Will first home buyers be better off using the Liberal or Labor low-deposit schemes?

First home buyers could save about $1000 a month on their mortgage repayments by choosing Labor’s Help to Buy scheme over the government’s First Home Guarantee, but may trade off up to $455,000 in equity gains, new modelling shows.

Each major party has pledged to help first home buyers, but only the Coalition would allow them to access up to $50,000 of their super.

The Coalition will also retain and expand its low-deposit loan scheme, which allows a purchase with a 5 per cent deposit (raised independently of super) without paying lenders mortgage insurance. Labor will match this and add a shared equity scheme, where it co-purchases a home with the buyer, who may have owned previously.

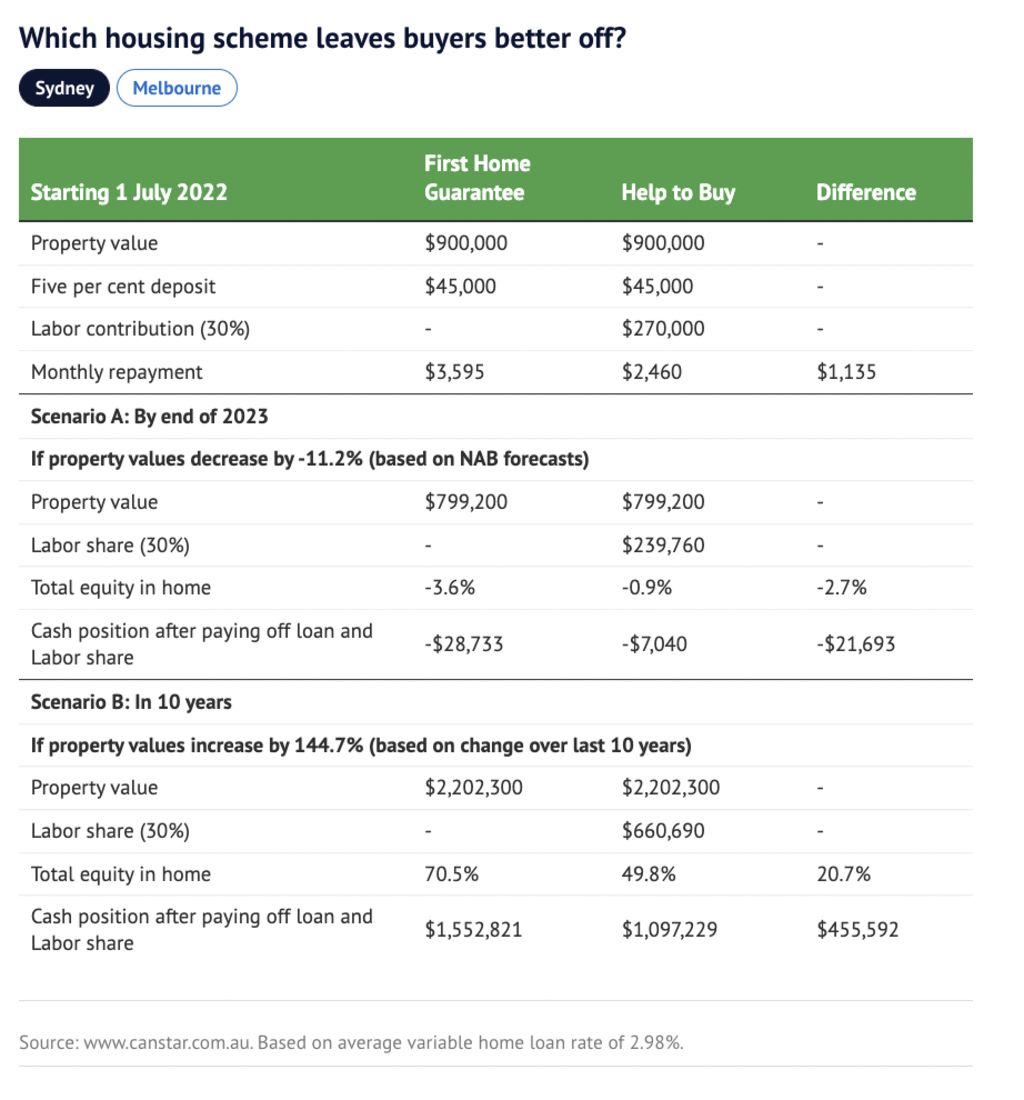

Take, for example, a first home buyer purchasing a $900,000 home in Sydney with a 5 per cent deposit of $45,000.

Their monthly mortgage repayment using the First Home Guarantee scheme would be $3595, Canstar research found.

But under the Help to Buy program, where the government owns 30 per cent of the buyer’s home and the mortgage is smaller, they would pay $2460 per month, saving $1135.

If property values fall, low-deposit buyers risk owing more money to the bank than their home is worth, known as negative equity.

Assuming a drop in line with economist forecasts, the same home could be worth $799,200 by the end of 2023.

Someone in the unfortunate situation of needing to sell due to job loss or family breakdown would face negative equity of $28,733 under the First Home Guarantee but only $7040 using Help to Buy, because the government shares the loss.

But if property values rise, someone who co-purchased would expect a smaller equity gain because the government shares the profit.

Assuming prices rise as much over the next decade as they have in the past, the same home could be worth $2,202,300.

A seller who paid off their commitments would pocket $1,552,821 if they used the First Home Guarantee, $455,592 more than if they used Help to Buy and walked away with $1,097,229.

