Why property prices could fall faster than first expected

Property price falls are expected to accelerate and become more widespread as buyers face reduced borrowing power and higher mortgage repayments due to interest rates rising.

The Reserve Bank lifted the official cash rate by half a percentage point to 0.85 per cent on Tuesday, marking the largest one-month increase in 22 years.

It was well above the 0.25 percentage point or 0.4 point rise expected by many. ANZ senior economist Felicity Emmett said a quicker than expected lift in the cash rate could result in swifter and sharper property price falls. While it was too early to revise its latest market forecasts, released last month, there was a downside risk to the expectation of a 3 per cent drop in capital city prices this year and an 8 per cent fall next year.

In Sydney, prices were already forecast to drop by 15 per cent over two years.

“We were factoring in that the cash rate would get to 2.35 per cent by the middle of next year … if it ends up being more rapid than we had previously expected, it’s fair to say house prices might respond more quickly,” Emmett said.

RBA governor Philip Lowe had flagged that the bank wanted to return the cash rate to a “more normal” level, which he expected would be about 2.5 per cent.

Emmett said the impact of rising rates would flow through to the market quickly as it would cap the borrowing capacity of buyers.

Increased mortgage repayments would also put more pressure on homeowners, but she did not expect to see an increase in forced sales. Rates are still historically low, and many households have built up financial buffers with additional mortgage repayments or increased savings.

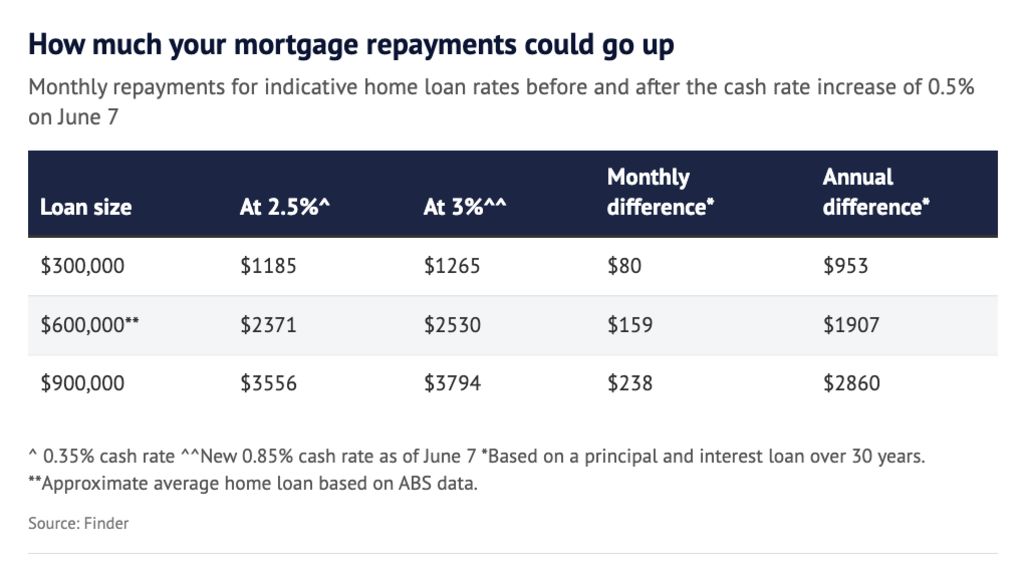

The latest rate rise will add $159 per month to repayments for a homeowner with an average home loan of $600,000, according to figures from comparison website Finder.

“Whilst it’s going to be difficult for a lot of people who have never seen an interest rate hike previously, and there will be some adjustment, I don’t think broadly there are going to be problems,” Emmett said.

AMP Capital chief economist Dr Shane Oliver expected average home prices would fall 10 to 15 per cent over 18 months, as previously forecast, but felt this may now occur earlier and faster.

Oliver noted falling home prices and weak consumer confidence suggested rising rates were having an earlier impact than seen in previous cycles. He attributed this to higher levels of household debt, the sharp rise in fixed mortgage rates well before any cash rate hike, and cost of living pressures that had seen a plunge in real wages and spending power.

Independent economist Saul Eslake said the RBA had more than fully reversed the reductions made at the start of the pandemic, when the cash rate was cut from 75 basis points. With more rate hikes to come, buyer demand and property prices are set to be impacted.

“It will probably extend the run of small [price] declines that started in Sydney and Melbourne a few months back and now includes Canberra. That will probably spread to other capital cities and regional areas where, according to CoreLogic, prices were still going up in May,” he said.

However, Eslake did not expect a large decline in prices. He said he would be surprised if the market dropped more than 10 per cent as rates rose, also noting that forced selling – which would increase supply – was unlikely.

Instead, he expected the number of homes for sale to fall quite a lot as vendors become reluctant to sell in a cooling market. This would reduce supply and limit price declines.

Gareth Aird, head of Australian economics at Commonwealth Bank, said their home price forecasts would be materially downgraded in the coming days, given the latest hike.

A previous forecast for property prices to end the year flat, then fall 8 per to 10 per cent next year, had been based on a more gradual rise in rates, he noted.

“Sydney prices were already coming off, so were Melbourne, but we’re going to see prices further slide and the rate of declines will accelerate under higher interest rates,” Aird said.

However, prices falls could be short-lived. With economic momentum expected to slow significantly, a rate cut could be on the cards by late 2023, Aird said.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More