What house prices did in the global financial crisis, and why it's different now

Homebuyers hoping recent falls in the Australian sharemarket will translate into a drop in property prices could be disappointed, if history is any guide, given house prices rose after the global financial crisis in 2008.

But economists also warn the economic situation now is different from the 2008 crisis, and today’s ultra-low interest rates are likely to be a bigger driver of the property market than share-price movements.

The global spread of coronavirus has raised fears for the health of the Australian economy as the tourism and education sectors take a hit, with investors selling off local shares. Monday’s fall was the worst since the GFC and the benchmark S&P/ASX 200 sharemarket index is 17.4 per cent lower than its February peak, despite a Tuesday afternoon rally that saw a 3.1 per cent daily lift.

The path of interest rates offers a clue to previous housing market activity in times of economic uncertainty.

Before the global financial crisis, interest rates were rising in a bid to control strong inflation and as mortgages got more expensive, housing prices were falling.

The national median house price began to slow down in the March 2008 quarter, when it rose only 0.8 per cent compared with a price increase of 3.7 per cent in the previous quarter.

In the June quarter it fell 1.4 per cent, before falling another 2.1 per cent in the three months to September of that year.

In that time, the Reserve Bank of Australia raised interest rates thrice, reaching 7.25 per cent and holding at that level until just before the crisis hit in mid-September 2008.

The Sydney areas where the most properties are selling under the hammer: Domain data

The Sydney areas where the most properties are selling under the hammer: Domain data The states where first-home buyers are most active revealed in new report

The states where first-home buyers are most active revealed in new report Sydney buyers not expected to rush for loans despite latest interest rate cut: agents

Sydney buyers not expected to rush for loans despite latest interest rate cut: agents The suburbs around Australia with the biggest price gains in the past five years

The suburbs around Australia with the biggest price gains in the past five years RBA cuts rates to record low but this may not be enough to avoid a recession

RBA cuts rates to record low but this may not be enough to avoid a recession

As the central bank slashed interest rates to contain the emerging crisis – falling to 3 per cent by April 2009 – house prices started to pick up again.

In the March 2009 quarter, the national median reversed its falls to edge up by 0.1 per cent, before jumping 3.5 per cent in the June quarter, another 3.9 per cent in September and a strong 4.6 per cent in the three months to December 2009.