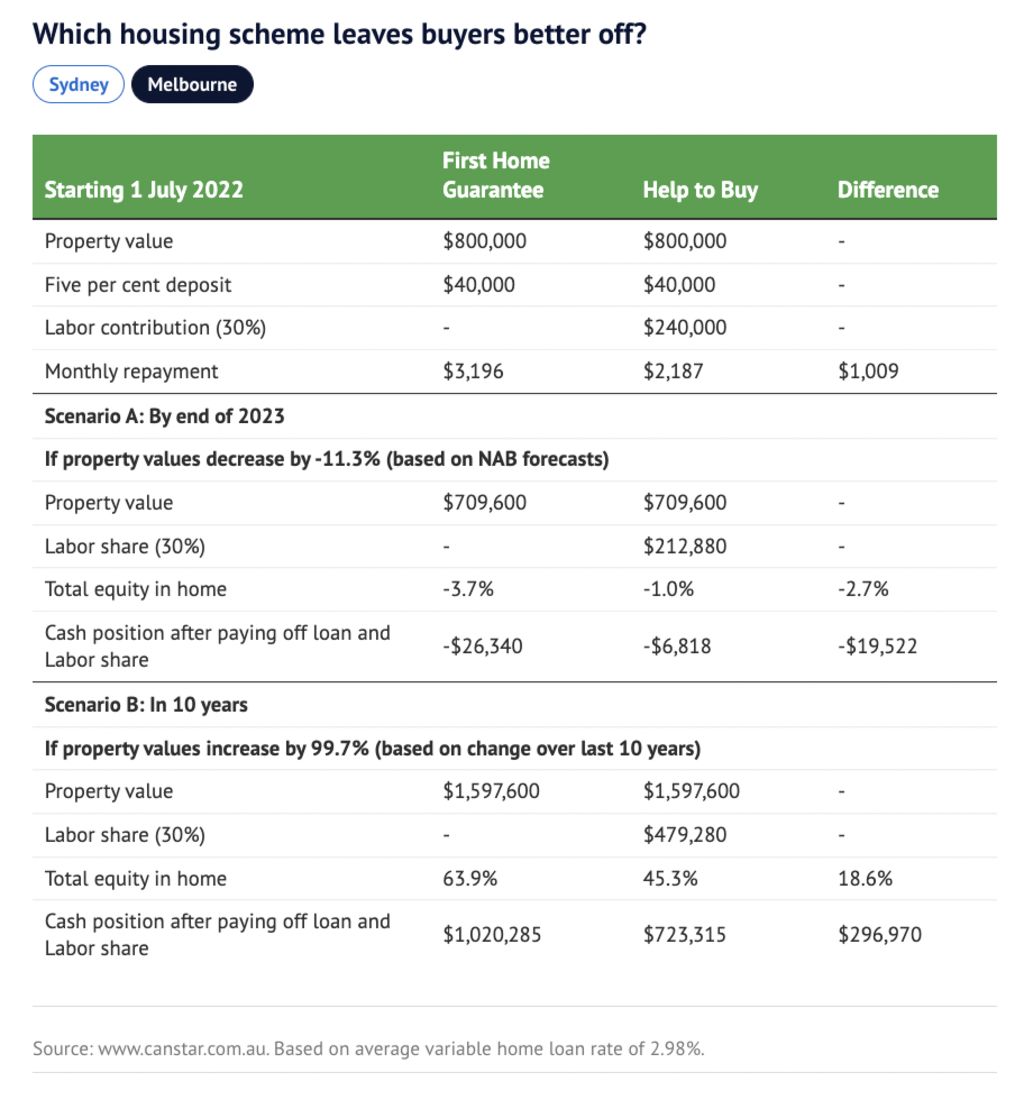

The schemes’ price caps are targeted at each state’s housing market.

A buyer in Melbourne might look at an $800,000 home with a $40,000 deposit.

Their monthly mortgage repayment would be $3196 if they used the First Home Guarantee, $1009 more than if they used Help to Buy and paid $2187 a month.

If property values fall, as forecast by the end of next year, and they had to sell, they would have negative equity of $26,340 via the First Home Guarantee or $6818 through Help to Buy.

But if property values rise as much over the next decade as they have over the last, the same home would be worth $1,597,600.

A seller would then pocket $1,020,285 through the First Home Guarantee, $296,970 more than if they used Help to Buy and profited $723,315.

Canstar’s group executive of financial services, Steve Mickenbecker, cautioned low-deposit buyers to check if they could make the higher repayments required of a loan of 95 per cent of their home’s value as interest rates rise.

“You’ve got to look at your financial situation pretty clearly and ask, ‘Am I going to be in a situation to pay back a 95 per cent loan if interest rates go up 2 per cent’?” he said.

He said negative equity is not a widespread issue, but someone using the existing government program could end up in negative equity if property prices fell.

He reassured buyers not to panic – provided they keep making their repayments, as prices are likely to recover over the longer term.

He applauded both schemes as programs that help buyers, but said they were too limited and called for both improved housing supply and changes to tax breaks for property investors.

Katrina Raynor, postdoctoral research fellow in affordable housing at University of Melbourne, said there is a strong social equity argument for shared equity schemes if they have very targeted eligibility and income limits.

They could help older buyers and keep them out of housing crisis later in life, or help social housing residents with savings to purchase.

She warned they should be introduced alongside measures to support rental affordability and social housing.

“Most banks are suggesting we’re about to see house price declines, and the people who are going to suffer the absolute most in that situation are people who have just bought their homes at an inflated price with the biggest loan they can possibly handle,” she said.

Mortgage broker Chris Foster-Ramsay said about a quarter of his first-home buyer clients knew about the existing first-home buyer scheme and were asking for more information.

Those who could not get a place may consider lenders mortgage insurance as a back-up.

He advised low-deposit buyers to choose a property in a sought-after location and check they could afford their loan.

“You want to make sure you can afford the repayments in an environment where interest rates are increasing,” the principal finance broker at Foster Ramsay Finance said.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More