The postcodes where Australians are most behind on mortgage repayments

Inner-city hubs and far-flung postcodes in suburbia across Australian capital cities are where home owners are falling behind in their mortgage repayments, new data reveals.

Analysis of mortgage delinquency rates across the country by credit bureau illion has found that despite government support like JobKeeper and mortgage repayment holidays, the rate of households behind on their repayments has blown out, in some postcodes, to 233 per cent than the capital average.

And it’s feared the current rates, as of September 2020, could be just the tip of the iceberg.

Illion head of analytics Louis Tsang said while the record level of support from the government and financial institutions made it difficult to measure a true increase or decrease in distress, the delinquency rate was used as a “proxy for mortgage distress”.

“It is likely that areas already in distress [as of September 2020] could deteriorate further once support payments and mortgage deferrals cease,” Mr Tsang said.

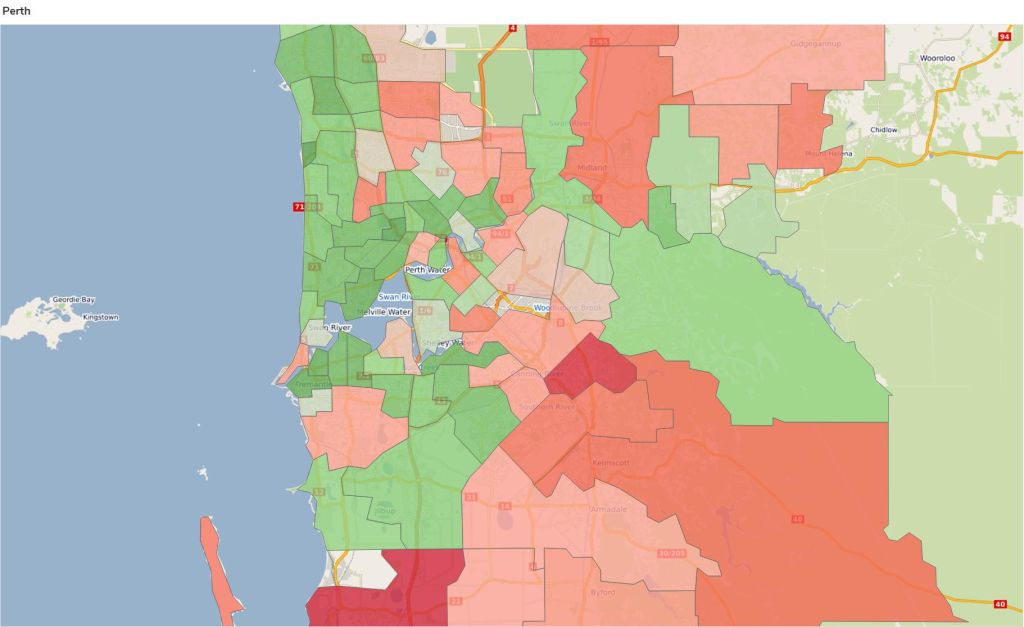

Western Australia may have avoided any major outbreaks of COVID-19 but it has not escaped the economic damage the pandemic brought with it.

illion found out of the four capital cities, Perth had the highest city-wide average delinquency rate of 0.85 per cent.

The delinquency rate is defined as the number of accounts in the postcode that are 30 days past due.

Mortgage holders in outer-lying Perth postcodes were doing it even tougher, with delinquency rates more than 100 per cent higher than the city average.

The postcode 6037, which covers Two Rocks, 61 kilometres north of Perth, recorded the highest delinquency rate, where 2 per cent of mortgage holders were behind on repayments.

Travel outside of the city and the situation becomes worse, with an average of 1.28 per cent of mortgage holders in regional WA behind on repayments.

