These are the unanswered questions about where landlords and tenants stand

The federal government is set to announce what is to be done about the fractured relationship between tenants and landlords on Friday, but property experts say there’s still a lot that needs to be done before the tense situation is defused.

Since the coronavirus lockdown and subsequent ban on evictions were announced, tenants have been subjected to “aggressive and intrusive” requests from landlords, and landlords faced with requests for clemency on rents despite being in financial stress themselves.

On Wednesday federal Housing Minister Michael Sukkar told ABC TV that the ban on evictions didn’t mean that tenants could get away with the non-payment of rent without an agreement in place with their landlord, and pointed to the increased JobSeeker and new JobKeeper payments as measures to make up for losing income.

Those measures still leave most non-citizens without access to financial relief, which means that if they’ve lost their job in the past month they could still be unable to pay rent.

Even still, the income replacement measures might not be as effective without a reduction in rents and mortgage repayments across the board, City Futures Research Centre research fellow Chris Martin said.

“The aim of governments in this particular crisis should be: keep households in their homes, and incomes in households,” he said. “So as the federal government tries to tip some replacement income into households, it makes sense to stop or reduce the outflow – the biggest items of which are rents and interest.”

Rent relief measures for all should be considered, Dr Martin said.

REIA’s Adrian Kelly said some clear guidance or broad approach would be best.

“It’s not rocket science, is it? It makes perfect sense, we’re all in this together and we’re all going to have to share the pain,” he said. “I expect tomorrow there should be announcements that will be fair across the board.”

A broad approach would also cover foreign nationals, some of which have been subjected to xenophobic attacks in searching for rent reductions, with one Sydney property management company telling them they’re not welcome in Australia and to leave because they can’t access any government support.

