risk ” than previous generations. A pathway that fits the bill is rentvesting, in which you buy your first property but lease it out to someone else.

Ray White chief economist Nerida Conisbee revealed in her weekly report that 55 per cent of Millennials aged between 25 and 39 own their home, but at the same age, 70 per cent of the Baby Boomers owned their own home (in 1991) and, in 2006, 65 per cent of Gen X owned their own home.

Rentvesting is a tactic for first-home buyers who are priced out of the capital city or suburb they most want. Because their debut property purchase an investment, it comes down to numbers and not personal preferences.

“This is a strategy where a buyer purchases an investment property in a more affordable area while renting in the suburb in which they would like to live,” Conisbee says.

“The capital gain made on the investment property can ultimately assist with the purchasing power of the young adult when they are in a position to purchase a property in their desired location. Importantly, rentvestors get a foothold in the real estate market, and minimise any disadvantage caused by a continued increase in home prices.

“In 1991, owning a capital-city home was achievable for many young adults as more affordable housing meant many could save up for a deposit by the time they were ready to move out of their parents home and start a family. Today, in a much less affordable market and a challenging purchasing environment, many young adults that are ready to buy their first home may be hesitant as they are priced out of the capital-city market they’re living in.”

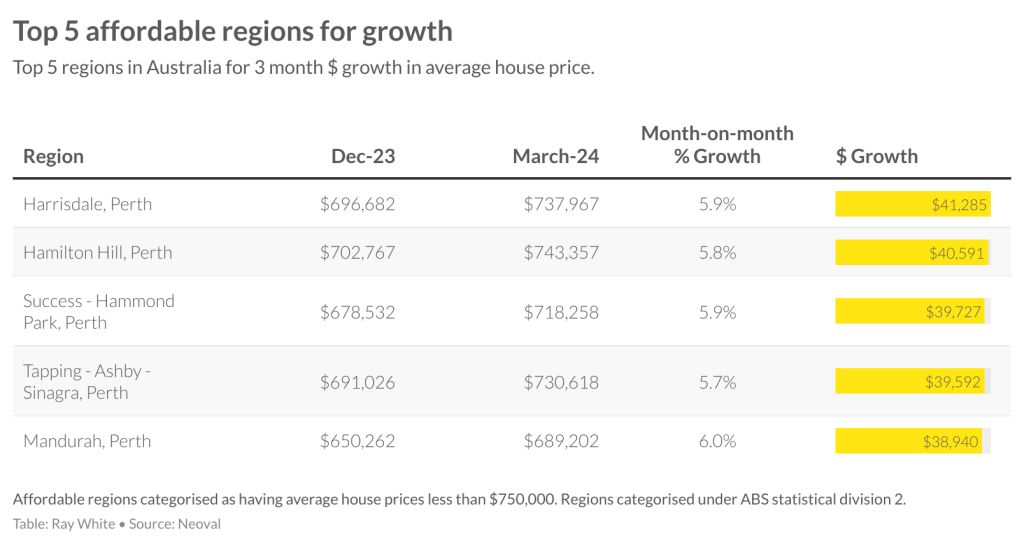

Using Ray White data, Conisbee ranked the five most affordable regions in Australia for capital growth, on month-by-month price gains.

For this, east-coast Millennials will need to head west.

From five to one they are Perth’s Mandurah, followed by Tapping – Ashby Sinagra, Success – Hammond Park and Hamilton Hill. On top was Harrisdale.

Conisbee warns that rentvesting does not come without particulars to weigh up, including taxes, risks of leasing a property and uncertainty in the market.

However, with prices remaining high in capital cities and no sign of slipping, for some it could be an alternative to the traditional owner-occupier model.

“On a whole, it seems that with historically low vacancy rates, possibilities of interest rate cuts and high population growth, the Australian capital-city property market will continue to be harder for first-home buyers to get in,” she says.

“Rentvesting is one way to live in an expensive city but invest in property in a much more affordable area.”

Houses for sale right now in Harrisdale, Western Australia

The family-sized house is near to Harrisdale’s education options.

This neat property is aimed at both investors and first-home buyers, but may also suit downsizers.

The block can accommodate a variety of design choices.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More