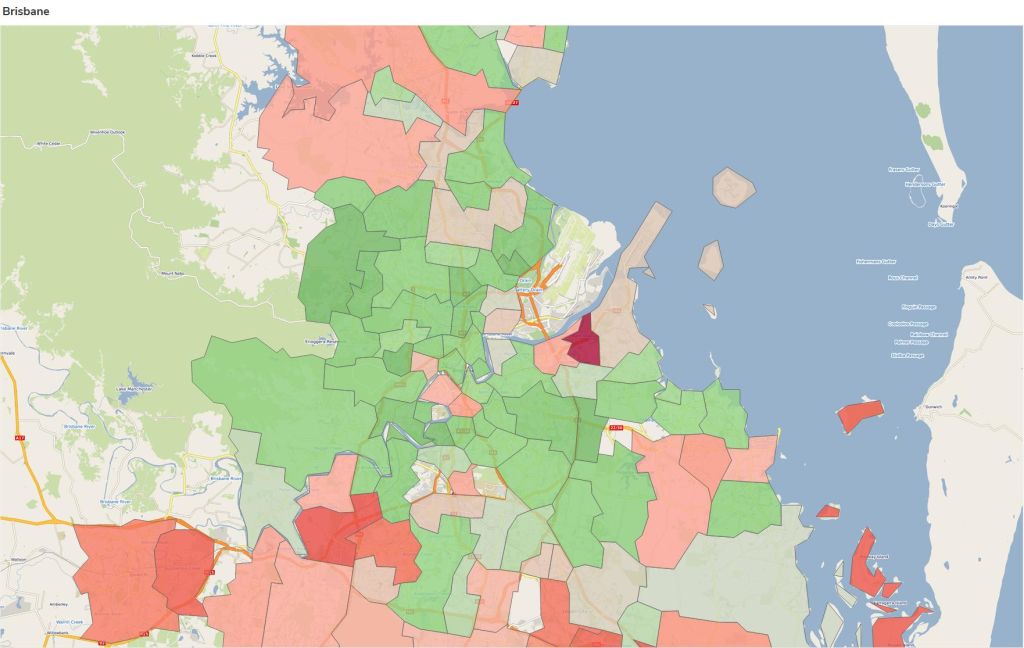

It is a similar story in Queensland, where a mix of postcodes from inner-city Brisbane and far-flung suburbs like Ipswich and Logan, on Greater Brisbane’s outskirts, make up the top 10 areas with the highest delinquency rates.

The city-wide average is 0.56 per cent but that rises to 0.90 per cent for the regional average.

The postcode 4174, which covers Hemmant, 11 kilometres east of the Brisbane CBD, recorded the highest delinquency rate, where 1.9 per cent of mortgage holders were behind on repayments – that is 233 per cent above the city-wide average.

Mr Tsang said mortgage stress in city hubs with apartments and outer-metropolitan areas was evident across all major states.

He said as well as home owners in lower-socioeconomic areas being hit with mortgage stress, investors in every city would have felt the impact of the COVID-19-induced recession, especially those with properties tenanted by casual or lower-paid employment workers, younger demographics in hospitality jobs and student populations.

| The top 10 delinquencies rates in Western Australia | How much higher than metro average | |

| 6037 – TWO ROCKS | 2.02% | 137% |

| 6167 – ANKETELL | 1.77% | 108% |

| 6109 – MADDINGTON | 1.71% | 101% |

| 6174 – GOLDEN BAY | 1.61% | 89% |

| 6084 – AVON VALLEY NATIONAL PARK | 1.52% | 78% |

| 6035 – YANCHEP | 1.46% | 71% |

| 6169 – SAFETY BAY | 1.45% | 70% |

| 6111 – ASHENDON | 1.37% | 61% |

| 6110 – GOSNELLS | 1.33% | 56% |

| 6069 – AVELEY | 1.33% | 56% |

| Source: illion | ||

LJ Hooker Two Rocks Western Australia selling Kelsie Leach said while she had not seen any distressed sales, there were more homes coming to market.

RE/MAX Extreme’s Cristina Botha said there was some expectation of forced sales in the future.

“We haven’t seen it yet … we think it might still come but at the moment we’re still desperately trying to convince sellers to come to market.”

Curtin University professor of economics and finance Steven Rowley said the same areas in each state and their respective cities had been affected when it comes to households keeping up with mortgage repayments.

“It’s very much an income-driven thing … generally those with insecure incomes are forced into this position. If the income isn’t coming, then you don’t have any chance of [keeping up the payments],” Professor Rowley said.

“Those outer suburbs are affordable so you do have people on lower incomes and are more vulnerable to a loss of income and defaulting on mortgages.”

| Top 10 delinquency rates in Queensland | How much higher than metro average | |

| 4174 – HEMMANT | 1.88% | 233% |

| 4515 – KILCOY | 1.56% | 176% |

| 4129 – LOGANHOLME | 1.33% | 135% |

| 4076 – DARRA | 1.32% | 134% |

| 4184 – COOCHIEMUDLO ISLAND | 1.28% | 127% |

| 4304 – BLACKSTONE | 1.23% | 118% |

| 4131 – LOGANLEA | 1.22% | 116% |

| 4077 – DOOLANDELLA | 1.13% | 100% |

| 4114 – KINGSTON | 1.10% | 95% |

| 4305 – IPSWICH | 1.04% | 84% |

| Source: illion | ||

He said there was a strong likelihood delinquency rates would increase once all the income support and mortgage holidays come to an end.

But the figures were low given the pandemic-induced economic dip, he said.

“The actual rates are very low, well under 2 per cent in the top 10. I think we can take a lot of confidence in that,” he said. “The mortgage holiday has helped.”