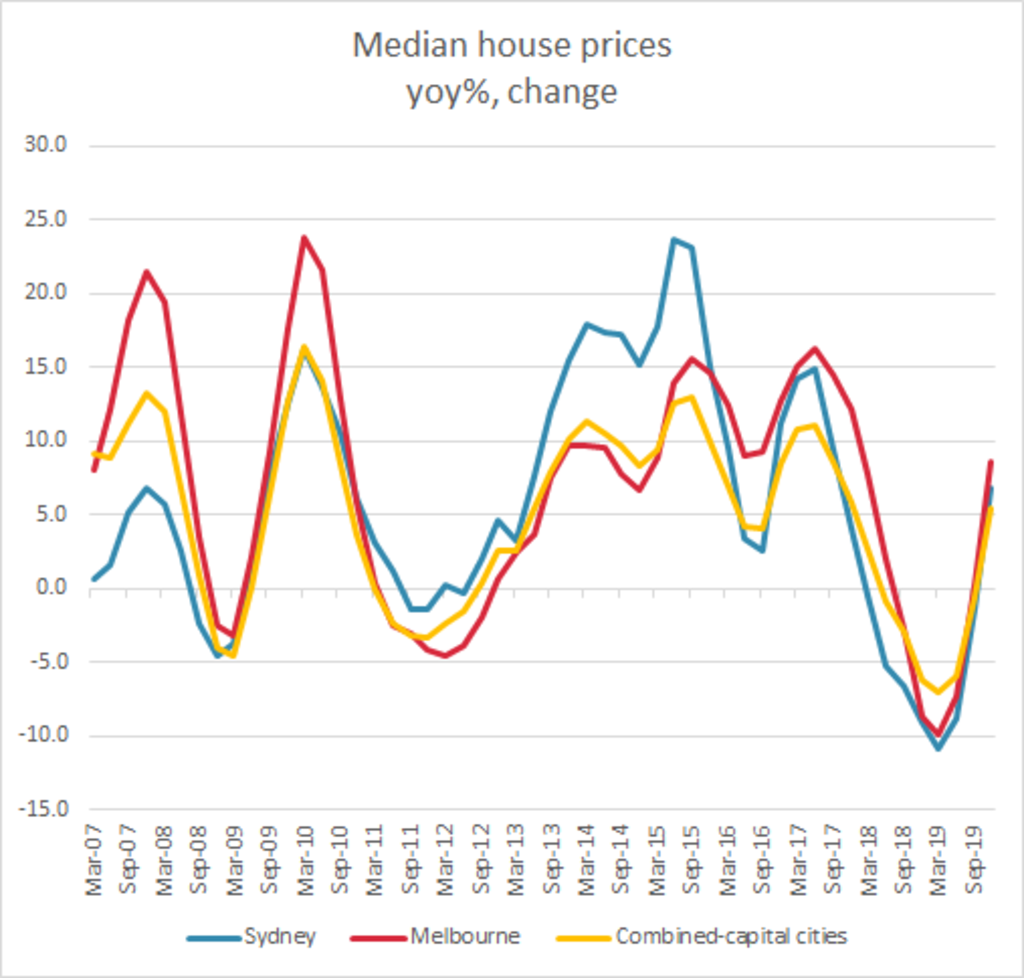

Ahead of the COVID-19-sparked share sell-off, the tables have turned as the property market in major capital cities – such as Sydney and Melbourne – has been recording remarkable house price growth while the Reserve Bank continues to slash interest rates, reaching an ultra low of 0.5 per cent as late as last week.

Australia’s median house price jumped 4.2 per cent in the December 2019 quarter to $809,349, and is 5.5 per cent higher than a year earlier.

Domain economist Trent Wiltshire said the current housing market will be affected in a completely different way from the global financial crisis should the economic situation go awry.

“It’s a very different shock. The GFC was a financial and demand shock whereas the coronavirus is a supply side shock, meaning supply chains are affected, people can’t work,” Mr Wiltshire said.

He said it was not yet clear how big an impact the coronavirus will have on the broader economy and, along with it, the housing market.

“If the coronavirus leads to a huge economic slowdown and lots of quarantining and unemployment rising then that would probably contribute to prices falling and turnover slowing dramatically.”

He said for the time being most buyers and sellers were not worried.

He said the government’s surplus should be abandoned and the focus should be saving the economy and boosting jobs.

Reserve Bank of Australia official cash rate

| Date | Cash rate change | Cash rate |

| 5-Dec-07 | 0 | 6.75 |

| 6-Feb-08 | 0.25 | 7 |

| 5-Mar-08 | 0.25 | 7.25 |

| 2-Apr-08 | 0 | 7.25 |

| 7-May-08 | 0 | 7.25 |

| 4-Jun-08 | 0 | 7.25 |

| 2-Jul-08 | 0 | 7.25 |

| 6-Aug-08 | 0 | 7.25 |

| 3-Sep-08 | -0.25 | 7 |

| 8-Oct-08 | -1 | 6 |

| 5-Nov-08 | -0.75 | 5.25 |

| 3-Dec-08 | -1 | 4.25 |

| 4-Mar-09 | 0 | 3.25 |

| 8-Apr-09 | -0.25 | 3 |

| 6-May-09 | 0 | 3 |

| 3-Jun-09 | 0 | 3 |

| 8-Jul-09 | 0 | 3 |

| 5-Aug-09 | 0 | 3 |

| 7-Oct-09 | 0.25 | 3.25 |

| 4-Nov-09 | 0.25 | 3.5 |

| 2-Dec-09 | 0.25 | 3.75 |

SQM research managing director Louis Christopher said rates were being raised before the GFC for fear of the economy overheating.

“It’s definitely different this time round in that the market was rising into this crisis,” Mr Christopher said.

“[Housing] markets started to stall in early 2008 and was falling going into the GFC but then bottomed out in the first quarter of 2009, following the aggressive rate cuts. Then, the market took off.”

He said Australia’s current property markets were “arguably still strong up until the last weekend”.

Mr Christopher said while there was potential for continued price growth, there was a lot of fear in the community.

“The stock market crash has not helped … the concern is if we were to see schools closed en masse, large public gatherings [auctions] closed en masse and we end up where Italy is at the moment the housing market will stop in its tracks no matter what rate cut we have.”

“If the panic settles down a little bit the [recent] rate cut and potential other rate cuts will stimulate the market.”

NAB group chief economist Alan Oster was more optimistic about the housing market.

“You had a global meltdown [in 2008] and now you’ve got a recovery so it’s very different,” Mr Oster said. “If you’re looking peak to trough falls both Sydney and Melbourne are almost a point or two from the peak.”

He said NAB’s forecast remains unchanged with house prices expected to rise 0.5 per cent every month, reaching around 7.5 per cent growth in Sydney and Melbourne.

“If the virus is still around by the end of the year then you will have an economic impact … but that’s not our forecast.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More