The tough decisions homeowners face as rates rise

Household budgets are set to be stretched further by the second interest rate rise in as many months, after the Reserve Bank raised the cash rate from 0.35 per cent to 0.85 per cent on Tuesday.

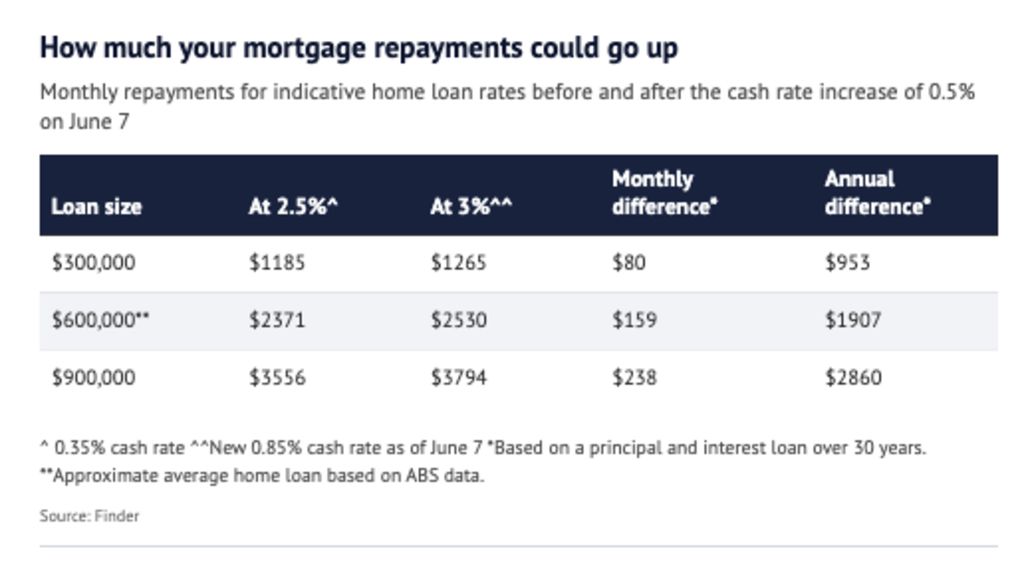

The hike will add $159 per month to repayments for the average homeowner, according to comparison website Finder, leaving many mortgagees considering how to meet these larger repayments.

Some are cutting discretionary spending and cancelling Netflix subscriptions, while others are looking into tried and true formulas like refinancing their home loan.

Mortgage brokers say more borrowers are asking about shifting to new lenders offering a better interest rate, or even a cash incentive, while others are demanding a better deal from the banks they have been loyal.

Mortgage Choice Elsternwick’s Christopher Ladley said the number of refinancing enquiries jumped from around 28 per cent of clients to 40 per cent after the first interest rate rise in May.

And he’s expecting more this week.

“Now that interest rates are moving, it definitely brings it more to the front of people’s minds – onto the radar,” Ladley said. “Anytime rates go up it stirs the pot.”

Rate rises were already on the minds of Anna Baxendale and husband Neil when they took on their mortgage in 2018.

The couple, who bought an apartment in Footscray to be closer to work and lower their carbon footprint, borrowed an amount they were confident they could repay, but are refinancing as part of their plan which includes refinancing every two years.

Even though the couple are established in their careers, they know that interest rate rises, including this latest one, will affect the budget they have in place.

“We’re neither the richest people in the world nor the poorest … we run a 23-year-old car, and we’ll have to work out whether we can afford another one or not once it breaks down,” Baxendale said.

“But we are still very lucky – lots of people are looking at whether they can afford food and petrol and heating bills, and we can afford those things.”

An occupational therapist, Baxendale works an extra day to help pay the bills, while husband Neil works in social enterprise services, which includes working with homeless people.

That work makes the couple grateful for what they do have, as many vulnerable people face an uncertain future due to rising rents or rising rates.

But while more people like the Baxendales are looking to refinance, there are still a number of Australians choosing not to despite the higher monthly repayments.

A recent Mortgage Choice survey of 1000 borrowers showed more than 60 per cent said refinancing was a “hassle they would like to avoid”.

Only one in four felt entirely confident navigating the refinancing process and 61 per cent agreed they were cautious about ending up worse off.

“It takes a lot for people to bite the bullet and change banks,” Wheatley Finance founder Andrew Wheatley said. “Dealing with a bank is the most horrible thing to do [for some people], they’d rather get ripped off than deal with a bank.”

Nevertheless, Wheatley said it was important for those with a home loan to seriously consider refinancing, especially as interest rates rise.

“People who don’t refinance and let it ride are usually paying 1.5 per cent more than they otherwise would,” he said.

ANZ senior economist Felicity Emmett said homeowners who bought on rock-bottom 2 per cent fixed rates, and will roll onto higher rates in the next couple of years, will “feel the pain more acutely”.

“It’s really for the people who have got in in the last few years, when prices have been so high for first-home buyers, they’re getting a new mortgage, they have very little equity, it does make it quite difficult,” she said.

RateCity research director Sally Tindall said some borrowers may not think of refinancing because they think they are already on a good deal, when that is often not the case.

Banks offer better deals to borrowers with more equity in their homes, and many owners have watched the value of their home soar in the last 18 months, she said.

“Rates are going up and people think that puts them on the back foot,” she said. “If you’re an ideal customer, you’re in the driver’s seat. Banks will be competing to get your business.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More