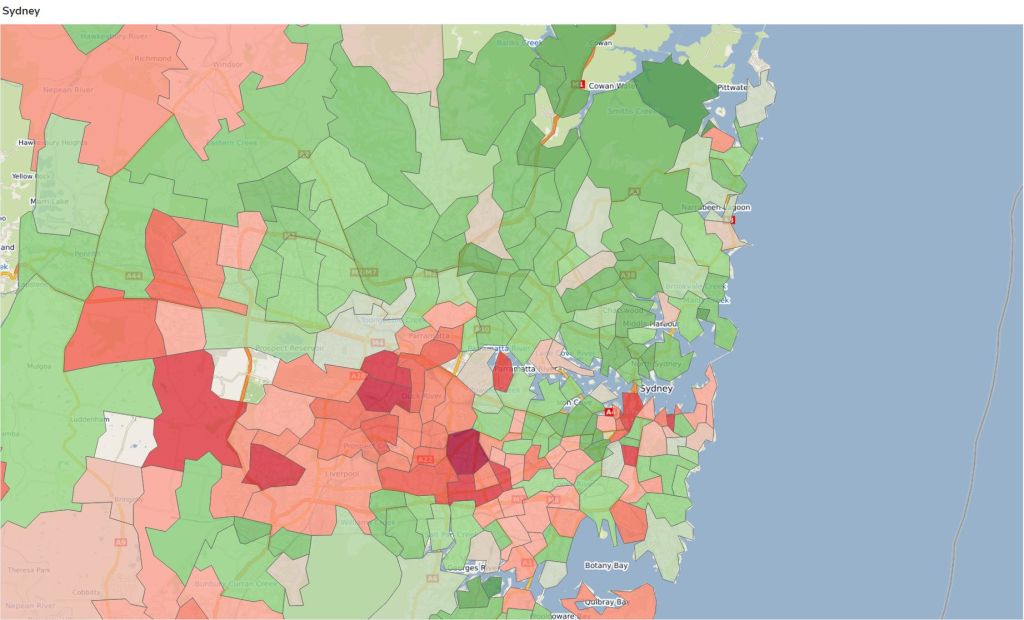

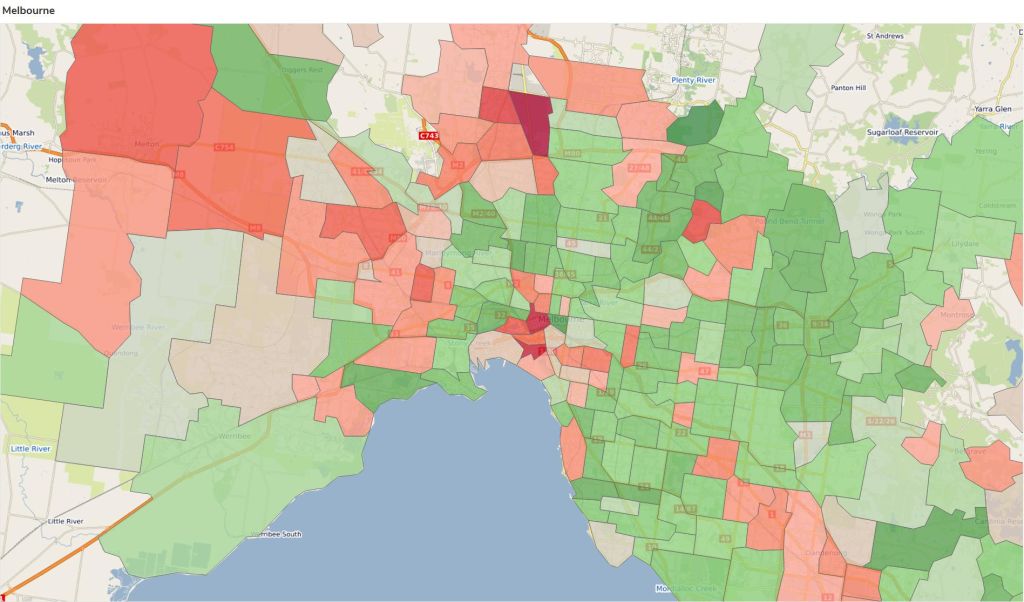

The trend also played out in Melbourne and Sydney, where high-density suburbs and outlying postcodes saw mortgage holders fall behind on repayments.

In Sydney, the postcode 2190, which covers the suburbs of Greenacre, parts of Mount Lewis and Chullora, about 15 kilometres west of Sydney’s CBD, had the highest rate of mortgage delinquency at 1.37 per cent — a whopping 160 per cent above the city average, according to illion.

Sydney’s average delinquency rate was 0.53 per cent as of September 2020.

Meanwhile in Melbourne, the postcode 3061 which takes in Campbellfield saw 1.3 per cent of mortgage-holders fall behind on repayments – the highest in Melbourne.

The city-wide average delinquency rate is 0.52 per cent.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More