‘Weight off our shoulders’: First home buyers welcome property tax

First home buyers have welcomed the option to swap stamp duty for an annual property tax, saying it would help them into the housing market sooner by reducing upfront costs.

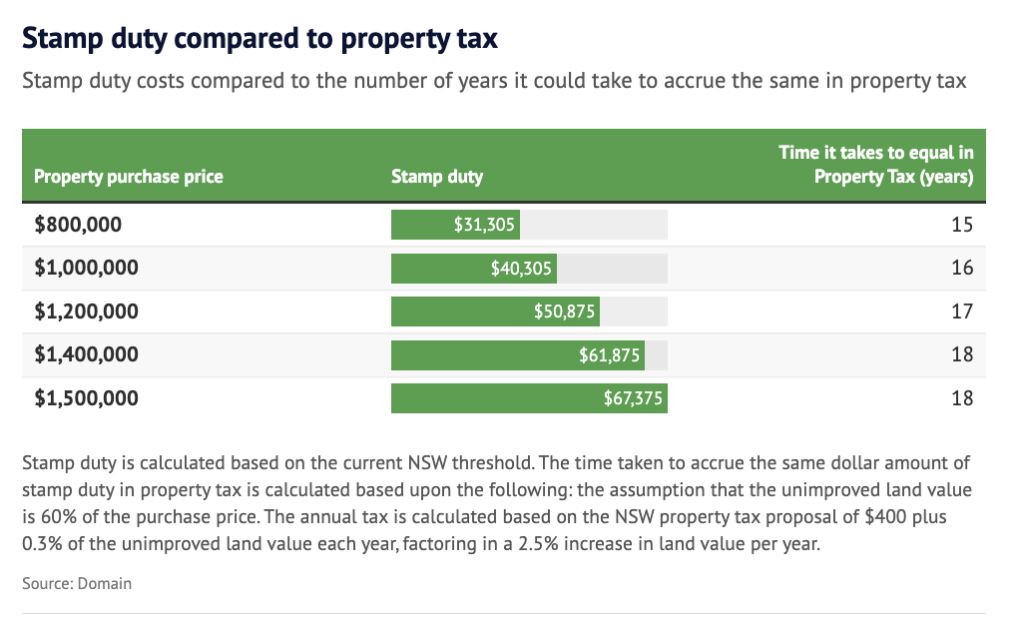

First home buyers will be able to pay a property tax for homes worth up to $1.5 million, which would consist of an annual levy of $400 plus a 0.3 per cent tax on the value of their land, it was confirmed in the NSW budget on Tuesday.

First home buyer Dylan Bow, 24, was pleased to see more support to help buyers onto the property ladder. However, the project surveyor, who has been saving for several years, felt the upfront cost of stamp duty would still be a better option for him.

“When I buy I’m planning to hold on to [the property] for ages, I’d rather just pay the one fee upfront rather than have to pay a fee every single year on top of mortgage repayments and bills,” Bow said. “I probably won’t use it, but do see the plus side if someone is struggling to save money.

“It will definitely be a lot better and quicker for them to get into the market, and that can build them more money in the long run.”

Bow, who lives with family in the Hills District, may avoid stamp duty altogether as he hopes to buy an apartment in Newcastle with the help of buyers’ agent Jack Henderson, of Henderson Advocacy. The aim is to buy for below $650,000 – the cut-off for the existing first home buyer stamp duty exemption.

He also hopes to use the federal government’s First Home Loan Deposit Scheme, which would enable him to purchase with as little as a 5 per cent deposit.

“I’d love to stay around here, but I don’t see how I’d ever be able to afford to do that, affordability for sure [is why I’m looking to buy in Newcastle].”

Aspiring homeowners Avneet Kumar, 38, and Namrata Nath Kumar, 35, who have been saving for five years, also welcomed the property tax option.

The inner west renters expect to be pre-approved to purchase a home worth up $850,000 in coming days, and hope to buy a townhouse or duplex in the likes of Marsden Park or Quakers Hill. At that price point, they would face a stamp duty bill exceeding $33,000.

“There are definitely a few questions we have, but overall [a property tax] sounds better. If something … is out of range for our pre-approval now we could have a greater deposit [if we don’t have to pay stamp duty upfront],” Mr Kumar said.

But with their lease due to run out in coming months, the couple may still push ahead with their plans rather than wait for the introduction of the property tax. They were also wary of how the tax may increase over time, as land values rise, and would need to do calculations to see what the tax may be for homes they are looking at.

Recent first home buyer Bjorn Shearer, 26, thought it was a fantastic idea and only wished it had been in place when he purchased a two-bedroom apartment two weeks ago.

“I think we should have moved to land tax policy a hell of a lot earlier,” Shearer said. “Stamp duty creates one more barrier for people to get out of the rental market, not having that lump sum payment will be a good thing, if we were still looking now it would be a massive weight off our shoulders.”

The northern beaches pharmacist and his partner saved for more than three years and used the federal government’s First Home Super Saver Scheme. Priced out of their area, they turned to Newcastle, where they wanted to buy below $650,000 to qualify for a stamp duty exemption.

“I think if we hadn’t already purchased … we would have probably held off until [the property tax] comes into effect, as it may have influenced our decision in terms of maximum price point if we didn’t have to pay stamp duty,” Shearer said.

Modelling by Domain shows a buyer of an $800,000 home may need to pay the property tax for 15 years to reach the cost of stamp duty.

Buyers’ agent Rich Harvey, chief executive of propertybuyer.com.au, said stamp duty was a significant impost for first home buyers and noted it had become increasingly challenging to qualify for an exemption for a family home in Sydney, with houses in the city’s west and south-west tracking north of $800,000.

“A much reduced property tax is a much more palatable way to get into the market and can stimulate demand to the lower end,” he said.

Mortgage Choice broker Rob Lees felt the scheme would appeal mostly to those looking to spend above the $800,000 cut off for a stamp duty concession.

“It’s going to certainly assist people wanting to spend a larger amount of money as those first home buyers wouldn’t normally have any benefits,” he said.“[That $1.5 million threshold], that’s your average house price for people in the city, so it’s good to include those people too.”

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.