Why are property values rising during an economic shock?

Property values are rising despite the economic shock of prolonged and widespread lockdowns, as more people want to buy a home than to sell one.

The counterintuitive surge in the housing market has slowed somewhat since the March boom as affordability constraints kick in, but continues even as workers are stood down to curb the spread of COVID-19. Many of those lucky enough to keep their jobs are taking advantage of low interest rates and hoping conditions will improve soon.

Sydney home values rose another 1.8 per cent in August, the city’s second month of stay-at-home orders, while Melbourne – where physical property inspections are not allowed under lockdown – still managed to rise 1.2 per cent, on CoreLogic figures released on Wednesday. Canberra, in lockdown for most of August, rose 2.2 per cent.

Values rose across almost all the open capital cities with the exception of Darwin, where they fell just 0.1 per cent in August after rising 22 per cent in the past year.

The gains come as the broader economy escaped a technical recession by growing 0.7 per cent in the June quarter, on ABS data. However, it has been hit hard by the closure of non-essential businesses in NSW, Victoria and the ACT, and is set to contract this quarter.

Many nervous potential sellers have decided to wait until later in spring to list their homes, fearful they won’t be able to achieve a strong price, or concerned about the health risk.

At the same time, many locked-down buyers are desperate to purchase and confident enough to go ahead. Some have been searching for months, while others, forced to stay at home, decide afresh they need more space – then realise there is little on the market to choose from.

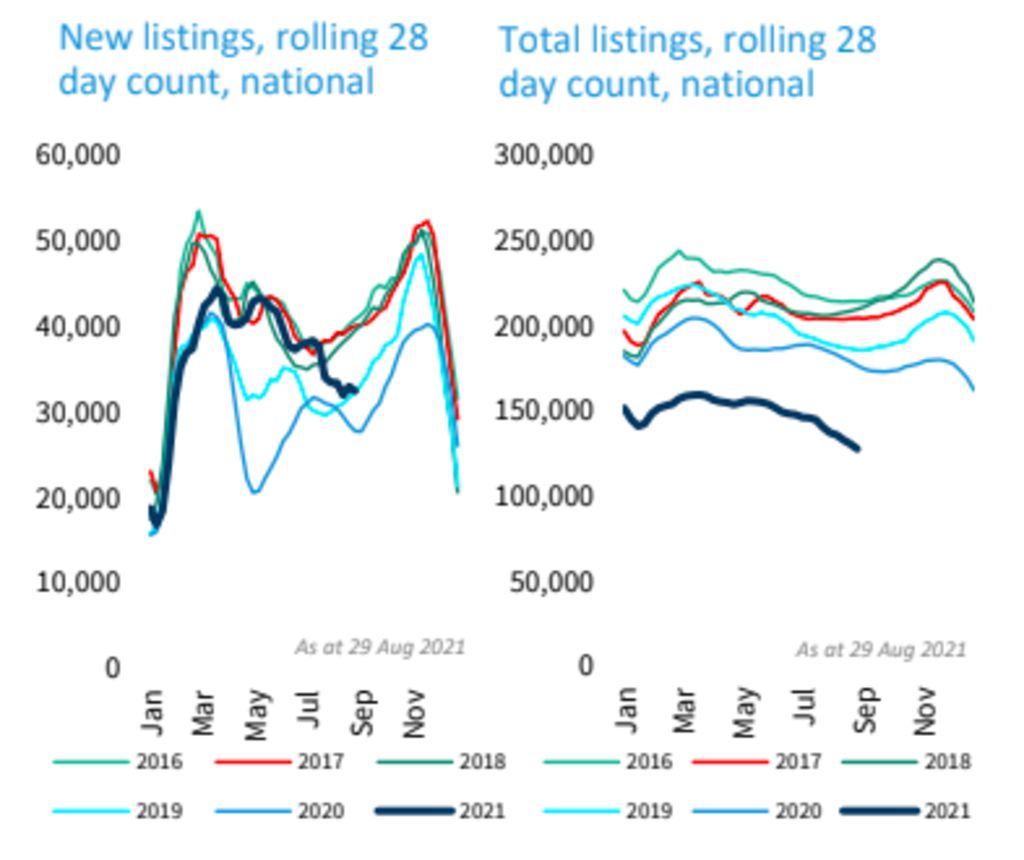

Over the past three months, the number of home sales has been 30 per cent above average, while the number of listings is 29 per cent below average, pushing prices up, CoreLogic found.

Buyers who have kept their jobs have been helped by rock-bottom interest rates, while many home-owners can access government support and bank mortgage holidays to avoid a wave of forced selling.

For a vendor to push ahead and sell for a lower price in this environment, they would have to be in real distress, Westpac senior economist Matthew Hassan said.

He noted that consumer sentiment surveys found an expectation that house prices would rise over the next year, as the economy recovered thanks to the vaccine rollout.

“From our consumer sentiment measures, what we’ve seen from the consumer is a drop in confidence following the Delta outbreak, but nothing like the collapse we saw during the first wave lockdown last year or the Victorian second-wave outbreak,” he said.

“The bulk of that comes down to the prospects of a vaccine-led stabilisation in the situation.”

Affordability constraints could start to flatten price growth in the coming months, he said, but warned there was a chance this could change when the economy reopened.

“Last time, listings were quite slow to respond and there were lots of buyers and not a lot of properties,” he said. “That could be even worse.”

AMP Capital chief economist Shane Oliver highlighted the bounce-back in prices last year when prices fell briefly and then rose again when the economy reopened.

“Whenever you have a lockdown many people decide they don’t want to sell now,” he said. “Apart from the low interest rates I think it’s just a function of buyers having learnt from last year that after lockdown ends prices take off, so they’re trying to get in now.”

Vaccines were giving confidence to buyers to make big financial decisions, he added.

“Last year, prices fell, there was no medical solution on the horizon,” Mr Oliver said. “This time around, people think, ‘Yeah it’s horrible now, but there’s government support, there are bank payment holidays and, in several months’ time, we’ll hit the vaccine targets and there will be a reopening.’

“Yes there are less buyers but in many cases, there are a lot less sellers, so that’s enabled prices to keep rising.”

Prices have been stronger last month than was forecast before lockdowns were announced – but there is a risk that price growth could slow in a few months if there isn’t a substantial easing in restrictions.

Commonwealth Bank head of Australian economics Gareth Aird noted that most workers had been able to keep their jobs and were confident the lockdowns would be temporary.

Remote workers were also saving money while they couldn’t go out and spend, he said.

“Obviously there’s a lot of people impacted by the lockdown, a lot of workers have been stood down, but the vast majority of people haven’t been stood down and they’re the ones transacting in the property market,” he said.

“Low interest rates are still what’s driving the increase in property prices … people know the lockdowns don’t go on indefinitely.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More