What risks is the Reserve Bank worried about in the rising property market?

Investor lending, interest-only lending and the pace of growth in new loans will be in focus as the nation’s regulators assess whether soaring property prices need reining in.

The Reserve Bank has repeatedly said it aims to keep interest rates at rock-bottom levels for three years to support the economic recovery from the coronavirus crisis, even though low rates are helping push up housing prices.

Governor Philip Lowe on Wednesday emphasised his plan to keep interest rates low until wages growth picks up to healthy levels.

He instead flagged a focus on lending standards, warning he would be concerned if banks make it easier to get a home loan, which could increase risks.

His comments come as the federal government prepares to roll back responsible lending rules that prompted banks to scrutinise borrower expenses closely – down to how many coffees or Uber trips they buy – in the wake of the financial services royal commission.

But AMP Capital chief economist Shane Oliver said the central bank sees these rules as largely “legalese”.

“They would be looking through the changes in responsible lending laws,” Dr Oliver said, instead focusing on “measures of lending, and who it’s going to, and how much debt people are taking on”.

Surging growth in the total amount of mortgage debt would be a worry for the central bank, Dr Oliver said, but its current pace of about 3.6 per cent growth would not be considered excessive.

The share of loans granted to investors would also be in focus, he said, with official data showing a recent uptick in investor lending that has been dwarfed by the rush into the market by owner-occupiers and first-home buyers.

And, the proportion of loans written as interest only — where the borrower does not pay any principal for five years — would be another key measure for the central bank to watch, he said.

Four years ago the share of interest-only lending had risen high enough to worry the bank regulator the Australian Prudential Regulation Authority, which forced banks to clamp down on lending and tipped booming house prices into reverse.

Aside from hard data, he said central bankers would worried if anecdotes emerged about borrowers lying on their application or the number of investment properties they owned, which were common before APRA’s most recent tightening of lending standards.

They would likely be less worried about how many coffees borrowers buy.

“When push comes to shove, most people will pay off the loan rather than have the coffee,” Dr Oliver said.

With prices rising, the Bank of Mum and Dad has been stepping in to help some first-home buyers scrape together a deposit, which Dr Oliver said would not worry regulators.

“Their terms are going to be pretty easy, it’s really just an advance on their inheritance,” he said.

“It’s probably the right thing to do — mum and dad have benefited from the rise in house prices.”

NAB chief economist Alan Oster said the Reserve Bank would be focused on making sure people were not able to get loans they could not have accessed in the past or that they would not be able to refinance in future.

“They’re just wanting to make sure that banks are not making it easier for people to access credit where in the past we wouldn’t have given them credit,” he said.

“When you look at the credit data what you see is housing credit isn’t growing very fast.”

Influential UBS bank analyst Jonathan Mott believes tighter lending standards are likely to be introduced later this year.

Mr Mott — who in 2017 warned $500 billion of liar loans had been made to borrowers who were not completely factual in their applications — warned again of rising risks in a note to clients.

He expects limits on the amount of loans made to borrowers with only a small deposit, similar to a focus of the Reserve Bank of New Zealand, or limits on lending to borrowers who are taking on more than six times their income in debt.

He tipped an increase in the interest rate buffer that would force borrowers to prove they could pay back loans at a higher hypothetical rate, if rates rise in future.

Independent economist Saul Eslake agreed small deposits could be in the crosshairs.