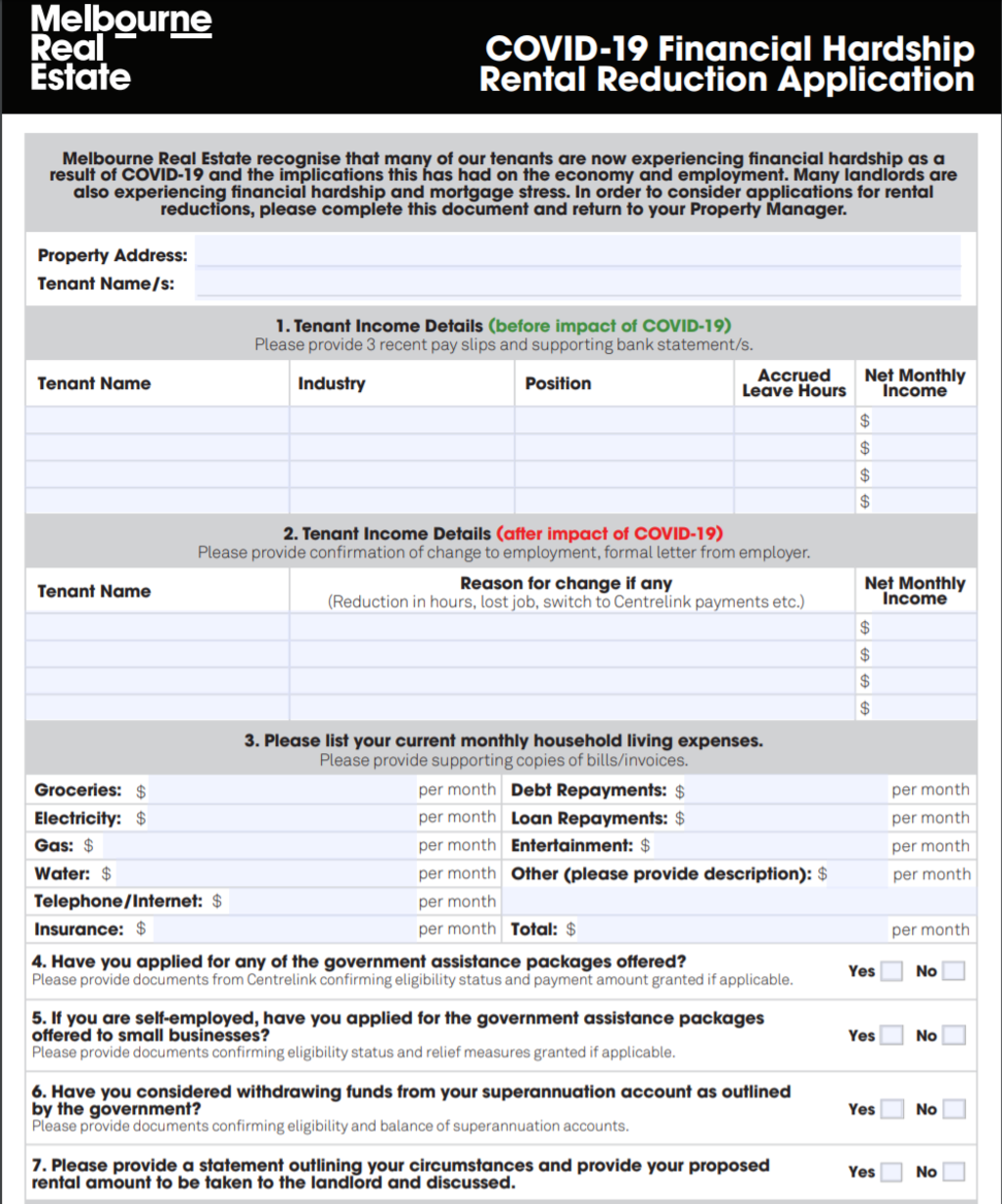

Other agencies have sent combative emails to tenants, and attached intrusive application forms which ask for details on accrued leave and breakdowns of household expenditure that they can forward to the landlord.

Dr Martin said the lack of a clear position from the government was prompting these terse exchanges.

“This past week has shown that leaving it to agents and landlords individually to ‘make arrangements’ is turning rent relief into a lottery,” he said. “A lucky few tenants may get a reasonable response, more are being treated disgracefully.”

The same emails and forms warn tenants that they may be evicted if they don’t make up the rent they can’t pay during the crisis, which could prove difficult for those who had little to no savings before the lockdown, or were already living from pay cheque to pay cheque.

Mr Kelly said he didn’t think it was reasonable to ask someone in financial strain to repay their missed rent later on.

“I have a personal view that if a tenant can’t pay the rent and they get to the end of the six months and they have a large debt, I don’t think that will be able to be dealt with in a practical way,” he said. “The last thing we want to see is a tenant or a property owner who has lost employment with children and a family to feed is for them to come out of this crisis with a really bad financial situation.”

Agents and landlords have also been blasted for asking if tenants have withdrawn any of their superannuation to pay rent, which some have labelled as unlicensed financial advice.

“Across the household sector, incomes have been smashed,” Dr Martin said. “The agents and landlords lobby appear to think that they should be treated specially, with rental incomes maintained at pre-crisis levels with households that have less.

“They are even directing tenants to run down their own wealth, in super, to keep up landlords’ incomes – an outrageous suggestion.”

Mr Kelly disputed that using super to pay rent was unethical.

What’s also unresolved is the issue of landlord insurance, which appears to be pressing landlords into a tough position.

Some policies don’t allow landlords to claim for loss of rent unless they evict their tenants or if they don’t act on the arrears, two situations which are no longer possible.

The loss of rent they can claim is also tied to the weekly rent they collect, which would then be a reduced amount if they agreed to knock a few hundred dollars off the price to let their property.

This has been used as a reason for rejecting rent decreases by agents and landlords, but Finder insights manager Graham Cooke said this was not a feature on every insurance policy, so it might not always be a valid excuse.

The industry had mostly stopped issuing new landlord policies during the crisis, Mr Cooke said, which meant the government would need to address the issue with any further rental relief measures.

“The messaging has been a bit vague. It isn’t very specific and he’s asked banks to come on board to try to help,” he said. “It’s just such a complicated issue and I don’t know [the federal government] has answers.

“I don’t know if there’s a clear solution, but I do think they should come out and offer a solution of some type.”

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More