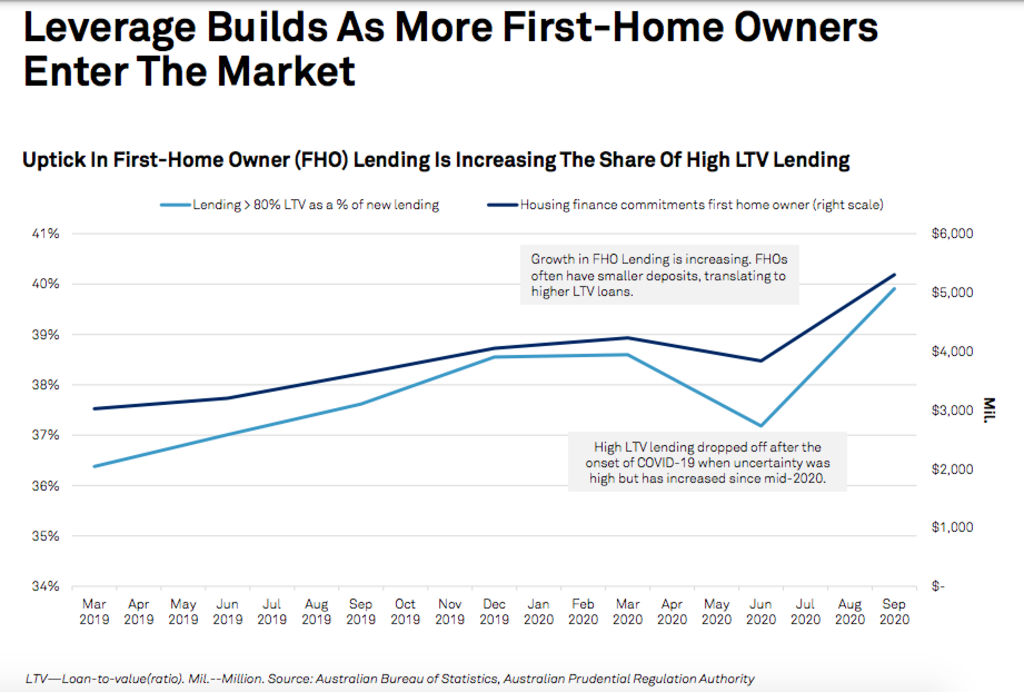

The proportion of new loans with loan-to-valuation ratios above 80 per cent reached its highest point since 2008 in the September quarter, rising to about 40 per cent of all loans, he said, double where it was in the March quarter of 2018.

Lending standards are “a lot sounder than they were”, he said.

“But they’re not quite as sound as they were two years ago. There clearly has been some loosening of lending standards.”

The rise in small-deposit loans was highlighted this week in a note from ratings agency S&P that warned first-home owners often have smaller deposits.

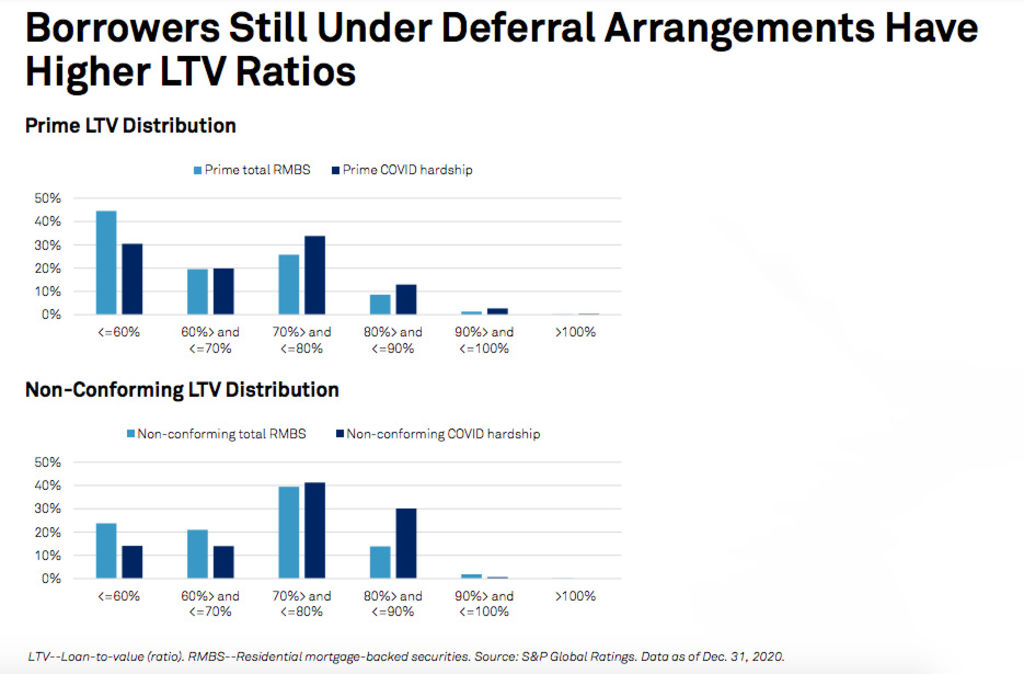

The research also found borrowers with small amounts of equity were more likely to still be under pandemic-era mortgage holiday arrangements than those with more equity in their loan, and warned up to 15 per cent of all deferred mortgages could transition to formal hardship arrangements.

BIS Oxford Economics chief economist Sarah Hunter said banks could become more restrictive with their lending without waiting for regulators to act.

“It can also be the banks take steps to move themselves,” she said.

“We saw that as the royal commission was under way. The banks voluntarily took steps to tighten up across the board.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More